Investment ThemesDetailed Quotes

ESG Investing

Watchlist

ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1379.962

- -2.635-0.19%

Trading Dec 4 15:49 ET

1385.359High1373.162Low

1383.575Open1382.597Pre Close58.10MVolume6Rise32.00P/E (Static)11.36BTurnover--Flatline0.24%Turnover Ratio5.26TMarket Cap9Fall5.23TFloat Cap

Constituent Stocks: 15Top Rising: VRSK+1.16%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

Latest PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

VRSKVerisk Analytics

292.4053.355+1.16%290.14K84.69M289.090289.050293.020288.17041.29B41.20B141.21M140.89M-0.80%+3.82%+4.55%+7.03%+11.83%+25.25%+22.98%0.52%0.21%45.6270.121.68%Consulting Services

SCLStepan

75.5000.320+0.43%27.34K2.06M75.05075.18075.70574.9101.70B1.60B22.49M21.20M-0.18%+0.76%+2.08%+5.50%-10.59%-10.27%-18.65%1.99%0.13%37.7543.141.06%Specialty Chemicals

WORWorthington Enterprises

41.5200.140+0.34%78.59K3.25M41.27541.38041.55040.8602.09B1.30B50.26M31.26M+3.36%+7.82%+5.62%-2.36%-20.73%-18.80%-27.17%2.31%0.25%55.3618.871.67%Metal Fabrication

JBHTJB Hunt Transport Services

185.4700.460+0.25%316.09K58.46M184.110185.010186.200183.22518.70B14.87B100.83M80.16M-2.82%+2.94%+0.18%+9.00%+17.27%-0.45%-6.26%0.92%0.39%33.7226.611.61%Integrated Freight & Logistics

AAPLApple

243.1100.460+0.19%28.27M6.87B242.870242.650244.105241.2503.67T3.67T15.12B15.09B+3.42%+6.50%+8.92%+10.57%+13.73%+27.03%+26.89%0.40%0.19%39.9939.991.18%Consumer Electronics

LNGCheniere Energy

223.2950.185+0.08%730.51K162.52M223.760223.110224.495221.59050.10B49.75B224.37M222.80M+0.63%+1.48%+16.24%+25.92%+40.93%+30.61%+32.17%0.78%0.33%14.205.481.30%Oil & Gas Midstream

HSTHost Hotels & Resorts

18.485-0.035-0.19%2.61M48.14M18.55018.52018.59018.38512.92B11.88B699.03M642.45M+0.96%+6.66%+4.73%+11.46%+3.29%+11.07%-1.95%4.33%0.41%17.9517.771.11%REIT - Hotel & Motel

TXNTexas Instruments

196.770-0.460-0.23%2.81M553.22M197.700197.230198.470195.610179.50B179.07B912.22M910.03M-2.08%-2.14%-2.81%-0.87%+1.57%+29.69%+18.73%2.64%0.31%36.5727.831.45%Semiconductors

MRKMerck & Co

101.500-0.350-0.34%5.37M545.63M102.020101.850102.090101.050256.76B256.44B2.53B2.53B-0.12%+5.14%-0.15%-11.40%-20.54%-1.36%-5.11%3.03%0.21%21.23725.001.02%Drug Manufacturers - General

SRESempra Energy

91.493-0.518-0.56%2.00M183.25M91.99092.01092.05091.09057.95B57.87B633.40M632.47M-1.93%-2.02%+11.24%+12.31%+22.06%+28.35%+25.46%2.68%0.32%20.1519.101.04%Utilities - Diversified

MAMasterCard

521.675-4.505-0.86%1.68M875.03M523.850526.180525.880518.170478.81B477.57B917.83M915.46M-1.29%+0.43%+3.19%+7.04%+17.56%+27.86%+23.02%0.49%0.18%39.4344.101.47%Credit Services

CVXChevron

158.440-3.480-2.15%5.34M849.41M162.110161.920161.830157.860284.73B270.56B1.80B1.71B-2.52%-0.73%+4.33%+15.79%+5.89%+15.95%+10.80%4.04%0.31%17.4113.952.45%Oil & Gas Integrated

COPConocoPhillips

103.560-2.490-2.35%5.35M555.25M106.105106.050106.105102.830133.96B133.74B1.29B1.29B-3.02%-8.43%-4.51%+0.27%-5.28%-3.67%-8.28%2.82%0.41%12.2811.433.09%Oil & Gas E&P

FSLRFirst Solar

201.470-6.040-2.91%1.71M346.44M207.690207.510207.690199.37021.57B20.39B107.06M101.20M+4.76%+7.53%-6.68%-3.24%-30.90%+38.67%+16.94%--1.69%17.3526.034.01%Solar

MPCMarathon Petroleum

149.830-5.660-3.64%1.51M227.43M154.510155.490154.900149.08048.15B48.01B321.39M320.45M-4.65%-5.10%+0.76%-7.85%-11.19%+6.78%+3.05%2.20%0.47%11.626.343.74%Oil & Gas Refining & Marketing

News

Making Money From Crowd Stampede – Palantir Becomes Largest Defense Contractor In Blink Of An Eye

Texas Instruments's Options: A Look at What the Big Money Is Thinking

AT&T, JPMorgan Have Reportedly Pulled Out of Twitch Ads After Allegations of Antisemitism

What the Options Market Tells Us About ConocoPhillips

Shares of Oil and Gas Companies Are Lower Ahead of OPEC's Supply Decision on Thursday. The Commodity May Be Falling Due to Ongoing Conflict in the Middle East.

Why You Should Be Checking Reddit Again Ahead of Trading

Comments

$Apple (AAPL.US)$ pretty soon your watch can make you cum without touching yourself.. take it to 400

2

2

$Apple (AAPL.US)$ good price to take profit you better take

2

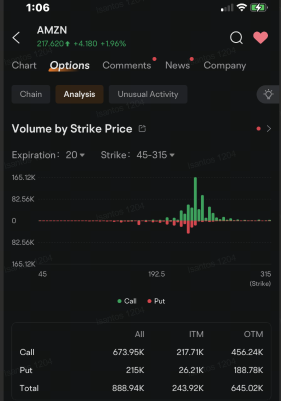

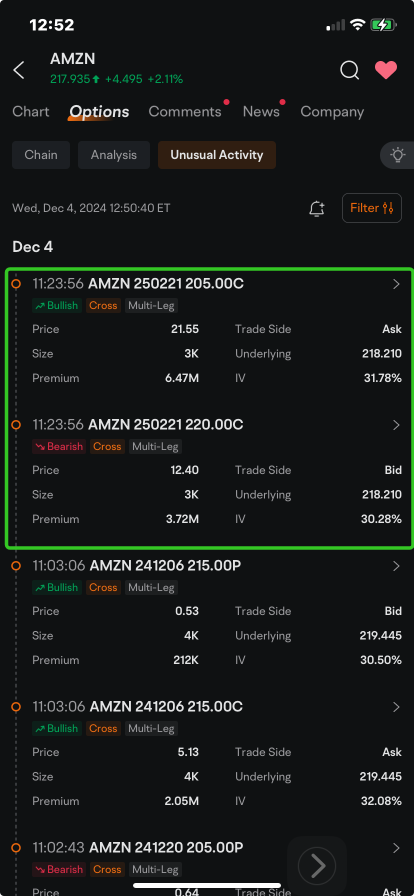

$Amazon (AMZN.US)$ stock options volume rose Wednesday, surpassing that of $Tesla (TSLA.US)$, as shares of the top cloud services provider rose to an intraday record high after unveiling its new array of powerful chips for artificial intelligence applications.

The company's cloud services division, the Amazon Web Services began offering the chips to customers, Bloomberg reported yesterday. $Apple (AAPL.US)$ is in early stag...

The company's cloud services division, the Amazon Web Services began offering the chips to customers, Bloomberg reported yesterday. $Apple (AAPL.US)$ is in early stag...

14

1

4

3

6

Read more

101721316 : LOL

OG Kanaka :