Dividend Aristocrats includes high-dividend stocks that offer a regular stream of income to investors in the form of dividend payments. High-dividend stocks are often issued by stable, established companies with strong cash flows and earnings. They are defensive investments because they tend to be less volatile than other types of stocks. During periods of market volatility or economic uncertainty, these stocks may hold up better than growth stocks, which can help protect investors during market downturns. Refer to the S&P 500 Dividend Aristocrats Index for more details.

- 1523.737

- -38.949-2.49%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Mizuho Upgrades Stanley Black & Decker to Outperform, Maintains Price Target to $110

Stanley Black & Decker Analyst Ratings

Earnings Scheduled For December 19, 2024

Here's the Major Earnings Before the Open Tomorrow

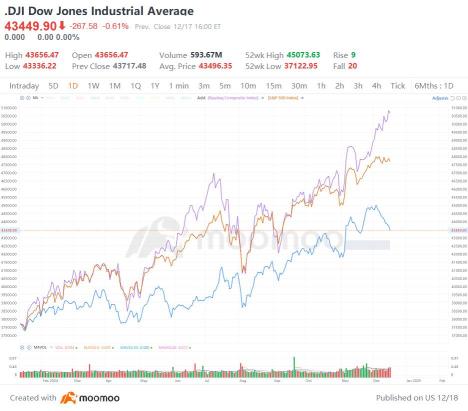

Tesla, Bitcoin, S&P 500, Dow, Tank: Thanks a Lot FOMC | Wall Street Today

Express News | FOMC Cuts Interest Rates by 25 Basis Points, Sees Fewer Reductions Next Year

Comments

Gapping up

$NVIDIA (NVDA.US)$ stock rose 2.6% in premarket trading, The GB200 rack-mounted solution requires further optimization and adjustment in its supply chain, according to recent research by TrendForce. The complex design specifications of the GB200 rack, including high-speed interconnect interfaces and thermal design power (TDP) requirements that exceed market norms, are the primary reasons for this need. A...

Key Drivers Behind t...

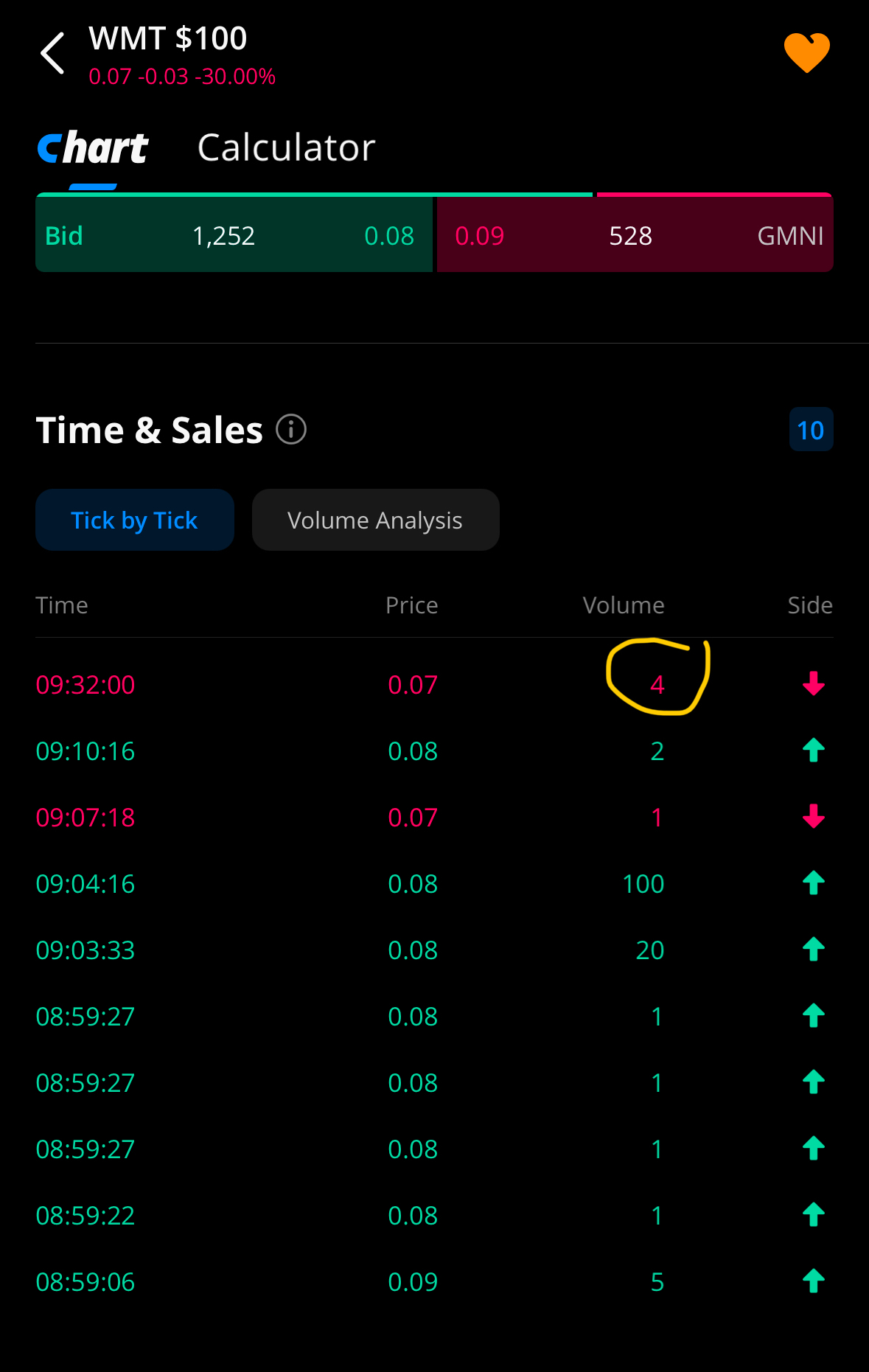

Today’s $100 strike call option has only 4 trades. Trading activity is slow due to a lack of interest, possibly because few people are buying additional shares at the current low price. I’ve learned that options trading volume significantly influences liquidity and trading activity.