Dividend Aristocrats includes high-dividend stocks that offer a regular stream of income to investors in the form of dividend payments. High-dividend stocks are often issued by stable, established companies with strong cash flows and earnings. They are defensive investments because they tend to be less volatile than other types of stocks. During periods of market volatility or economic uncertainty, these stocks may hold up better than growth stocks, which can help protect investors during market downturns. Refer to the S&P 500 Dividend Aristocrats Index for more details.

- 1453.013

- -11.726-0.80%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

This Cloudflare Analyst Turns Bullish; Here Are Top 5 Upgrades For Tuesday

Express News | U.S. Stock Futures Turn Positive; Tesla Up Nearly 2% Premarket

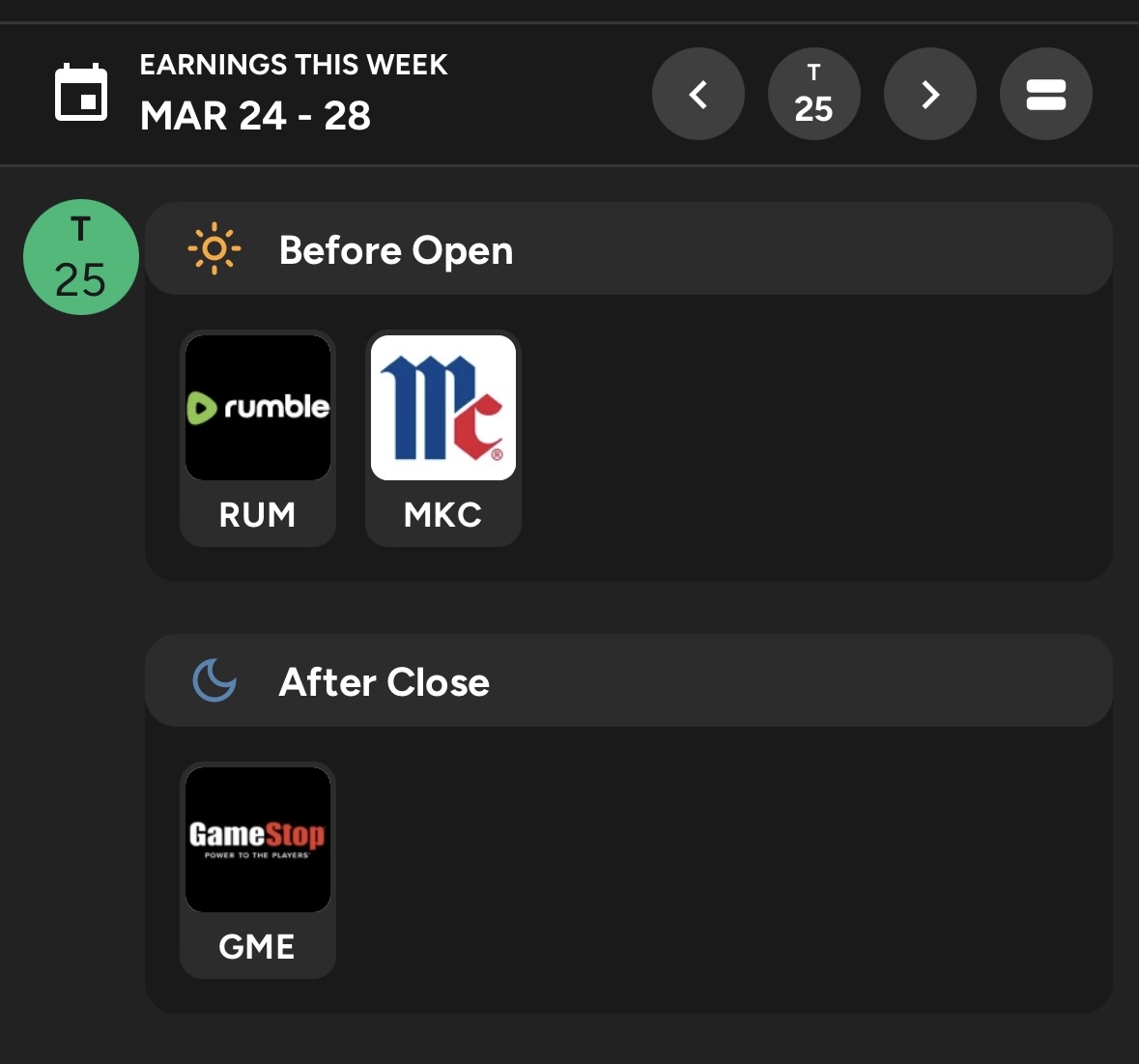

McCormick & Company Falls After FQ1 Profit Miss Amid 'Dynamic Environment'

No Deal: Cintas Abandons UniFirst Proposal After Talks Hit A Wall

US Morning News Call | Trump Considers Giving 'A Lot of Countries' Tariff Breaks

McCormick & Co Q1 Adj $0.60 Misses $0.64 Estimate, Sales $1.60B Miss $1.61B Estimate