Investment ThemesDetailed Quotes

ESG Investing

Watchlist

ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1327.756

- +7.555+0.57%

Close Jan 17 16:00 ET

1334.976High1322.639Low

1333.948Open1320.201Pre Close130.49MVolume11Rise30.80P/E (Static)24.54BTurnover--Flatline0.53%Turnover Ratio5.06TMarket Cap4Fall5.03TFloat Cap

Constituent Stocks: 15Top Rising: TXN+2.70%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

TXNTexas Instruments

192.4205.050+2.70%5.41M1.04B192.540187.370192.930190.020175.53B175.11B912.22M910.02M+1.19%+2.93%+2.29%-1.06%-3.49%+13.97%+2.62%2.70%0.59%35.7727.221.55%Semiconductors

SRESempra Energy

85.1801.190+1.42%3.63M308.16M84.19083.99085.33083.72053.95B53.87B633.40M632.45M+8.19%-2.24%-2.05%+0.98%+10.00%+20.59%-2.90%2.88%0.57%18.7617.781.92%Utilities - Diversified

CVXChevron

161.4702.090+1.31%9.26M1.49B159.130159.380161.770158.798290.18B275.74B1.80B1.71B+5.44%+10.06%+9.02%+8.11%+4.50%+18.41%+11.48%3.96%0.54%17.7414.211.87%Oil & Gas Integrated

FSLRFirst Solar

192.8801.990+1.04%1.54M296.10M193.880190.890194.000190.57020.65B19.21B107.06M99.58M+1.92%+3.44%+2.45%-1.72%-14.93%+32.18%+9.44%--1.55%16.6124.921.80%Solar

AAPLApple

229.9801.720+0.75%68.49M15.78B232.115228.260232.290228.4803.48T3.47T15.12B15.09B-2.90%-5.69%-9.27%-2.64%+5.75%+20.65%-8.16%0.43%0.45%37.8337.831.67%Consumer Electronics

MPCMarathon Petroleum

152.7001.000+0.66%2.49M379.13M151.500151.700153.540149.95049.08B48.93B321.39M320.45M+7.33%+7.92%+10.66%-2.12%-10.61%+1.85%+9.46%2.16%0.78%11.856.462.37%Oil & Gas Refining & Marketing

SCLStepan

63.8700.300+0.47%107.66K6.86M64.26063.57064.26063.0901.44B1.35B22.49M21.20M+5.99%+1.09%-10.67%-12.73%-28.77%-28.20%-1.28%2.35%0.51%31.9436.501.84%Specialty Chemicals

WORWorthington Enterprises

42.0100.190+0.45%369.90K15.53M42.32041.82042.63041.6002.10B1.30B50.04M31.05M+6.03%+7.86%+9.97%+2.31%-16.62%-22.84%+4.74%1.17%1.19%50.0119.102.46%Metal Fabrication

MAMasterCard

524.7001.560+0.30%2.37M1.25B524.580523.140528.130521.010481.59B477.23B917.83M909.53M+3.97%+0.59%-1.04%+2.03%+20.08%+20.81%-0.21%0.49%0.26%39.6644.351.36%Credit Services

COPConocoPhillips

105.8500.240+0.23%8.56M904.98M105.800105.610106.150105.170136.92B136.69B1.29B1.29B+3.86%+5.77%+7.72%+1.52%-3.15%+0.88%+6.74%2.76%0.66%12.5611.680.93%Oil & Gas E&P

VRSKVerisk Analytics

278.5500.080+0.03%670.74K187.51M282.060278.470282.060277.77039.33B39.24B141.21M140.87M+3.69%+1.89%-0.60%+4.04%-0.23%+16.70%+1.13%0.54%0.48%43.4666.801.54%Consulting Services

HSTHost Hotels & Resorts

17.060-0.010-0.06%5.65M96.73M17.20517.07017.28917.03011.93B10.96B699.03M642.44M-0.12%-0.81%-7.38%-1.56%+0.61%-10.34%-2.63%4.69%0.88%16.5616.401.52%REIT - Hotel & Motel

LNGCheniere Energy

252.760-0.900-0.35%2.50M636.51M254.980253.660257.650251.39056.71B56.32B224.37M222.83M+12.23%+14.58%+19.97%+39.94%+43.73%+58.58%+17.63%0.69%1.12%16.076.212.47%Oil & Gas Midstream

MRKMerck & Co

97.920-2.780-2.76%16.18M1.60B100.470100.700100.47097.920247.70B247.40B2.53B2.53B-1.34%-1.26%-2.14%-7.18%-20.67%-15.39%-1.57%3.15%0.64%20.49699.432.53%Drug Manufacturers - General

JBHTJB Hunt Transport Services

172.450-13.750-7.38%3.30M573.19M175.000186.200178.400171.41017.34B13.78B100.56M79.89M-1.06%+0.73%-2.74%-2.67%+1.02%-12.40%+1.05%1.00%4.13%31.0231.023.75%Integrated Freight & Logistics

News

TikTok to Restore Service in US After Assurances From Trump

Could Cupertino Save Struggling Sonos? Speculation About Apple Bid Abounds

Earnings Week Ahead: JNJ, NFLX, AAL, UAL, AXP, ABT, VZ, PG, and More

Apple Watch Saves Another Life, Credit Card Partnerships, And iPhone Market Share Woes: This Week In Appleverse

TikTok Goes Dark in the U.S.

14 Out of 20 Names Post Earnings Beat With Blockbuster Wins From Banks-Earnings Scorecard

Comments

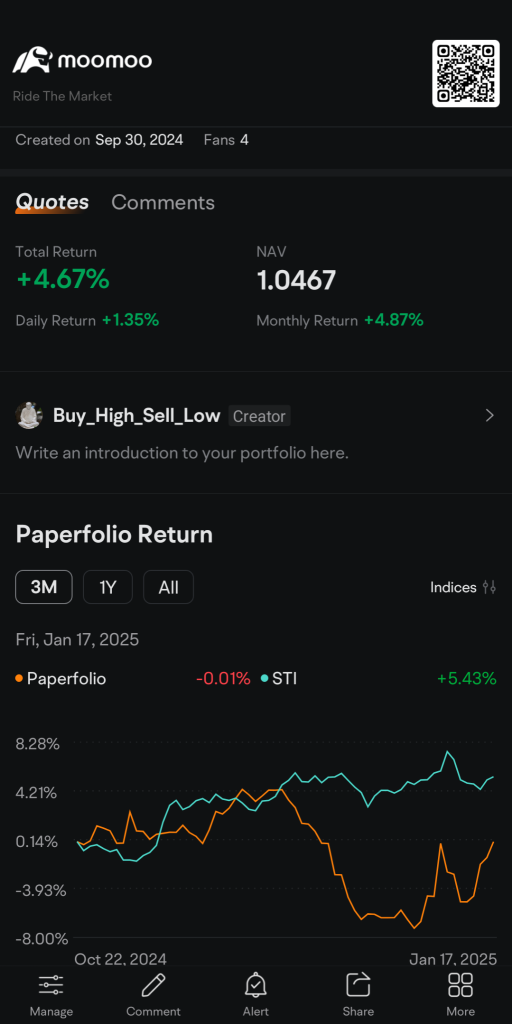

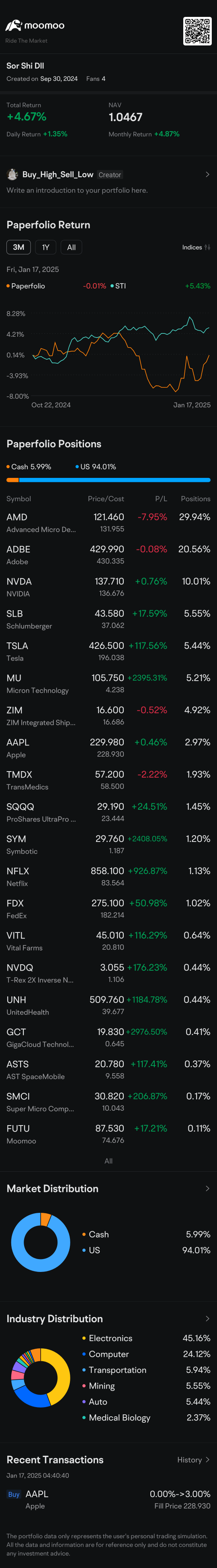

$ZIM Integrated Shipping (ZIM.US)$ and $TransMedics (TMDX.US)$are newly added stocks in my portfolio. $Advanced Micro Devices (AMD.US)$ , $NVIDIA (NVDA.US)$ and $Adobe (ADBE.US)$ are my largest holdings while trimming position on $Micron Technology (MU.US)$ and $Tesla (TSLA.US)$. Kept $Schlumberger (SLB.US)$ for long portfolio position.

$SPDR S&P 500 ETF (SPY.US)$ and $Apple (AAPL.US)$ are long for my personal account. Recently, purchased $Schlumberger (SLB.US)$ short ter...

$SPDR S&P 500 ETF (SPY.US)$ and $Apple (AAPL.US)$ are long for my personal account. Recently, purchased $Schlumberger (SLB.US)$ short ter...

$Trump Media & Technology (DJT.US)$ ANYONE in the USA on a MARGIN ACCOUNT and below 25,000 can SWITCH to a CASH ACCOUNT and have UNLIMITED DAY TRADING with your available Funds DAILY with Trading Options options funds settle DAILY!!!

ANYONE Outside of USA has UNLIMITED DAY TRADING REGARDLESS of your Funded Amount you are not BOUND by U.S.A Wall Street Rules you are on UNLIMITED DAY TRADING DAILY!!! $SPDR S&P 500 ETF (SPY.US)$ $Apple (AAPL.US)$ $NIO Inc (NIO.US)$ $Bitcoin (BTC.CC)$ $Coinbase (COIN.US)$ $Dogecoin (DOGE.CC)$

ANYONE Outside of USA has UNLIMITED DAY TRADING REGARDLESS of your Funded Amount you are not BOUND by U.S.A Wall Street Rules you are on UNLIMITED DAY TRADING DAILY!!! $SPDR S&P 500 ETF (SPY.US)$ $Apple (AAPL.US)$ $NIO Inc (NIO.US)$ $Bitcoin (BTC.CC)$ $Coinbase (COIN.US)$ $Dogecoin (DOGE.CC)$

2

38

2

Read more