ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1407.837

- -23.837-1.67%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Friday Market Pulls Back, Led by Mag Seven Decline | Live Stock

Assessing Apple's Performance Against Competitors In Technology Hardware, Storage & Peripherals Industry

4 Stocks to Watch on Friday: NFLX, AAPL on $4T Watch and More

US Morning News Call | Apple Hits Record High with 5-Day Rally, Market Cap Nears $4 Trillion

Steve Jobs Knew What MacBook Should Be Like In 1983 — It Took Apple 25 Years To Bring His Vision To Life: With AAPL Stock At Record Highs, Here's What Analysts Say

Dow Edges Higher In Thin Holiday Trading As Tesla, Apple Surge: Investor Sentiment Improves, But Greed Index Remains In 'Fear' Zone

Comments

Just a few more days before we see the first surge of 2025.

$Apple (AAPL.US)$ $Meta Platforms (META.US)$ $Alphabet-C (GOOG.US)$ $Tesla (TSLA.US)$ $Microsoft (MSFT.US)$ $Amazon (AMZN.US)$ $NVIDIA (NVDA.US)$

The market turned around, and mag seven stocks were leading the Dow lower Friday. Ten out of 11 S&P 500 sectors were lower.

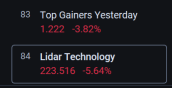

Within industry themes tracked by moomoo, Lidar Technology was leading the market lower, followed by "Top Gainers Yester...

Key Decliners

• Tesla ( $Tesla (TSLA.US)$): The biggest loser today, dropping a hefty -4.81%, possibly driven by profit-taking or concerns over valuation.

• Nv...