ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1335.349

- -5.863-0.44%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

SoftBank-Backed Arm Plans Major Price Hike: Apple, Qualcomm Supplier Explores Chip Development

The arrangement for Trump's inauguration ceremony has been announced: it is expected to cost 0.037 million dollars per minute.

① The inauguration activities of the president-elect Trump in the USA have been announced, including an official party, a MAGA rally, and a large fireworks display, with multiple events taking place at Trump's golf course outside Washington, D.C. ② Trump's inaugural committee has raised over $0.17 billion, expected to reach $0.2 billion, spending $0.037 million per minute, far exceeding the record of $8,600 per minute set during Obama's first inauguration.

The largest Energy IPO in over a decade! USA LNG company Venture Global seeks a valuation of 110 billion dollars.

According to the documents submitted by Venture Global, the company plans to issue 50 million shares of Stocks at a maximum price of $46 per share, raising up to $2.3 billion. Under Trump's possible New energy Fund policies, LNG developers are expected to be one of the biggest beneficiaries.

A five-month high! Amidst a chorus of bearish voices, oil prices continue to rise.

The market previously widely expected that there would be a significant oversupply in the Crude Oil Product market this year, and that oil prices would remain stable or weaken. However, with the USA announcing a new round of sanctions on the Russian Energy sector, the market outlook became complex, compounded by concerns over Trump's tariff policy, leading to rising oil prices for consecutive days.

Wall Street Today: Market Turns Around, Let's See if it Lasts

$100 Invested In Cheniere Energy 20 Years Ago Would Be Worth This Much Today

Comments

New AR glasses patent exposed

It is said that NVIDIA’s patent is expected to bring many aspects of AR changes. On the one hand, it uses digital holography and ambient ligh...

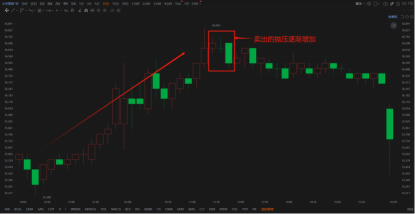

The formation process of different types of Doji candlesticks

The six major Doji patterns.

Doji at the Bottom

When a stock has been in a prolonged downtrend, the selling pressure gradua...

Agricultural Technology (AgTech) refers to the use of technology, innovation, and scientific methods to enhance agricultural productivity, sustainability, and efficiency. As global populations continue to grow, climate change accelerates, and resources become scarcer, AgTech has become increasingly vital in modern agriculture. It encompasses innovations across various agricultural stages, from planting and irrigation to...