Investment ThemesDetailed Quotes

ESG Investing

Watchlist

ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1358.901

- +3.365+0.25%

Trading Nov 29 11:07 ET

1359.204High1352.609Low

1355.098Open1355.537Pre Close15.48MVolume8Rise31.51P/E (Static)3.02BTurnover--Flatline0.06%Turnover Ratio5.18TMarket Cap7Fall5.15TFloat Cap

Constituent Stocks: 15Top Rising: TXN+1.41%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

Latest PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

TXNTexas Instruments

201.9902.800+1.41%820.25K165.29M200.080199.190202.500199.700184.26B183.82B912.22M910.03M+1.91%-1.95%-0.58%+0.88%+3.56%+33.85%+21.88%2.57%0.09%37.5428.571.41%Semiconductors

LNGCheniere Energy

223.9252.155+0.97%204.50K45.85M222.500221.770224.813222.50050.24B49.89B224.37M222.80M-0.47%+6.24%+17.30%+23.83%+42.45%+24.59%+32.54%0.78%0.09%14.245.501.04%Oil & Gas Midstream

HSTHost Hotels & Resorts

18.6050.175+0.95%561.74K10.43M18.46018.43018.64518.45013.01B11.95B699.03M642.45M+4.00%+6.56%+7.92%+12.45%+5.05%+10.90%-1.32%4.30%0.09%18.0617.891.06%REIT - Hotel & Motel

FSLRFirst Solar

194.2901.720+0.89%512.95K99.76M194.820192.570195.713192.41520.80B19.66B107.06M101.20M+6.78%-0.44%-0.10%-9.53%-30.56%+21.21%+12.78%--0.51%16.7325.101.71%Solar

COPConocoPhillips

108.2400.850+0.79%1.15M124.20M107.990107.390108.390107.395140.02B139.78B1.29B1.29B-3.27%-4.14%-0.50%+1.44%-3.10%-3.43%-4.13%2.70%0.09%12.8411.950.93%Oil & Gas E&P

WORWorthington Enterprises

40.8150.185+0.46%13.74K563.97K41.35040.63041.35540.6002.05B1.28B50.26M31.26M+3.15%+0.18%+6.57%-5.48%-22.35%-9.56%-28.41%2.35%0.04%54.4218.551.86%Metal Fabrication

AAPLApple

235.8250.895+0.38%7.48M1.76B234.900234.930235.915233.9703.56T3.56T15.12B15.09B+3.20%+3.33%+4.50%+6.16%+22.39%+23.92%+23.09%0.42%0.05%38.7938.790.83%Consumer Electronics

SCLStepan

75.8100.105+0.14%17.97K1.36M76.07075.70576.06074.8401.71B1.61B22.49M21.20M+0.26%+0.39%+5.33%+4.25%-9.05%-7.15%-18.32%1.98%0.09%37.9143.321.61%Specialty Chemicals

MAMasterCard

532.120-0.260-0.05%456.98K242.75M533.500532.380534.000530.025488.40B487.14B917.83M915.46M+3.30%+2.25%+6.51%+11.62%+18.78%+29.17%+25.49%0.48%0.05%40.2244.980.75%Credit Services

MPCMarathon Petroleum

155.240-0.120-0.08%225.65K34.97M155.770155.360156.490154.23049.89B49.75B321.39M320.45M-2.54%-1.27%+7.33%-7.32%-10.01%+4.61%+6.77%2.13%0.07%12.046.571.46%Oil & Gas Refining & Marketing

JBHTJB Hunt Transport Services

189.970-0.340-0.18%134.24K25.56M191.470190.310192.260189.29519.15B15.23B100.83M80.16M+4.63%+2.96%+5.42%+12.47%+17.83%+1.04%-3.99%0.90%0.17%34.5427.261.56%Integrated Freight & Logistics

SRESempra Energy

94.080-0.200-0.21%382.61K36.03M94.50094.28094.90593.73059.59B59.50B633.40M632.44M-0.64%+4.02%+12.85%+14.08%+27.29%+32.79%+29.01%2.61%0.06%20.7219.641.25%Utilities - Diversified

VRSKVerisk Analytics

293.440-1.120-0.38%81.47K23.97M293.440294.560296.165292.83041.44B41.34B141.21M140.89M+2.04%+2.55%+6.81%+7.45%+11.70%+21.62%+23.42%0.51%0.06%45.7870.371.13%Consulting Services

CVXChevron

161.180-0.930-0.57%1.58M254.60M162.010162.110162.690160.720289.66B275.24B1.80B1.71B-0.28%+0.63%+9.41%+15.54%+5.04%+16.10%+12.72%3.97%0.09%17.7114.191.22%Oil & Gas Integrated

MRKMerck & Co

101.950-1.170-1.13%1.86M189.39M102.930103.120103.000101.530257.90B257.58B2.53B2.53B+2.09%+3.65%-0.36%-13.46%-21.48%+1.16%-4.69%3.02%0.07%21.33728.211.43%Drug Manufacturers - General

News

Apple Analyst Ratings

Investigating Apple's Standing In Technology Hardware, Storage & Peripherals Industry Compared To Competitors

Black Friday Shopping Kicks Off in the US

Elon Musk Lauds Apple AirPods Pro 2's Hearing Aid Feature As Tim Cook Highlights The Affordable Solution To What Otherwise Costs Up To $7,000

What Do Tim Cook, Sundar Pichai, Elon Musk, And Lisa Su Have In Common This Thanksgiving? Heartwarming Gratitude, Unexpected Humor, And A Turkey Or Two

Will Apple Or NVIDIA Be The World's Most Valuable Company By The End Of 2024? Polymarket Traders Have A Clear Favorite

Comments

1. $Apple (AAPL.US)$

• Market Cap: ~$3 trillion

• Why it’s important:

Apple leads in hardware and services, offering innovative products like the iPhone, Mac, and Apple Watch, and a robust ecosystem (App Store, iCloud). Its design and privacy policies set industry standards.

• Why not to abandon:

Apple drives consumer tech innovation and contributes massively to the U.S. economy, employment, and supply chains.

2. $Microsoft (MSFT.US)$

...

• Market Cap: ~$3 trillion

• Why it’s important:

Apple leads in hardware and services, offering innovative products like the iPhone, Mac, and Apple Watch, and a robust ecosystem (App Store, iCloud). Its design and privacy policies set industry standards.

• Why not to abandon:

Apple drives consumer tech innovation and contributes massively to the U.S. economy, employment, and supply chains.

2. $Microsoft (MSFT.US)$

...

5

6

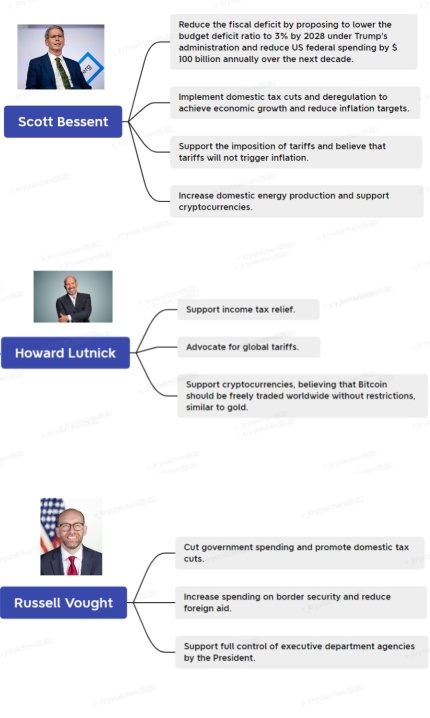

Trump’s second-term Cabinet nominations are nearly complete![]() . What are the core economic ideologies of this team? This article uses visuals and analysis to provide a deeper understanding for readers.

. What are the core economic ideologies of this team? This article uses visuals and analysis to provide a deeper understanding for readers.

1. Who’s on Trump’s team? What are their primary responsibilities?

2. Economic ideologies of Cabinet members in policy-related roles

3. Economic ideologies of non-Cabinet members in policy-related roles

4. Impacts...

1. Who’s on Trump’s team? What are their primary responsibilities?

2. Economic ideologies of Cabinet members in policy-related roles

3. Economic ideologies of non-Cabinet members in policy-related roles

4. Impacts...

+3

17

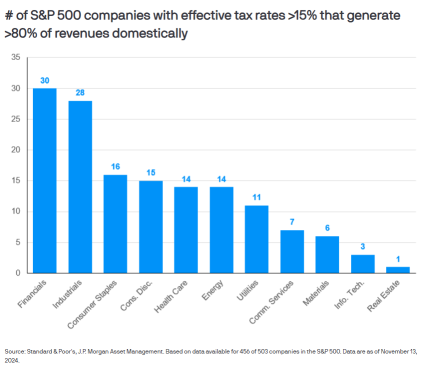

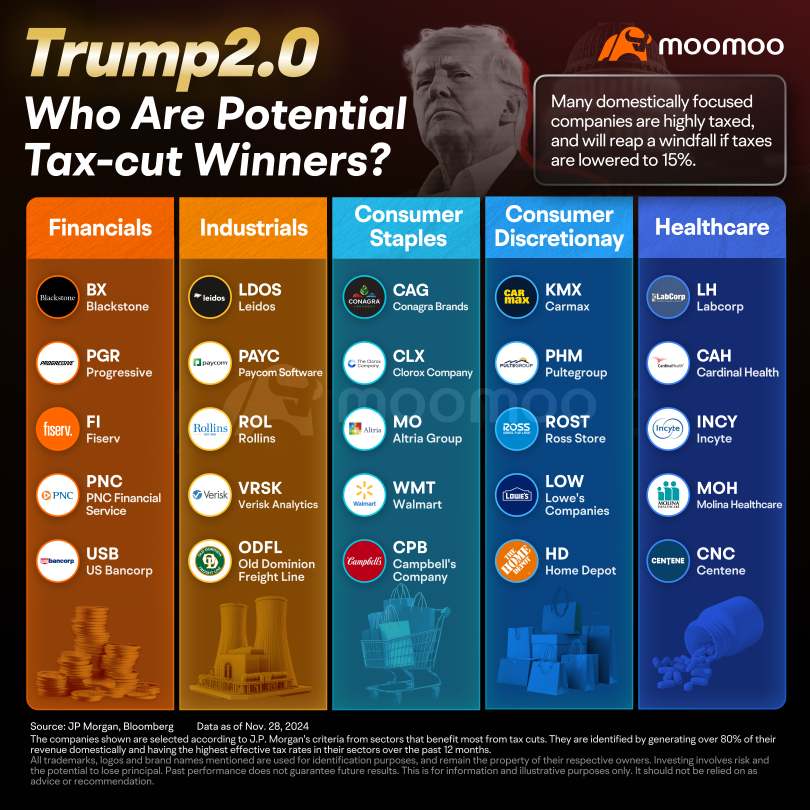

With Donald Trump's return to the presidency, Wall Street is bracing for the likelihood of tax-cuts. Trump emphasized tariffs and tax reductions as central components of his electoral platform. He maintained a strong focus on tax policy, similar to his previous term, but with an even more radical approach.

Trump's proposed tax policy can be described as "raising tariffs and lowering domestic taxes." During his campaign, Trump pledged to uphold t...

Trump's proposed tax policy can be described as "raising tariffs and lowering domestic taxes." During his campaign, Trump pledged to uphold t...

55

7

Read more