Investment ThemesDetailed Quotes

ESG Investing

Watchlist

ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1300.990

- +3.163+0.24%

Close Jan 23 16:00 ET

1312.477High1294.832Low

1301.833Open1297.827Pre Close121.88MVolume10Rise30.18P/E (Static)22.66BTurnover--Flatline0.50%Turnover Ratio4.96TMarket Cap5Fall4.93TFloat Cap

Constituent Stocks: 15Top Rising: MPC+4.54%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

MPCMarathon Petroleum

154.3106.700+4.54%2.95M451.09M148.800147.610154.430148.70849.59B49.45B321.39M320.45M+1.55%+8.93%+15.69%+1.52%-11.90%+1.52%+10.62%2.14%0.92%11.976.533.88%Oil & Gas Refining & Marketing

TXNTexas Instruments

200.6103.560+1.81%12.69M2.51B194.820197.050200.637193.810183.00B182.56B912.22M910.02M+1.57%+4.37%+7.35%-2.26%-0.92%+21.32%+6.99%2.59%1.40%37.2928.373.47%Semiconductors

MAMasterCard

534.2207.040+1.34%2.20M1.17B529.050527.180534.350528.680490.32B485.90B917.83M909.56M+2.27%+4.62%+1.32%+4.78%+15.53%+22.47%+1.60%0.48%0.24%40.3845.161.08%Credit Services

FSLRFirst Solar

174.1102.210+1.29%4.24M726.59M171.010171.900175.750165.85218.64B17.34B107.06M99.58M-6.80%-11.95%-4.54%-11.19%-19.39%+16.95%-1.21%--4.26%15.0022.495.76%Solar

MRKMerck & Co

96.6300.950+0.99%11.52M1.11B96.11095.68097.15595.220244.44B244.14B2.53B2.53B-3.46%-4.35%-1.45%-8.00%-13.32%-16.50%-2.86%3.19%0.46%20.22690.212.02%Drug Manufacturers - General

COPConocoPhillips

103.9900.930+0.90%5.73M597.91M104.110103.060105.480103.630134.52B134.29B1.29B1.29B-1.41%+2.28%+9.33%+0.33%-5.15%-2.52%+4.86%2.81%0.44%12.3411.481.80%Oil & Gas E&P

HSTHost Hotels & Resorts

17.4300.140+0.81%6.20M107.76M17.31017.29017.52017.12512.18B11.20B699.03M642.44M+0.64%+2.23%-2.63%+0.40%+2.43%-6.00%-0.51%4.59%0.96%16.9216.762.29%REIT - Hotel & Motel

SCLStepan

63.6300.390+0.62%112.60K7.16M62.77063.24063.87062.3201.43B1.35B22.49M21.20M+0.17%+2.43%-5.20%-12.30%-24.07%-28.96%-1.65%2.36%0.53%31.8236.362.45%Specialty Chemicals

LNGCheniere Energy

234.2900.930+0.40%3.09M723.19M235.970233.360236.750232.76052.57B52.21B224.37M222.83M-4.71%+4.82%+12.16%+26.02%+28.91%+43.19%+9.04%0.74%1.39%14.895.751.71%Oil & Gas Midstream

SRESempra Energy

82.8100.010+0.01%4.59M380.30M82.95082.80083.53082.52052.45B52.37B633.40M632.45M+0.47%-1.69%-4.61%-2.79%+4.92%+21.86%-5.60%2.96%0.73%18.2417.291.22%Utilities - Diversified

AAPLApple

223.660-0.170-0.08%60.23M13.50B224.740223.830227.030222.3003.38T3.38T15.12B15.09B-5.97%-7.66%-12.11%-2.89%+0.94%+15.56%-10.69%0.44%0.40%36.7936.792.11%Consumer Electronics

CVXChevron

156.010-0.400-0.26%5.98M935.58M157.630156.410157.940155.620280.36B266.41B1.80B1.71B-1.47%+4.29%+9.21%+4.75%-0.69%+12.29%+7.71%4.10%0.35%17.1413.731.48%Oil & Gas Integrated

VRSKVerisk Analytics

277.980-1.370-0.49%498.53K138.21M279.350279.350279.865274.82039.25B39.15B141.21M140.85M+1.52%+1.63%+0.40%+5.05%+6.50%+14.30%+0.93%0.54%0.35%43.3766.661.81%Consulting Services

WORWorthington Enterprises

41.420-0.440-1.05%243.52K10.08M41.56041.86041.89041.1202.07B1.29B50.04M31.05M-0.65%+4.02%+1.57%+7.77%-16.33%-22.66%+3.27%1.18%0.78%49.3118.831.84%Metal Fabrication

JBHTJB Hunt Transport Services

170.280-4.625-2.64%1.66M283.44M175.880174.905177.000169.43017.12B13.60B100.56M79.89M-8.72%-3.51%+0.03%-2.92%-1.18%-15.62%-0.22%1.01%2.07%30.6330.634.33%Integrated Freight & Logistics

News

Boeing, Nikola, Texas Instruments, Intuitive Surgical, And Tesla: Why These 5 Stocks Are On Investors' Radars Today

Earnings Call Summary | Texas Instruments(TXN.US) Q4 2024 Earnings Conference

Venezuela Loses Appeal of $8.5B ConocoPhillips Arbitration Award

Trump at Davos: EU Has Treated American Big Tech 'Very, Very Unfairly'

Earnings Breakdown: Texas Instruments Q4

Texas Instruments in Charts: Revenue Dips Sequentially Across All Operating Segments in Q4

Comments

Why to focus on defence, AI and health stocks, which will probably dominate this half year

US stocks punched to brand-new record all-time highs with defence stocks like GE rising almost 7% to a 24-year high. The Défense ETF ITA surged to a brand new record. While health names like Moderna gained 10%. And stocks like Palantir also rose,...

US stocks punched to brand-new record all-time highs with defence stocks like GE rising almost 7% to a 24-year high. The Défense ETF ITA surged to a brand new record. While health names like Moderna gained 10%. And stocks like Palantir also rose,...

From YouTube

2

2

$Texas Instruments (TXN.US)$ The free cash flow can’t cover the dividend at the present price. Give whatever premium valuation for the bulls, the truth will show up eventually.

$First Solar (FSLR.US)$ dont ignore that massive sell at end . trump daddy gonna burnt this dumpster fire

2

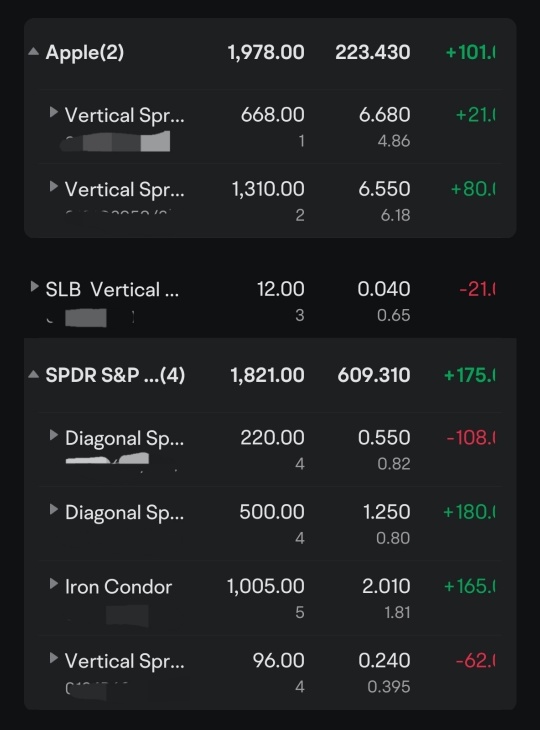

$SPDR S&P 500 ETF (SPY.US)$ $Apple (AAPL.US)$ $Schlumberger (SLB.US)$ Below is my trade bias:

SPY Friday: 603-613 (60% downside)

AAPL Friday: 219-225 (60% upside)

SLB Friday : 41-43 (60% downside)

(This is not a trading advice and my analysis is applied to my personal option strategies hedging against each other which may not suit for your trading techniques)

SPY Friday: 603-613 (60% downside)

AAPL Friday: 219-225 (60% upside)

SLB Friday : 41-43 (60% downside)

(This is not a trading advice and my analysis is applied to my personal option strategies hedging against each other which may not suit for your trading techniques)

+4

2

Read more

151453268 witso : 25 does feel to me to be a breakout year for investing, personally i think we cant be too certain on Aussie rate cuts of signifigance and oil and gas is controlled by a tap with supply and demand in the case of opec countries the mere request to open the tap up does carry a bit of weight because trump as a business man knows how to lean on countries with his tools of trade he has mentioned. Competition is the life blood of a healthy economy and he is trying to create some breathing space for competition to thrive, monopolys are never a good thing only for the greedy people who run them. The Aussie government i am not sure they have finished wringing the cash out of mortgage holders yet the realestate market is still awash with interstate and foreign cash more and more American trucks seem to be popping up on the roads demand in construction is out of control but materials and labour supply are still pushing inflation north along with the unsustainable immigration, hard to say where it ends the pot needs to simmer for a while i think. But i am optimistic of having a great year regardless.

Buy n Die Together❤ :