Investment ThemesDetailed Quotes

Credit Card Payment

Watchlist

- 1808.900

- +18.170+1.01%

Close Nov 22 16:00 ET

1810.227High1790.777Low

1790.777Open1790.729Pre Close44.06MVolume10Rise35.15P/E (Static)7.46BTurnover--Flatline0.60%Turnover Ratio1.69TMarket Cap1Fall1.60TFloat Cap

Constituent Stocks: 11Top Rising: AXP+2.83%

Berkshire Hathaway’s most recent portfolio update, based on filings as of Q3 2024, reveals several key holdings and recent changes:

Top Holdings:

1. $Apple (AAPL.US)$ 26.2% of the portfolio, valued at $69.9 billion. Despite recent trimming of the stake, Apple remains the largest holding.

2. $American Express (AXP.US)$ 15.4%, valued at $41.1 billion.

3. $Bank of America (BAC.US)$ 11.9%, worth $31.7 billion, though the stake was reduced by 23% in Q3.

4. $Coca-Cola (KO.US)$ 10.8%...

Top Holdings:

1. $Apple (AAPL.US)$ 26.2% of the portfolio, valued at $69.9 billion. Despite recent trimming of the stake, Apple remains the largest holding.

2. $American Express (AXP.US)$ 15.4%, valued at $41.1 billion.

3. $Bank of America (BAC.US)$ 11.9%, worth $31.7 billion, though the stake was reduced by 23% in Q3.

4. $Coca-Cola (KO.US)$ 10.8%...

1

1

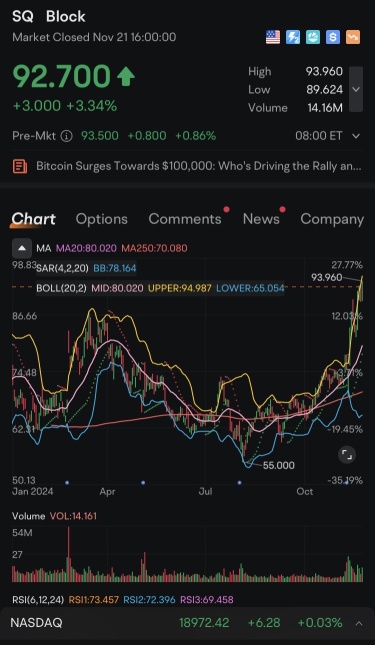

$Block (SQ.US)$ this is cooked on monday

There's going to be a lot of these huge losses with major investment firms soon.

Geriatric old white dudes don't have any idea what tech does anymore.

If you have a 401k, make sure you're hedging against major banks failing because they're doomed. You're high if you think ppl will open a Wells Fargo account when you can spend 5 minutes and not only have a cash app account or chime account but with competitive APY, 24/7, anywhere, and no fees.

$Goldman Sachs (GS.US)$

$Block (SQ.US)$

$Dave Inc (DAVE.US)$ �...

Geriatric old white dudes don't have any idea what tech does anymore.

If you have a 401k, make sure you're hedging against major banks failing because they're doomed. You're high if you think ppl will open a Wells Fargo account when you can spend 5 minutes and not only have a cash app account or chime account but with competitive APY, 24/7, anywhere, and no fees.

$Goldman Sachs (GS.US)$

$Block (SQ.US)$

$Dave Inc (DAVE.US)$ �...

3

$American Express (AXP.US)$ something must be going on. It rose so much in a day

5

$Block (SQ.US)$ good weekly vol trying to bo multi year base, soon will see new 52w hi…LFG 🚀🚀

“$SQ is flying high, closing at $92.70 (+3.34%)! 🚀 With #Bitcoin surging toward $100K, Block’s BTC exposure could supercharge its growth. The perfect storm for fintech & crypto innovation. Bulls in control—watch for that $94 breakout! 🐂💹

T

he biggest game changing event in financial markets happened this week. Bitcoin rose above US$99,000 for the first time on Thursday after rising 125% this year. That makes Bitcoin THE BEST performing asset. And more upside is ahead. Here’s what you need to know and the stocks to watch.

Bets are on for Bitcoin to imminently hit $100,000 then bring in the $175...

he biggest game changing event in financial markets happened this week. Bitcoin rose above US$99,000 for the first time on Thursday after rising 125% this year. That makes Bitcoin THE BEST performing asset. And more upside is ahead. Here’s what you need to know and the stocks to watch.

Bets are on for Bitcoin to imminently hit $100,000 then bring in the $175...

From YouTube

7

2

$Block (SQ.US)$ funny it makes profit better then mstr but way cheaper 😉 crap mara at least loses less money then mstr but smstr hit 550 today crazy how bad of earnings that has but how stupidly bullish it is but it won't last forever probably ended today actually still there are 3 and 4 dollar stocks that are crypto stocks that have way better earning then some love mara offering to buy more crypto what a free money glitch can u imagine I want more free money does a offering to buy crypto win wi...

8

No comment yet

Old Timer Trader : He sold 80 BILLION DOLLARS of AAPL stock. Just a year ago, he stated that Apple was a stock that he would never sell… can you explain that?