Dividend Aristocrats includes high-dividend stocks that offer a regular stream of income to investors in the form of dividend payments. High-dividend stocks are often issued by stable, established companies with strong cash flows and earnings. They are defensive investments because they tend to be less volatile than other types of stocks. During periods of market volatility or economic uncertainty, these stocks may hold up better than growth stocks, which can help protect investors during market downturns. Refer to the S&P 500 Dividend Aristocrats Index for more details.

- 1601.387

- +7.141+0.45%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

SA Asks: Which Retail Stocks Will Win or Lose This Holiday Season?

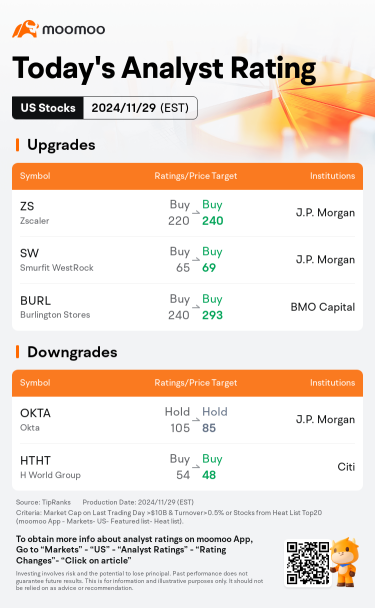

Earnings Week Ahead: CRM, DOCU, OKTA, ZS, S, MRVL, LULU, DG, and More

Executive Reshuffles: CGC, ADSK, KSS and ANF

Black Friday Spending Hits $10.8B, Keeping up the Holiday Season's Record-setting Pace

Shoppers Spent $11.3M Per Minute Online on Black Friday

Deal Dispatch: Stoli On The Rocks As US Business Goes Bankrupt, Ally Financial To Sell Credit Card Unit

Comments

Gapping up

$MicroStrategy (MSTR.US)$ shares jumped more than 4%, extending the roughly 10% gain seen in the previous session, after the cryptocurrency's price continued to climb. The stock has seen massive gains this year, surging more than 515%.

Chip equipment stocks increased following a report that the Biden administration may impose less stringent restrictions than anticipated on semiconductor equipment and AI...