Investment ThemesDetailed Quotes

Asset Management

Watchlist

- 1530.301

- -34.070-2.18%

Close Jan 10 16:00 ET

1556.469High1524.343Low

1556.469Open1564.371Pre Close202.39MVolume1Rise17.91P/E (Static)17.18BTurnover--Flatline0.68%Turnover Ratio2.91TMarket Cap31Fall2.81TFloat Cap

Constituent Stocks: 32Top Rising: AIV+3.83%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

AIVApartment Investment & Management

8.9400.330+3.83%3.10M27.83M9.0508.6109.1608.7701.26B1.09B141.27M122.03M-1.22%+8.10%+2.41%+3.35%-0.78%+14.03%-1.65%--2.54%LossLoss4.53%REIT - Residential

INTUIntuit

623.430-1.580-0.25%2.39M1.49B618.840625.010633.620617.290174.51B170.16B279.92M272.94M+0.27%-3.23%-3.49%+1.18%-1.73%+3.05%-0.64%0.60%0.88%60.6459.772.61%Software - Application

SCHWCharles Schwab

72.770-0.230-0.32%10.87M790.17M71.91573.00073.46071.480133.21B111.99B1.83B1.54B-1.45%-2.77%-11.60%+7.67%+18.09%+13.16%-1.68%1.37%0.71%28.4328.652.71%Capital Markets

AIGAmerican International Group

70.500-0.930-1.30%7.18M504.63M69.24071.43070.72069.24043.98B43.81B623.77M621.47M-3.40%-3.21%-2.89%-8.67%-4.22%+7.01%-3.16%2.16%1.16%Loss14.162.07%Insurance - Diversified

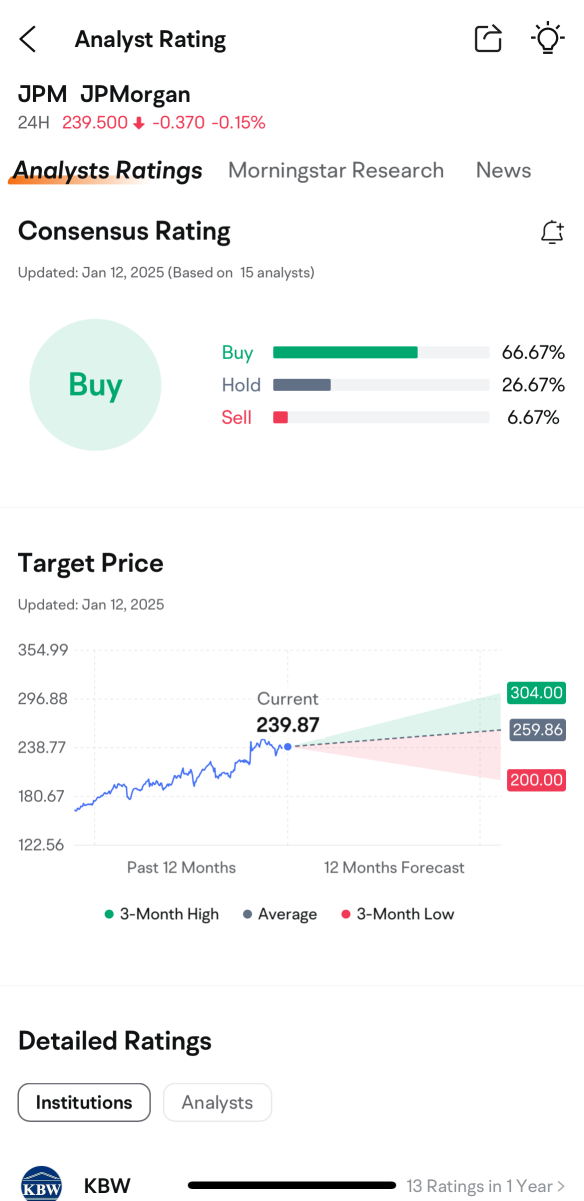

JPMJPMorgan

239.870-3.260-1.34%10.26M2.47B243.090243.130243.810238.740675.32B671.59B2.82B2.80B+0.46%-0.50%-0.72%+8.86%+15.64%+44.08%+0.58%1.92%0.37%13.3314.782.09%Banks - Diversified

VTRVentas Inc

57.390-0.880-1.51%2.12M121.63M57.61058.27058.22056.99024.08B23.96B419.51M417.57M-0.98%-2.43%-5.45%-9.59%+9.36%+24.14%-2.55%3.14%0.51%LossLoss2.11%REIT - Healthcare Facilities

MTBM&T Bank

187.750-3.390-1.77%1.45M270.93M190.420191.140190.500185.72031.15B30.98B165.92M165.03M-0.51%-1.66%-9.30%+1.81%+15.22%+43.34%-0.14%2.82%0.88%13.8911.892.50%Banks - Regional

SPGSimon Property

170.960-3.730-2.14%2.01M344.95M172.360174.690174.840170.10055.78B52.31B326.28M305.98M-1.48%-1.38%-4.61%+0.73%+14.12%+24.49%-0.73%4.62%0.66%22.7324.492.71%REIT - Retail

AMGAffiliated Managers

176.870-3.910-2.16%260.75K45.95M178.060180.780178.060174.0005.35B5.10B30.23M28.85M-5.37%-5.66%-4.58%-6.91%+5.33%+19.73%-4.35%0.02%0.90%11.4910.152.25%Asset Management

WFCWells Fargo & Co

69.960-1.610-2.25%14.47M1.01B70.90071.57070.93069.340232.93B232.45B3.33B3.32B-0.33%-2.28%-2.90%+13.20%+19.71%+46.43%-0.40%2.07%0.44%14.5414.482.22%Banks - Diversified

KEYKeyCorp

16.720-0.390-2.28%16.17M270.11M16.90017.11016.94516.59018.50B18.42B1.11B1.10B-1.53%-3.74%-9.18%-2.87%+9.74%+22.36%-2.45%4.90%1.47%0.0019.002.08%Banks - Regional

USBU.S. Bancorp

47.380-1.140-2.35%8.53M403.93M47.89048.52048.09047.05073.91B73.70B1.56B1.56B-1.00%-1.97%-7.23%+1.63%+8.25%+15.97%-0.94%4.16%0.55%14.5814.492.14%Banks - Regional

BACBank of America

45.110-1.100-2.38%40.74M1.84B46.00046.21046.05044.735346.12B345.63B7.67B7.66B+1.85%+1.64%-1.40%+8.24%+6.43%+39.54%+2.64%2.17%0.53%16.3414.652.85%Banks - Diversified

HBANHuntington Bancshares

16.020-0.410-2.50%16.41M262.74M16.41016.43016.41015.87023.27B23.08B1.45B1.44B-1.35%-2.67%-6.22%+4.17%+9.97%+31.66%-1.54%3.87%1.14%15.5512.923.29%Banks - Regional

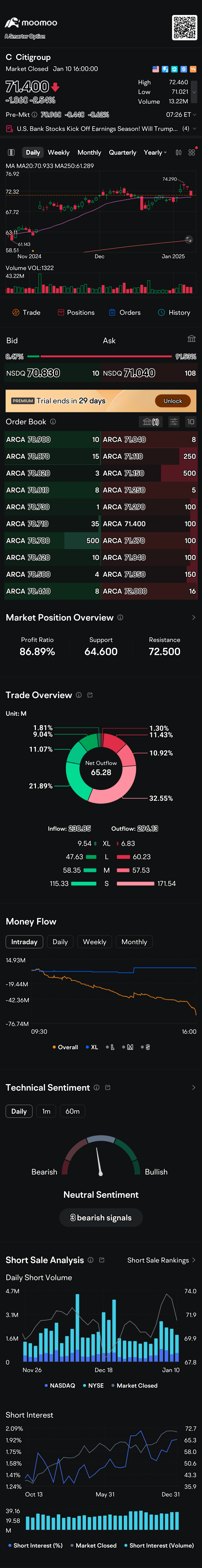

CCitigroup

71.400-1.860-2.54%13.22M945.32M72.46073.26072.46071.021135.04B130.71B1.89B1.83B+2.09%+0.56%-1.52%+9.12%+11.65%+42.20%+1.43%3.01%0.72%20.3417.671.96%Banks - Diversified

PFGPrincipal Financial

76.340-1.990-2.54%900.52K68.86M77.30078.33077.60576.11017.46B17.37B228.73M227.51M-1.36%-1.88%-5.45%-14.18%-8.30%+0.08%-1.38%3.65%0.40%Loss29.941.91%Asset Management

COFCapital One Financial

175.290-4.850-2.69%4.41M775.71M179.090180.140179.250174.66066.83B64.36B381.23M367.17M-1.91%-3.75%-4.70%+12.36%+20.05%+39.05%-1.70%1.37%1.20%16.5514.672.55%Credit Services

NTRSNorthern Trust

99.460-2.760-2.70%969.11K96.61M101.000102.220101.27599.13019.71B19.43B198.22M195.34M-3.43%-4.01%-8.04%+6.47%+18.13%+23.28%-2.97%3.02%0.50%12.3919.582.10%Asset Management

ZIONZions Bancorp

53.340-1.530-2.79%1.42M75.38M54.10054.87054.44052.8107.88B7.71B147.71M144.63M-1.35%-2.97%-8.70%+7.43%+10.88%+27.98%-1.68%3.07%0.98%12.1512.262.97%Banks - Regional

PNCPNC Financial Services

189.020-5.660-2.91%2.25M428.12M192.880194.680193.510188.61075.00B74.42B396.78M393.74M-1.24%-2.61%-7.54%+1.11%+8.60%+28.75%-1.99%3.31%0.57%15.9814.782.52%Banks - Regional

FITBFifth Third Bancorp

41.120-1.300-3.06%6.44M265.54M41.84042.42041.88541.00527.57B27.41B670.54M666.63M-2.49%-3.63%-10.65%-6.44%+2.12%+22.71%-2.74%3.45%0.97%13.7112.772.07%Banks - Regional

BLKBlackrock

955.640-30.460-3.09%908.17K870.33M979.790986.100982.050948.160148.01B147.96B154.88M154.83M-6.07%-9.40%-9.60%-3.16%+16.30%+23.45%-6.78%2.12%0.59%23.5826.173.44%Asset Management

RFRegions Financial

23.060-0.760-3.19%6.56M151.57M23.46023.82023.59022.94020.96B20.92B908.86M907.02M-0.86%-4.00%-8.96%-2.42%+6.50%+29.96%-1.96%4.21%0.72%12.9610.932.73%Banks - Regional

BKBank of New York Mellon

75.420-2.530-3.25%3.58M271.47M77.40077.95077.85075.39054.84B54.71B727.08M725.41M-2.57%-3.37%-6.45%-0.82%+21.96%+47.19%-1.84%2.29%0.49%16.4018.863.16%Banks - Diversified

BENFranklin Resources

19.120-0.680-3.43%5.53M106.02M19.47019.80019.66019.04010.02B5.91B523.98M309.00M-5.06%-6.99%-13.11%-3.48%-16.07%-29.78%-5.77%6.49%1.79%22.4922.493.13%Asset Management

MSMorgan Stanley

123.450-4.410-3.45%6.87M851.98M126.310127.860126.500123.290198.88B151.82B1.61B1.23B-1.07%-2.84%-2.63%+10.82%+22.98%+41.37%-1.81%2.81%0.56%18.7623.832.51%Capital Markets

GSGoldman Sachs

560.000-20.020-3.45%2.82M1.59B576.250580.020576.250558.010175.79B175.77B313.91M313.87M-2.60%-3.91%-4.28%+7.66%+16.74%+51.04%-2.20%2.01%0.90%16.4124.493.15%Capital Markets

AMPAmeriprise Financial

515.480-19.450-3.64%437.07K225.85M528.320534.930528.490514.40050.01B49.81B97.01M96.63M-2.73%-4.32%-5.65%+2.51%+26.29%+38.14%-3.18%1.10%0.45%19.7021.742.63%Asset Management

TROWT. Rowe Price

108.550-4.290-3.80%2.16M235.56M111.260112.840111.750108.04024.12B23.55B222.16M216.99M-4.30%-7.28%-10.85%0.00%-3.31%+3.77%-4.01%4.55%1.00%11.8913.993.29%Asset Management

STTState Street

93.910-3.820-3.91%2.53M239.09M96.65097.73096.65093.70027.53B26.02B293.15M277.02M-4.12%-4.66%-5.38%+4.08%+12.99%+27.51%-3.57%3.01%0.91%14.7216.833.02%Asset Management

1

2

News

Los Angeles Wildfires Blaze On, Strong Winds to Intensify This Week

Bank of America Gears Up For Q4 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

European Markets Fall Tracking Asian Peers, Tech Stocks Down

U.S. Bank Stocks Kick Off Earnings Season! Will Trump 2.0's Regulatory Easing Propel Stock Prices to New Heights?

Moody's Assesses California's P&C, Commercial Property Insurers Amid Wildfire Disaster

Newsom: LA Wildfires Could Become Worst Natural Disaster in US History

Comments

Columns Weekly Insights - 13th Jan 2025

Devastation caused by wildfires in the Los Angeles area have brought the total death toll of 24 as strong winds and no significant rainfall reins over the area. Thoughts and prayers are with those who have been impacted and first responders fighting to bring the fires under control.

Addicted to the Fed: Good news is bad news; monetary policy has been the single biggest driver of stock price performance ever since the US Fed discarded forward guidance and been extr...

Addicted to the Fed: Good news is bad news; monetary policy has been the single biggest driver of stock price performance ever since the US Fed discarded forward guidance and been extr...

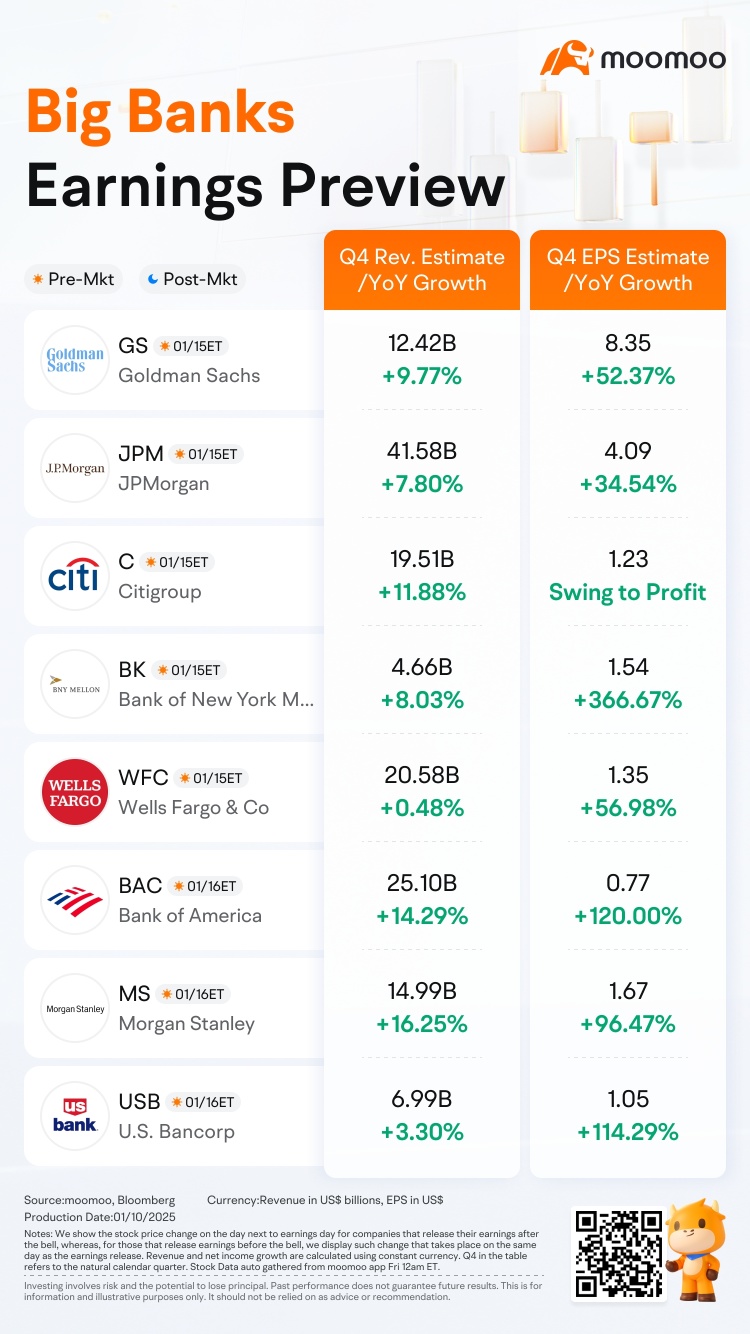

+2

The latest earnings season will kick off with the banking sector. $JPMorgan (JPM.US)$, $Goldman Sachs (GS.US)$, $Citigroup (C.US)$, $Bank of New York Mellon (BK.US)$ , and $Manulife Financial (MFC.US)$ are scheduled to release their earnings on Jan. 15, while $Bank of America (BAC.US)$ , $Morgan Stanley (MS.US)$ , and $U.S. Bancorp (USB.US)$ will report on Jan. 16.

Looking back at 2024, major...

Looking back at 2024, major...

21

5

12

Earnings Preview

This week marks the kickoff of a new earnings season for U.S. stocks, with major banks set to release their Q4 results. $JPMorgan (JPM.US)$, $Goldman Sachs (GS.US)$, $Citigroup (C.US)$ and $Wells Fargo & Co (WFC.US)$ are scheduled to report their earnings on Wednesday, followed by $Bank of America (BAC.US)$ and $Morgan Stanley (MS.US)$ on Thursday.

Reflecting on 2024, major bank stocks demonstra...

This week marks the kickoff of a new earnings season for U.S. stocks, with major banks set to release their Q4 results. $JPMorgan (JPM.US)$, $Goldman Sachs (GS.US)$, $Citigroup (C.US)$ and $Wells Fargo & Co (WFC.US)$ are scheduled to report their earnings on Wednesday, followed by $Bank of America (BAC.US)$ and $Morgan Stanley (MS.US)$ on Thursday.

Reflecting on 2024, major bank stocks demonstra...

+2

1

1

Hi, mooers!

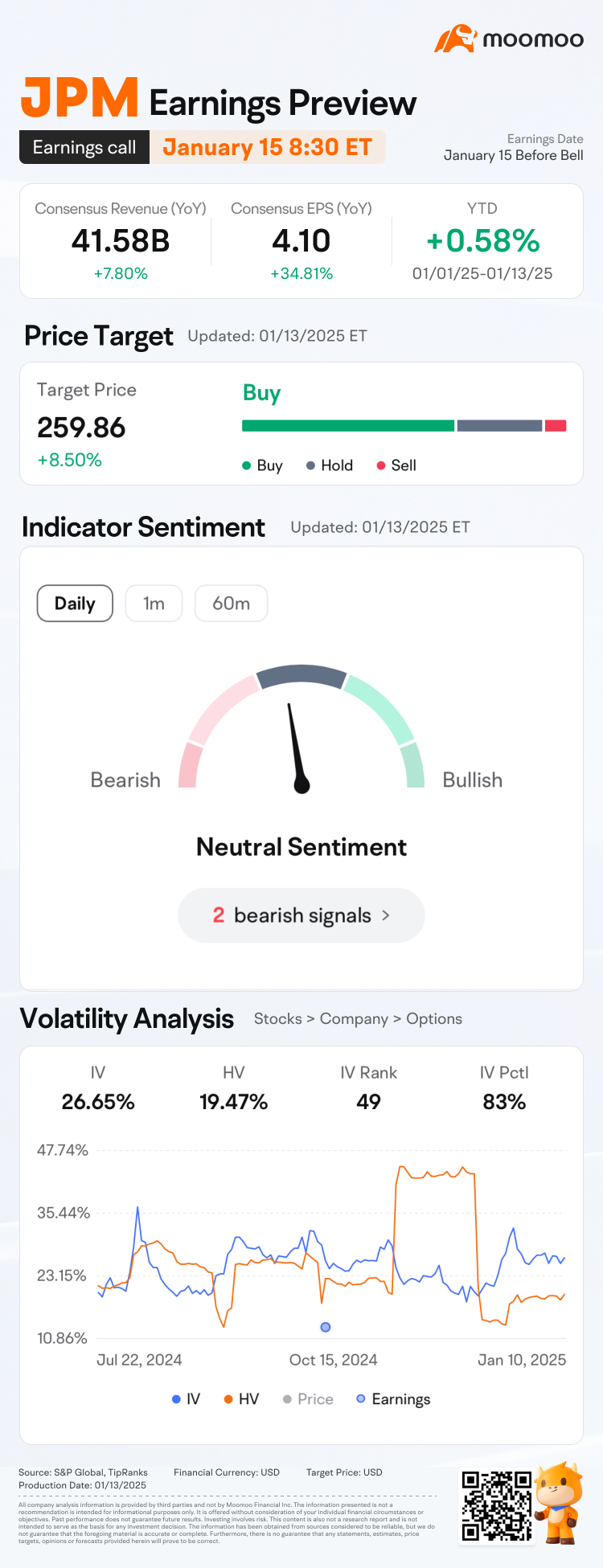

JPM is releasing its Q4 2024 earnings on January 15 before the bell. Unlock insights with JPM Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Subscribe to @Moo Live and book the conference call!

Since its Q3 2024 earnings release, shares of $JPMorgan (JPM.US)$ have seen an increase of 13.28%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal ...

JPM is releasing its Q4 2024 earnings on January 15 before the bell. Unlock insights with JPM Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Subscribe to @Moo Live and book the conference call!

Since its Q3 2024 earnings release, shares of $JPMorgan (JPM.US)$ have seen an increase of 13.28%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal ...

16

3

Read more