Dividend Aristocrats includes high-dividend stocks that offer a regular stream of income to investors in the form of dividend payments. High-dividend stocks are often issued by stable, established companies with strong cash flows and earnings. They are defensive investments because they tend to be less volatile than other types of stocks. During periods of market volatility or economic uncertainty, these stocks may hold up better than growth stocks, which can help protect investors during market downturns. Refer to the S&P 500 Dividend Aristocrats Index for more details.

- 1569.024

- -1.995-0.13%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Market Whales and Their Recent Bets on TGT Options

Watch These Stocks If the Retail Sales Report Next Week Shows a Trump Bounce

Market Mixed on Friday the 13th | Livestock

Walmart To Rally Over 22%? Here Are 10 Top Analyst Forecasts For Friday

With the Kroger-Albertson's Merger off the Table, Walmart Remains Untouchable - Analyst

Walmart Analyst Ratings

Comments

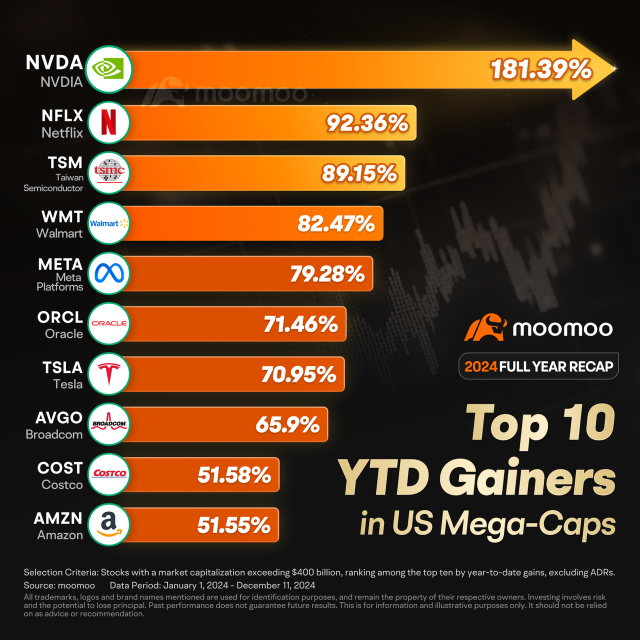

AI advertising firm $Applovin (APP.US)$ led gains with an almost 750% rise. AI data analytics company $Palantir (PLTR.US)$ jumped more than 320%, w...

Kinni420 : Nice APP took the top spot

104088143 : like