Dividend Aristocrats includes high-dividend stocks that offer a regular stream of income to investors in the form of dividend payments. High-dividend stocks are often issued by stable, established companies with strong cash flows and earnings. They are defensive investments because they tend to be less volatile than other types of stocks. During periods of market volatility or economic uncertainty, these stocks may hold up better than growth stocks, which can help protect investors during market downturns. Refer to the S&P 500 Dividend Aristocrats Index for more details.

- 1546.665

- +19.876+1.30%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

As Trump Backs 'Drill Baby, Drill,' His DOGE Co-Lead Elon Musk Believes 'All Energy Generation Will Be Solar' — Here's What UBS Recommends After Election Dip

Bitcoin Hits $99k, Thursday Market Whiplash Following Nvidia Price | Wall Street Today

Oppenheimer Asset Management Spotlights Buy Calls on WMT, VRT, and MOD

Citi Research's U.S. Equity Strategy Large-Cap Recommendation List

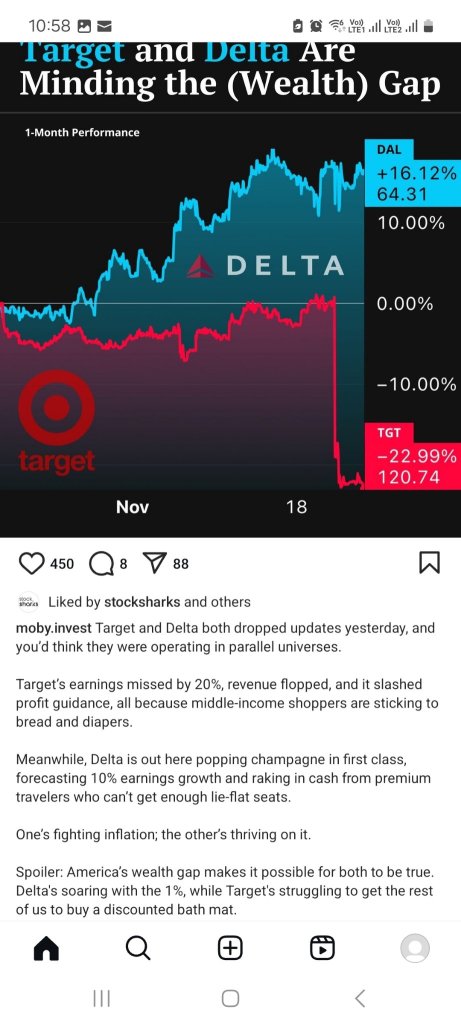

Target Posts Q3 Earnings Miss: Analysts Slash Forecasts On Market Share Loss, Margin Concerns

Bitcoin Hits $98k, Nvidia Falls on Forward Guidance, Google Chrome Break-Up | Live Stock

Comments

Investors can’t seem to open their pockets quickly enough to buy more Bitcoin with it rising to US$98,258 and looks set to imminently hit US$100,000 before marching toward US$175,000, the next key level.

As for stocks that put on a table-thumping perf...