Dividend Aristocrats includes high-dividend stocks that offer a regular stream of income to investors in the form of dividend payments. High-dividend stocks are often issued by stable, established companies with strong cash flows and earnings. They are defensive investments because they tend to be less volatile than other types of stocks. During periods of market volatility or economic uncertainty, these stocks may hold up better than growth stocks, which can help protect investors during market downturns. Refer to the S&P 500 Dividend Aristocrats Index for more details.

- 1534.151

- +5.919+0.39%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Beacon Roofing May See Other Takeover Interest, Lowe's Most Compelling - Analyst

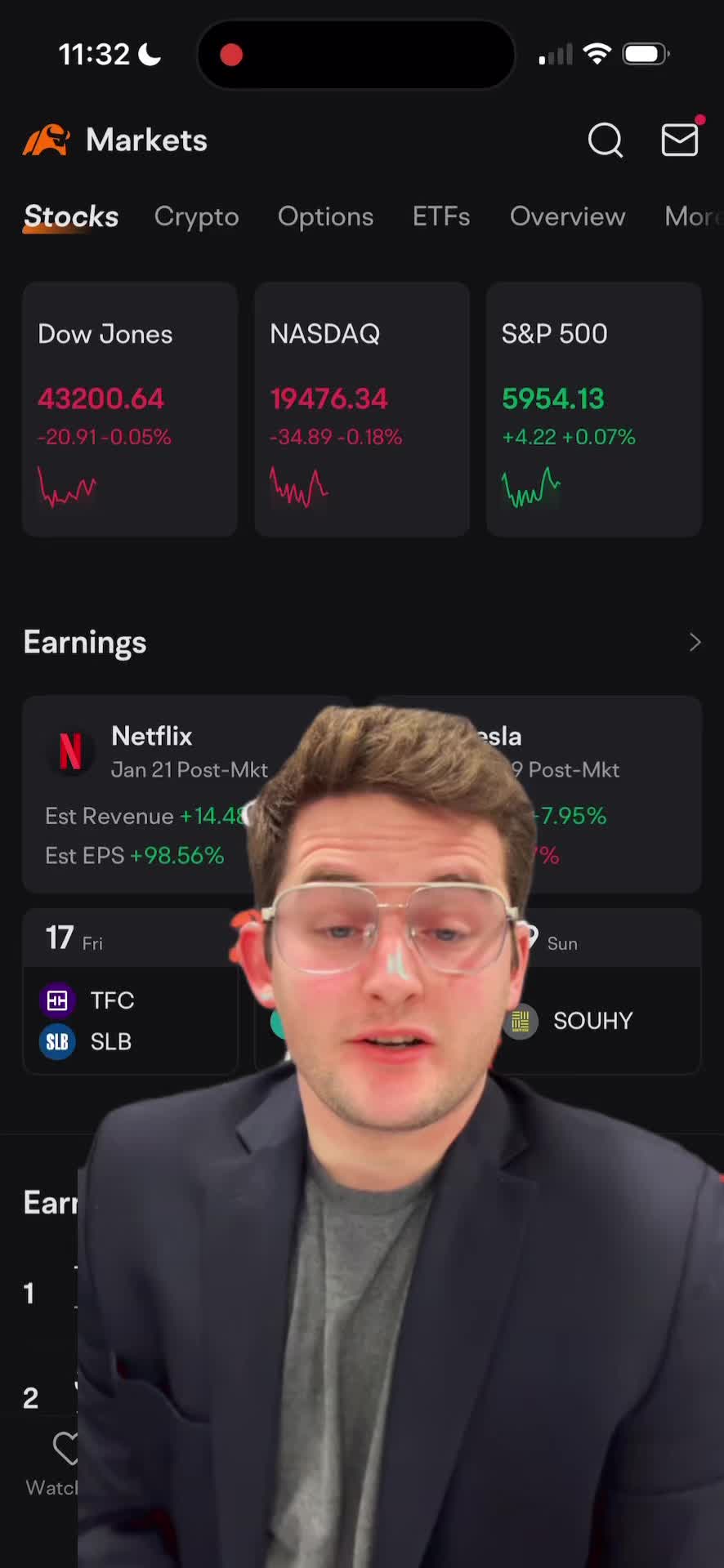

Earnings Week Ahead: JNJ, NFLX, AAL, UAL, AXP, ABT, VZ, PG, and More

Real Estate Stocks Bounce Back to Green, Outperform Broader Markets

Trending Stocks as Wall Street Bounces Back With Strong Week

BofA's Best Financial, Consumer Stock Ideas for 2025: WFC, SBUX, More

Weekly Buzz: Finally a Good Week for 2025

Comments

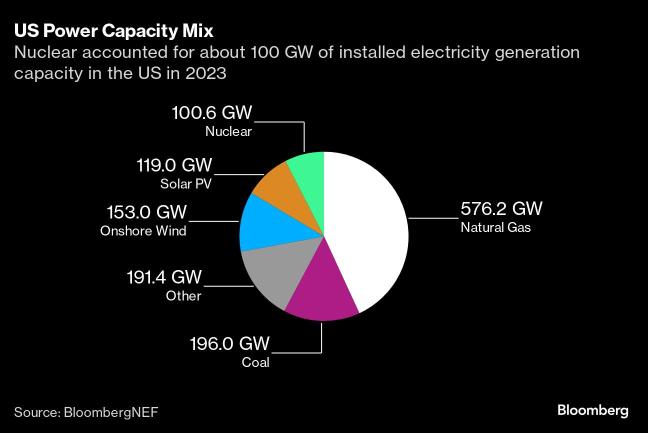

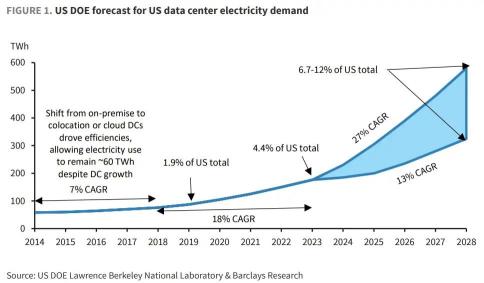

Nuclear energy is emerging as a cornerstone solution for achieving global carbon neutrality.Globalnuclear power ca...

Click here for more moomoo produced news!!

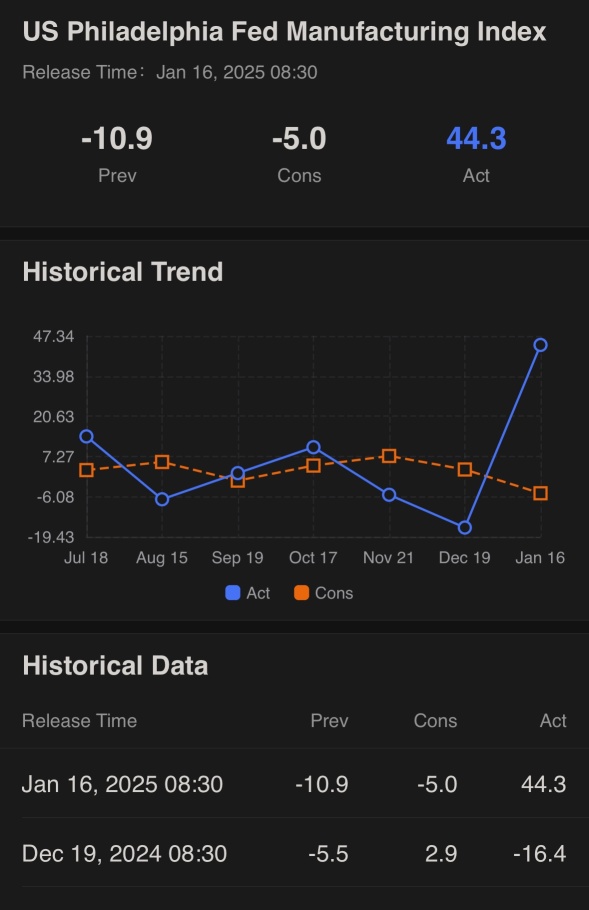

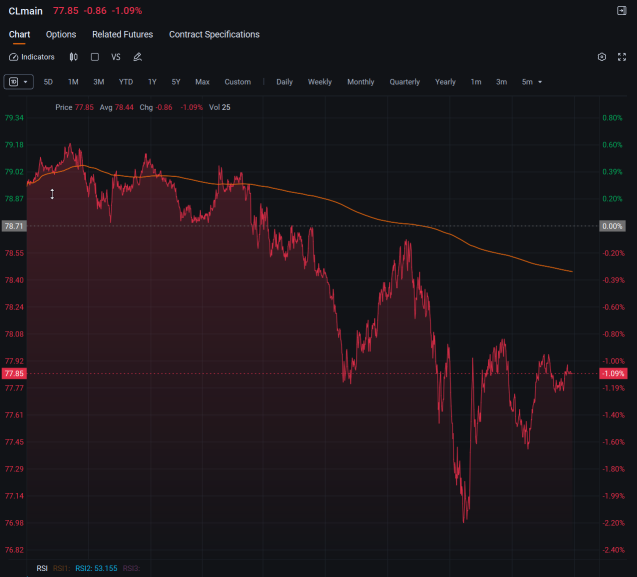

Overall, the market was sideways Thursday morning. Just past 4 pm ET the $S&P 500 Index (.SPX.US)$ traded -0...

$UnitedHealth (UNH.US)$ fell 4%, the lowest percentage decliner on the Dow Jones after the firm reported Q4 earnings above estimates but total revenue of ...

Buy n Die Together❤ :