- 1564.120

- +20.640+1.34%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Sanctions? Russia Is Now Using Bitcoin for International Trade

Famous Analyst warns: the Technology bubble is approaching a "critical point", be wary of large hedge funds selling off.

Kaplan, the CEO of True Contrarian blog and newsletter, believes that the current technology bubble in U.S. stocks has grown larger... the current bear market may have already begun. He also stated that if stocks like QQQ drop by 20%, those funds worth trillions of dollars will sell off at the same time.

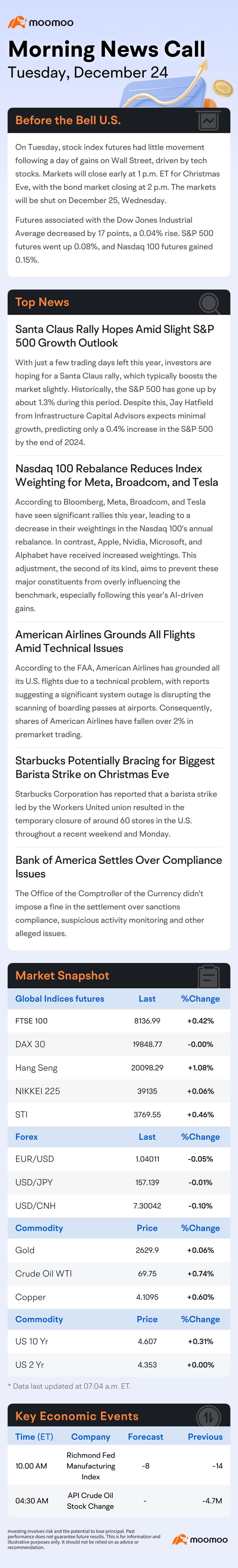

Payments of Up to $1,400 Coming for 1 Million Eligible Taxpayers, IRS Confirms

Is Stock Market Open Or Closed On Christmas Day 2024? Here Is What You Can Trade Today

Companies Line up to Fund Trump Inauguration Despite Withholding Support After Jan. 6

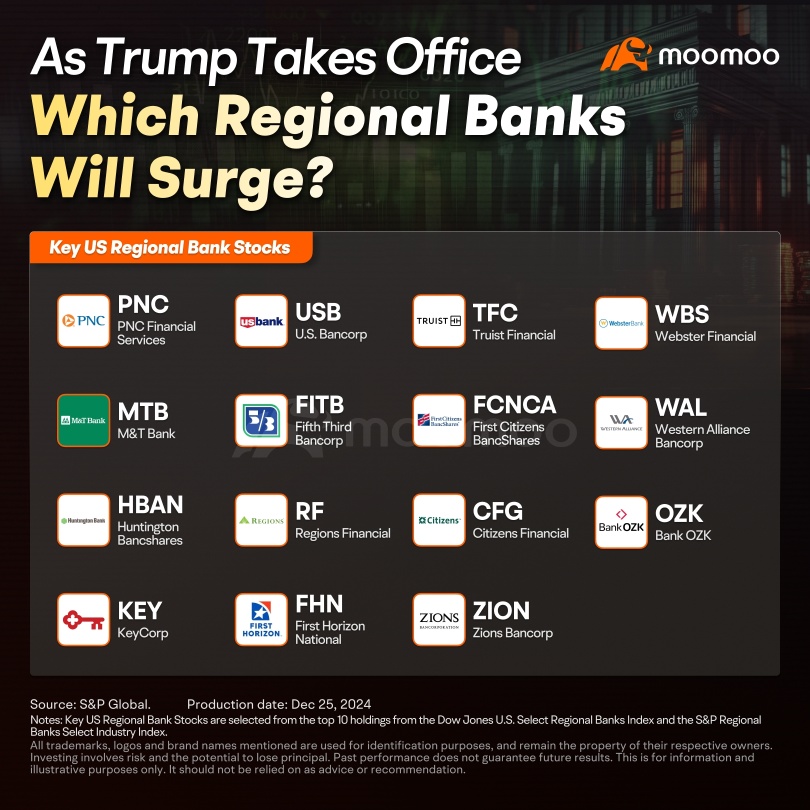

Trump's Presidency: A New Era of Growth for U.S. Regional Banks?

Comments

🎯 Here's my strategic blueprint:

Tap into AI & Energy Opportunities: Focus on stocks like $Tesla (TSLA.US)$, $NVIDIA (NVDA.US)$ for AI leadership and $Exxon Mobil (XOM.US)$ for energy resilience. 🛠️⚡

Embrace Trump 2.0: Expect regulatory ease & tax cuts to boost finances. 🏛️💰 $Goldman Sachs (GS.US)$ $JPMorgan (JPM.US)$

Small-Caps Strategy:

Buy $AST SpaceMobile (ASTS.US)$ , $Jumia Technologies (JMIA.US)$ , $indie Semiconductor (INDI.US)$ , ...

Year-End Market Trends (“Santa Claus Rally”)

1. Santa Claus Rally:

Historically, U.S. markets often experience a “Santa Claus Rally” during the last week of December through the first two trading days of ...

Ultratech : trump is a monster

Laine Ford : I like all future hold this year come