ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1355.537

- +1.027+0.08%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Elon Musk Lauds Apple AirPods Pro 2's Hearing Aid Feature As Tim Cook Highlights The Affordable Solution To What Otherwise Costs Up To $7,000

What Do Tim Cook, Sundar Pichai, Elon Musk, And Lisa Su Have In Common This Thanksgiving? Heartwarming Gratitude, Unexpected Humor, And A Turkey Or Two

Will Apple Or NVIDIA Be The World's Most Valuable Company By The End Of 2024? Polymarket Traders Have A Clear Favorite

Understanding Apple's Position In Technology Hardware, Storage & Peripherals Industry Compared To Competitors

Trump's tariff plan angers many? US oil industry warns: rbob gasoline costs rise exacerbating consumer burden

① President-elect Trump of the usa threatens to impose a 25% tariff on products from Mexico and Canada, causing concerns in the oil rbob gasoline industry; ② U.S. refineries highly rely on crude oil imports. The American Petroleum Institute warns that tariffs will raise refining costs and gasoline prices, exacerbating consumer burden; ③ Analysts believe the likelihood of Trump implementing the tariff plan is small.

The "bad news" for technology giants: Is Trump also anti-monopoly?

Reports indicate that Trump is considering appointing Slater as the head of the Justice Department's Antitrust Division, with analysts suggesting that this nomination means Trump will continue the tough enforcement stance advocated by the Biden administration.

Comments

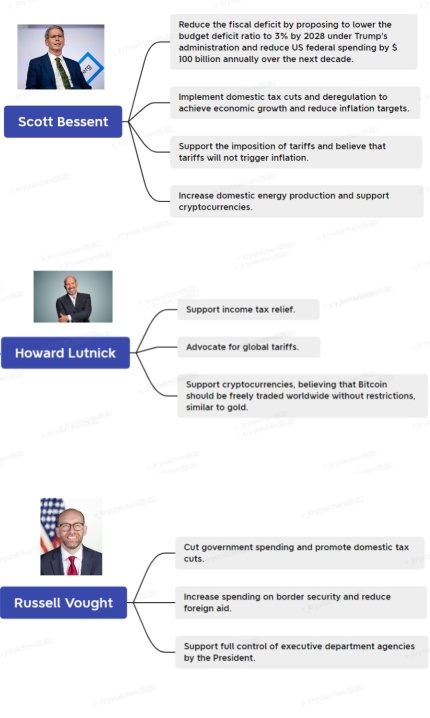

1. Who’s on Trump’s team? What are their primary responsibilities?

2. Economic ideologies of Cabinet members in policy-related roles

3. Economic ideologies of non-Cabinet members in policy-related roles

4. Impacts...

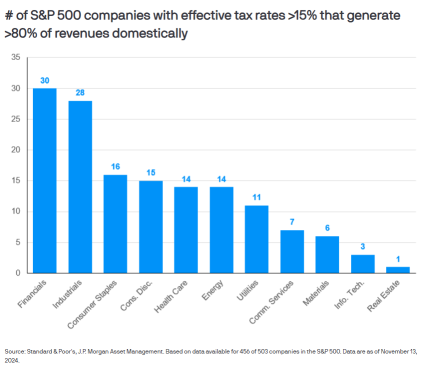

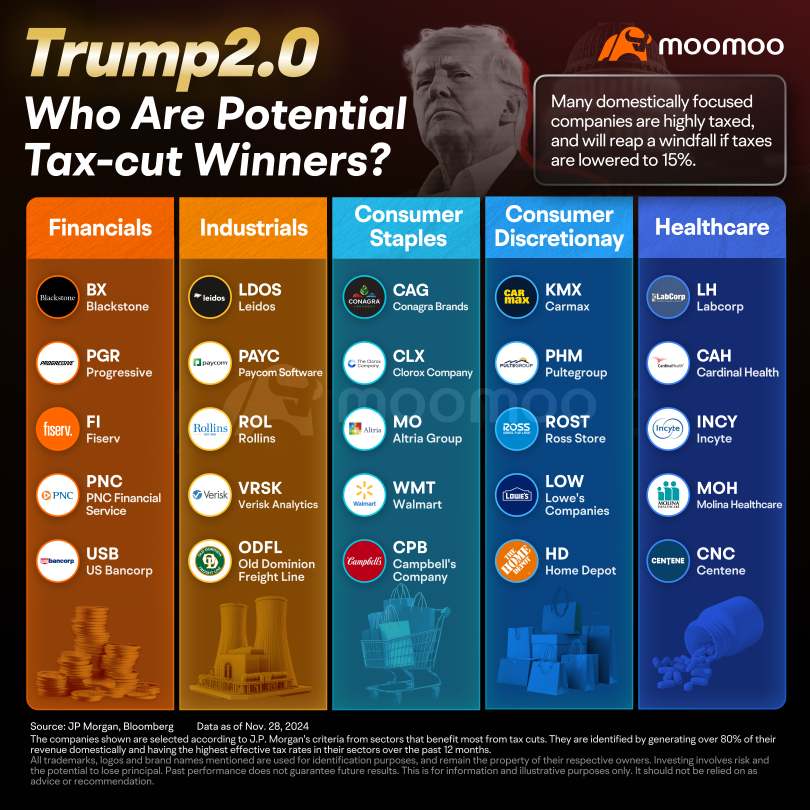

Trump's proposed tax policy can be described as "raising tariffs and lowering domestic taxes." During his campaign, Trump pledged to uphold t...

That feeling is often referred to as "market withdrawal" or "trader's withdrawal." It's the sensation of missing the usual market activity, excitement, and routine, especially when you're used to actively trading or monitoring the markets every day. This can happen on trading holidays or weekends when the markets are closed.

I cannot help checking in on market opening and the stocks I monitor daily such as $NVIDIA (NVDA.US)$ , �������...

$Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

In investment, the new high breakthrough as a definition of the upward, although the Dow Jones index closed do...