Dividend Aristocrats includes high-dividend stocks that offer a regular stream of income to investors in the form of dividend payments. High-dividend stocks are often issued by stable, established companies with strong cash flows and earnings. They are defensive investments because they tend to be less volatile than other types of stocks. During periods of market volatility or economic uncertainty, these stocks may hold up better than growth stocks, which can help protect investors during market downturns. Refer to the S&P 500 Dividend Aristocrats Index for more details.

- 1501.406

- +12.197+0.82%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

2024 Winners and Losers in Consumer Staples: Walmart and Kellanova Top Charts

Santa Clause Came and Went Without Bringing Gifts | Weekly Buzz

Friday? More Like Grinch Day | Wall Street Today

What Analysts Are Saying About S&P Global Stock

C.H. Robinson Worldwide Analyst Ratings

No S&P 500 Stocks Are Overbought, but These Are the 10 Most Oversold Names

Comments

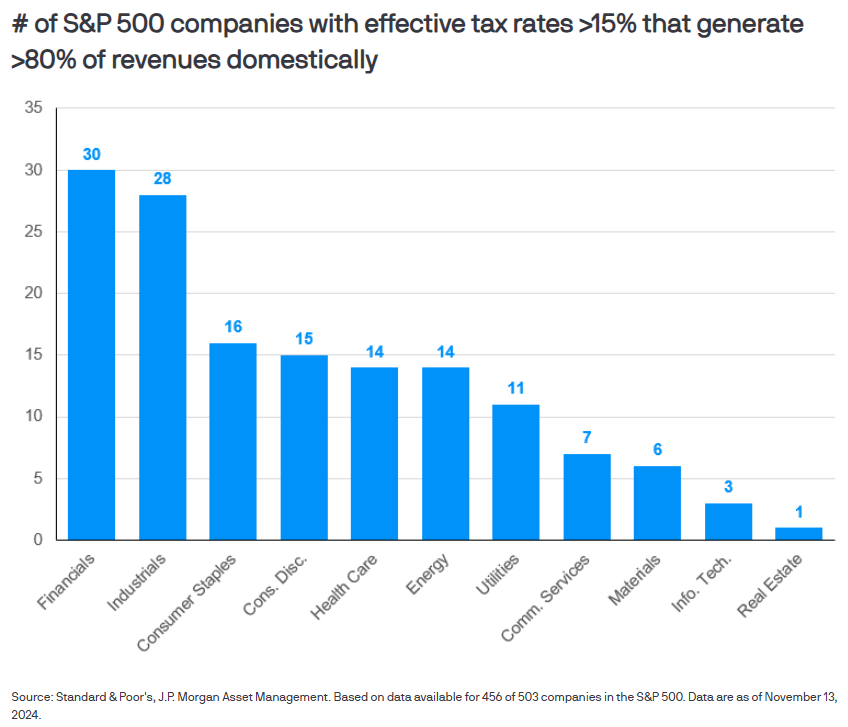

⭐ Tax cuts are expected to be a priority for Trump following his inauguration, with the financial and manufacturing sectors anticipated to be the primary beneficiaries.

⭐ Goldman Sachs projects that the S&P 500 could experience earnings growth of over 20% in the next two years.

⭐ Societe Generale indicates that lowering the corporate tax rate would significantly benefit small-cap stocks.

One of the landmark achievements during Trump's first...

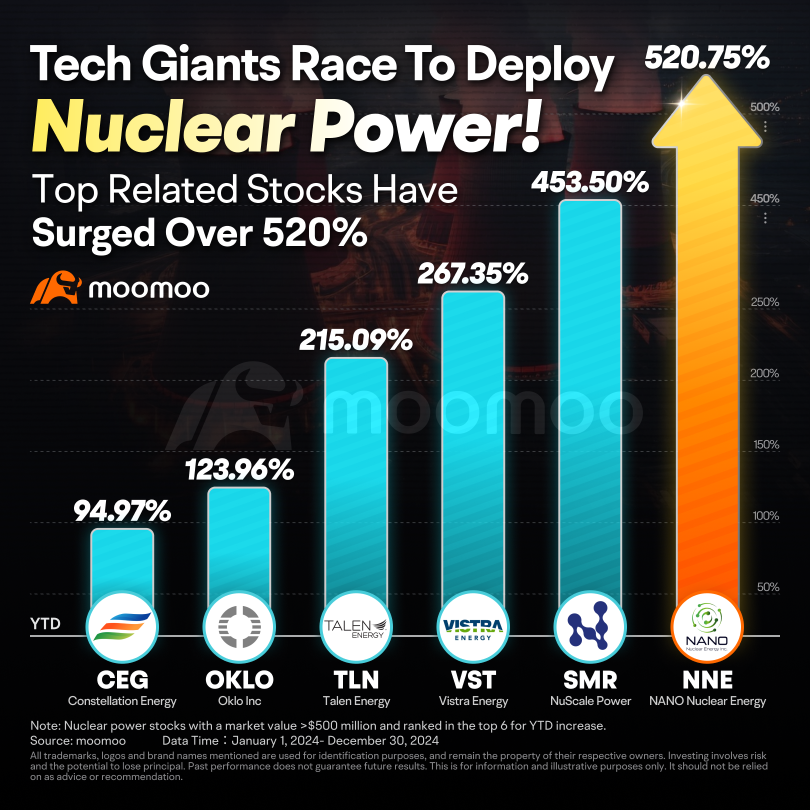

Looking at the year-to-date performance chart, some U.S. nucl...

Reuters: ADM shareholder presses CEO to resign as criminal probe continues

Seagullsfloppy : Next week possible, short interest decreases, institutions is holding and buying. Mark of bullish, as long as SPY close green