Investment ThemesDetailed Quotes

Shale Oil

Watchlist

- 1646.437

- +4.311+0.26%

Close Nov 29 13:00 ET

1650.324High1640.925Low

1643.990Open1642.126Pre Close36.71MVolume10Rise11.92P/E (Static)3.37BTurnover1Flatline0.31%Turnover Ratio1.23TMarket Cap3Fall1.19TFloat Cap

Constituent Stocks: 14Top Rising: COP+0.88%

$Occidental Petroleum (OXY.US)$ not moving

8

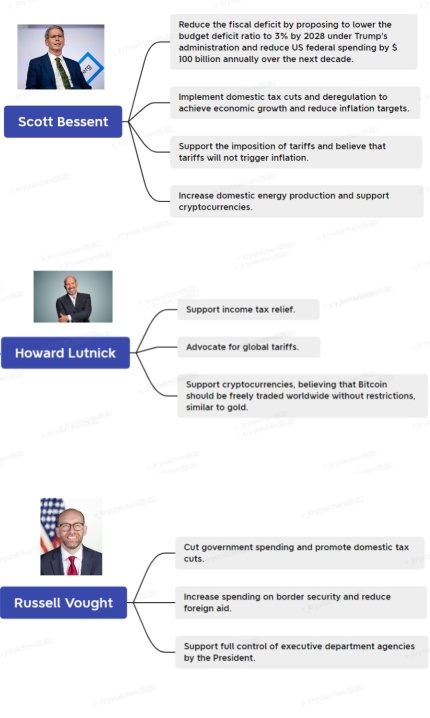

Trump’s second-term Cabinet nominations are nearly complete![]() . What are the core economic ideologies of this team? This article uses visuals and analysis to provide a deeper understanding for readers.

. What are the core economic ideologies of this team? This article uses visuals and analysis to provide a deeper understanding for readers.

1. Who’s on Trump’s team? What are their primary responsibilities?

2. Economic ideologies of Cabinet members in policy-related roles

3. Economic ideologies of non-Cabinet members in policy-related roles

4. Impacts...

1. Who’s on Trump’s team? What are their primary responsibilities?

2. Economic ideologies of Cabinet members in policy-related roles

3. Economic ideologies of non-Cabinet members in policy-related roles

4. Impacts...

+3

30

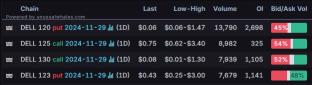

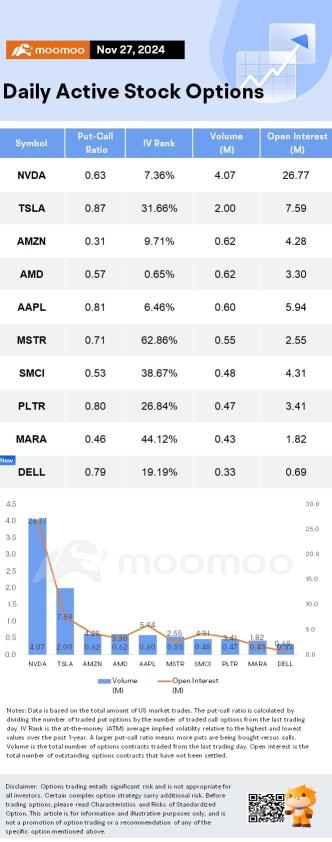

Columns Options Market Statistics: Dell Stock Sinks After Worse-Than-Expected Forecasts; Options Pop

News Highlights

1. $Dell Technologies (DELL.US)$ stock sinks 12% in Wednesday's trading, with the most traded puts are contracts of $120 strike price that expire on Nov. 29. The total volume reaches 13,790 with the open interest of 2,698

The company took a cautious approach to its forecast for investors while warning that AI growth "will not be linear."

"AI is a robust opportunity … and interest in our por...

1. $Dell Technologies (DELL.US)$ stock sinks 12% in Wednesday's trading, with the most traded puts are contracts of $120 strike price that expire on Nov. 29. The total volume reaches 13,790 with the open interest of 2,698

The company took a cautious approach to its forecast for investors while warning that AI growth "will not be linear."

"AI is a robust opportunity … and interest in our por...

+2

35

4

$Occidental Petroleum (OXY.US)$ I wonder how Warren Buffett feels?

Warren Buffett has been building a war chest of cash All Summer Long he's been reducing Bank of America he's been reducing Apple and he built up cash reserves and excess of $325 billion dollars.

it's the largest amount of cash of any company in the world it's in fact larger than the amount of cash that the Federal reserve holds, by a significant percentage.

Warren Buffett was betting on a Harris victory. and he bet that the mar...

Warren Buffett has been building a war chest of cash All Summer Long he's been reducing Bank of America he's been reducing Apple and he built up cash reserves and excess of $325 billion dollars.

it's the largest amount of cash of any company in the world it's in fact larger than the amount of cash that the Federal reserve holds, by a significant percentage.

Warren Buffett was betting on a Harris victory. and he bet that the mar...

6

12

Goldman forecasts gold will hit $3,000/oz by 2025, driven by central bank demand, Fed rate cuts, and risk aversion.

Brent oil prices may hover at $70-$85/bbl in 2025 due to OPEC+ and Trump tariffs but could fall to $61/bbl by late 2026.

$Crude Oil Futures(JAN5) (CLmain.US)$ $Brent Last Day Financial Futures(FEB5) (BZmain.US)$ $Occidental Petroleum (OXY.US)$ $Exxon Mobil (XOM.US)$

Brent oil prices may hover at $70-$85/bbl in 2025 due to OPEC+ and Trump tariffs but could fall to $61/bbl by late 2026.

$Crude Oil Futures(JAN5) (CLmain.US)$ $Brent Last Day Financial Futures(FEB5) (BZmain.US)$ $Occidental Petroleum (OXY.US)$ $Exxon Mobil (XOM.US)$

2

We have seen $Palantir (PLTR.US)$ continue its run during the AI rally, the concerns of overvaluation is still there, but I think we need to really look at how Palantir overall business have been performing.

I have a position on Palantir which I have hold because of the experience I have with their platform, so as we can see that Palantir have really grow since it experienced some stock price volatility over the past one year.

Pa...

I have a position on Palantir which I have hold because of the experience I have with their platform, so as we can see that Palantir have really grow since it experienced some stock price volatility over the past one year.

Pa...

+2

39

$Occidental Petroleum (OXY.US)$ I will buy it if it goes to $37.

2

2

$Occidental Petroleum (OXY.US)$ was buffet demented when he bought this stock? or does he know smth we don’t?

1

1

No comment yet

Let go OP : $Occidental Petroleum (OXY.US)$

WJH168OD : This market may not be suitable for me. As long as I increase my holdings, it will decline. My dear XO o(︶︿︶)o

Let go OP WJH168OD : What is ur cost ?

WJH168OD : 53

Let go OP WJH168OD : Got to wait .. my one 52.30

View more comments...