ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1306.983

- +12.318+0.95%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Rate-sensitive Real Estate Stocks Outperform Broader Markets

Apple To Unveil iPhone 16, Watches, And AirPods At September 10 Event: Report

Solar, Clean Energy Stocks Surge as Powell Points to Imminent Rate Cuts

Will the iPhone 16 be unveiled in two weeks? Apple may hold its most important new product launch event on September 10th.

According to reports, the iPhone 16 will be equipped with the A18 chip and will be enhanced by Apple Intelligence. It will introduce a new capture button similar to a shutter, and will be available for sale on September 20th. Apple will also release the Apple Watch Series 10 and update the entry-level and mid-range AirPods. Apple is currently testing four Mac models with the M4 chip.

Forecasting The Future: 6 Analyst Projections For Sempra

Nvidia Is Next Week's Top Stock, Market Strategist Says: Why Best Long-Term Idea Is 'Just Buy Nvidia And Put It Away'

Comments

Right now, S&P 500 is just a whisker away from its all-time high.

But we have 2 key events coming up – Nvidia’s earnings and a seasonal bearish September. How should we position ourselves ahead of these events?

$Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$ $Amazon (AMZN.US)$ $Alphabet-A (GOOGL.US)$ $Meta Platforms (META.US)$ $Microsoft (MSFT.US)$ $Apple (AAPL.US)$ $Netflix (NFLX.US)$ ��������...

🤣

Milestones ahead - not to disagree with any ones else, Just my opinion:

1. Jackson Powell speaking today - positive.

2. August. 28th: Earnings

3. Sept Fed dropping rates

4. Apple sept new iPhone released. AI UPDATES and new iMac mini etc

5. Fed rate cuts October

6. Fed rates. Cuts December

7. Blackwell Processers etc etc etc

Q4 will be a continuing bull 🐂 But will have. Few pull backs 😇

Only my opinion.

1. Jackson Powell speaking today - positive.

2. August. 28th: Earnings

3. Sept Fed dropping rates

4. Apple sept new iPhone released. AI UPDATES and new iMac mini etc

5. Fed rate cuts October

6. Fed rates. Cuts December

7. Blackwell Processers etc etc etc

Q4 will be a continuing bull 🐂 But will have. Few pull backs 😇

Only my opinion.

Make Your Choice

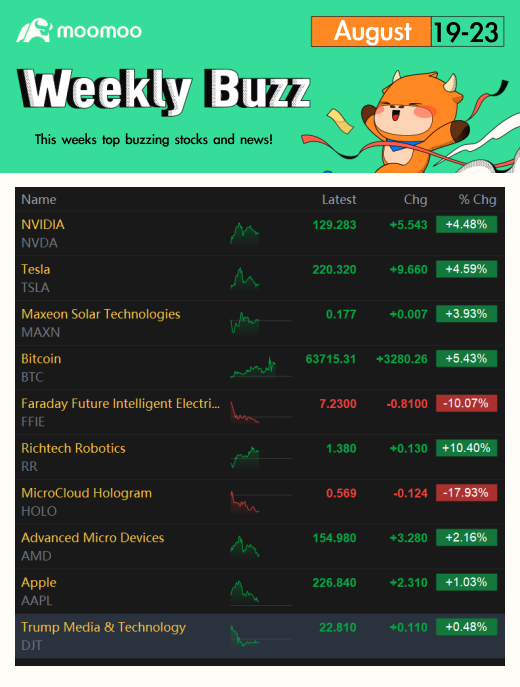

Weekly Buzz

What a Friday it is! Federal Reserve President Jerome Powell said everything short of 'we are cutting rates in September' at the Jackson Hole, WY Ec...

remember, the 1% make money on the way down and on the way up.

remember, the 1% make money on the way down and on the way up.

with you

with you  is to have as many shares of whatever YOU believe in long term, and to enjoy the ride

is to have as many shares of whatever YOU believe in long term, and to enjoy the ride RIGHT

RIGHT

DISCLAIMER:

DISCLAIMER: