Investment ThemesDetailed Quotes

ESG Investing

Watchlist

ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1290.721

- -5.791-0.45%

Close Mar 26 16:00 ET

1304.848High1286.411Low

1297.898Open1296.512Pre Close99.91MVolume13Rise29.43P/E (Static)16.09BTurnover--Flatline0.41%Turnover Ratio4.87TMarket Cap2Fall4.85TFloat Cap

Constituent Stocks: 15Top Rising: WOR+23.76%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

WORWorthington Enterprises

51.5209.890+23.76%1.92M97.51M43.52041.63052.27843.3902.58B1.60B50.04M31.04M+24.84%+28.26%+22.61%+25.07%+26.25%-13.55%+29.00%1.28%6.20%42.5823.4221.35%Metal Fabrication

SRESempra Energy

70.7701.660+2.40%5.30M373.85M69.35069.11070.98069.30046.10B46.03B651.46M650.41M+0.46%+3.58%-1.97%-18.48%-14.32%+5.49%-18.58%3.50%0.82%16.0116.012.43%Utilities - Diversified

VRSKVerisk Analytics

292.0304.270+1.48%773.09K225.58M288.450287.760293.000288.10540.96B40.85B140.28M139.89M+0.79%+1.55%+1.55%+5.07%+9.03%+27.05%+6.19%0.53%0.55%43.5243.521.70%Consulting Services

CVXChevron

167.9702.030+1.22%10.08M1.69B167.370165.940168.960167.250295.73B286.84B1.76B1.71B+2.39%+10.02%+8.27%+17.96%+14.61%+12.86%+17.26%3.88%0.59%17.2817.281.03%Oil & Gas Integrated

JBHTJB Hunt Transport Services

151.3901.440+0.96%2.27M341.36M147.590149.950152.340147.57515.14B12.00B100.01M79.25M+2.95%-1.98%-5.57%-11.76%-10.30%-21.06%-11.06%1.14%2.86%27.2327.233.18%Integrated Freight & Logistics

MAMasterCard

549.0703.910+0.72%2.68M1.47B547.140545.160551.030545.119500.59B496.19B911.71M903.69M+2.42%+4.66%-2.17%+2.56%+10.93%+15.81%+4.43%0.48%0.30%39.5339.531.08%Credit Services

COPConocoPhillips

103.2000.650+0.63%7.17M743.39M103.650102.550104.870102.610131.31B131.04B1.27B1.27B+1.85%+5.58%+7.35%+7.38%-4.21%-15.71%+4.91%3.02%0.57%13.2113.212.20%Oil & Gas E&P

MPCMarathon Petroleum

149.8100.720+0.48%1.98M298.26M150.920149.090153.885149.35046.67B46.54B311.53M310.63M+0.16%+9.25%+2.40%+11.29%-8.61%-22.48%+8.01%2.26%0.64%14.8614.863.04%Oil & Gas Refining & Marketing

SCLStepan

57.3700.210+0.37%113.61K6.52M57.52057.16058.43056.8551.29B1.22B22.55M21.26M-2.15%+0.17%-7.14%-13.94%-24.92%-33.20%-10.77%2.63%0.53%26.0826.082.76%Specialty Chemicals

TXNTexas Instruments

184.4900.520+0.28%5.82M1.07B184.260183.970186.010183.280167.87B167.45B909.92M907.63M+1.51%+5.00%-6.94%-3.06%-7.20%+12.95%-0.88%2.85%0.64%35.4835.481.48%Semiconductors

MRKMerck & Co

88.1100.240+0.27%13.81M1.22B88.24087.87089.32087.310222.57B222.22B2.53B2.52B-6.29%-4.80%-0.57%-11.01%-21.92%-27.72%-10.66%3.54%0.55%13.0713.072.29%Drug Manufacturers - General

LNGCheniere Energy

232.4500.450+0.19%1.19M276.54M234.750232.000235.570230.29051.99B51.64B223.67M222.16M+2.28%+8.04%+6.15%+10.80%+28.83%+46.98%+8.43%0.78%0.54%16.3716.372.28%Oil & Gas Midstream

HSTHost Hotels & Resorts

14.8100.010+0.07%8.61M127.22M14.83014.80014.93014.64010.35B9.52B699.11M642.79M-2.05%-1.99%-7.50%-17.59%-14.16%-23.25%-15.47%5.40%1.34%14.9614.961.96%REIT - Hotel & Motel

AAPLApple

221.530-2.220-0.99%34.49M7.68B223.510223.750225.020220.4703.33T3.33T15.02B15.02B+2.92%+2.10%-7.83%-14.38%-1.85%+31.15%-11.44%0.45%0.23%35.1636.442.03%Consumer Electronics

FSLRFirst Solar

126.340-5.120-3.89%3.69M471.03M131.070131.460132.500124.53013.53B12.58B107.06M99.58M-2.32%-7.13%-19.45%-31.23%-47.50%-17.51%-28.31%--3.71%10.5110.516.06%Solar

News

10 Information Technology Stocks With Whale Alerts In Today's Session

GameStop Pole-Vaults Over Palantir, Apple to Top 3 Stock Option: Options Chatter

12 Industrials Stocks Moving In Wednesday's Intraday Session

Crude Oil Gains Over 1%; Cintas Shares Jump After Q3 Earnings

How Is The Market Feeling About Cheniere Energy?

Earnings Call Summary | Worthington Enterprises(WOR.US) Q3 2025 Earnings Conference

Comments

The Nasdaq Composite Index, S&P 500 and Dow industrials all sank Wednesday as tariff turmoil once again rattled the market and the "Magnificent Seven" stocks all fell.

The tech-heavy $Nasdaq Composite Index (.IXIC.US)$ shed 372.84 points (2%) to 17,899.01, while the $S&P 500 Index (.SPX.US)$ dropped 64.45 ticks (1.1%) to 5,712.20. The $Dow Jones Industrial Average (.DJI.US)$ had a better session, but still gave bac...

The tech-heavy $Nasdaq Composite Index (.IXIC.US)$ shed 372.84 points (2%) to 17,899.01, while the $S&P 500 Index (.SPX.US)$ dropped 64.45 ticks (1.1%) to 5,712.20. The $Dow Jones Industrial Average (.DJI.US)$ had a better session, but still gave bac...

8

4

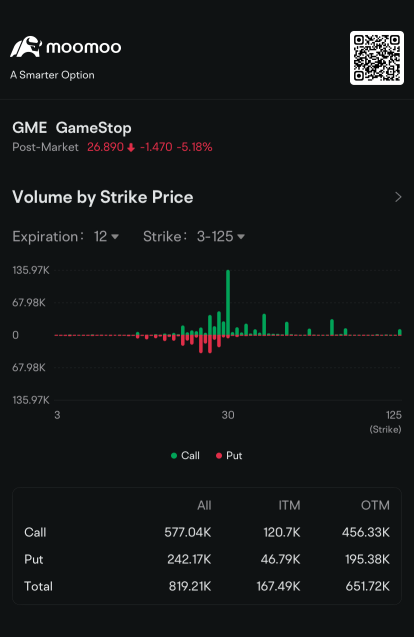

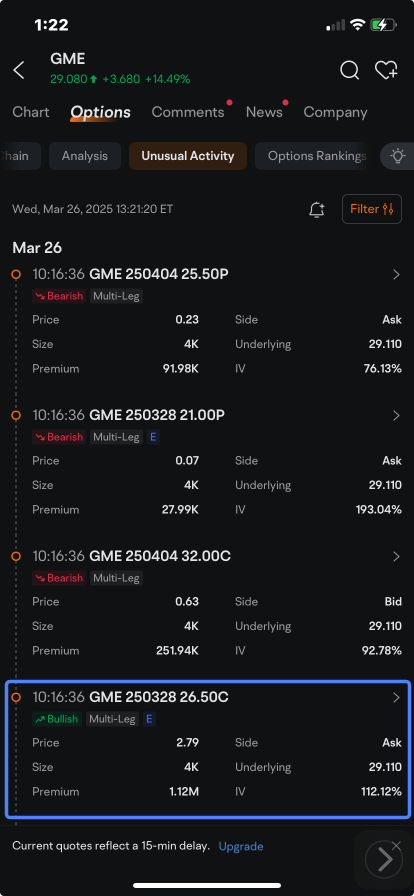

$GameStop (GME.US)$ pole-vaulted over $Palantir (PLTR.US)$ and $Apple (AAPL.US)$ to become Wednesday’s third most active stock option after the struggling video game retailer said its board approved a plan to add Bitcoin as a treasury reserve asset.

The video game retailer that reported a sixth straight quarterly revenue decline Tuesday joined other companies investing in the largest cryptocurrency, inspired by $Strategy (MSTR.US)$, whose sh...

The video game retailer that reported a sixth straight quarterly revenue decline Tuesday joined other companies investing in the largest cryptocurrency, inspired by $Strategy (MSTR.US)$, whose sh...

13

3

6

first share i gotten when get intro to moomoo app, and deposit the money. from there onwards, Learning all the strategies and courses shared. know the strategy and reading the P&L helps to boost confidence to invest in the stock. Just like apple!

1

Read more