Dividend Aristocrats includes high-dividend stocks that offer a regular stream of income to investors in the form of dividend payments. High-dividend stocks are often issued by stable, established companies with strong cash flows and earnings. They are defensive investments because they tend to be less volatile than other types of stocks. During periods of market volatility or economic uncertainty, these stocks may hold up better than growth stocks, which can help protect investors during market downturns. Refer to the S&P 500 Dividend Aristocrats Index for more details.

- 1550.711

- -7.832-0.50%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Here's How Much You Would Have Made Owning S&P Global Stock In The Last 10 Years

Here's the Major Earnings Before the Open Tomorrow

$100 Invested In Caterpillar 10 Years Ago Would Be Worth This Much Today

Knight-Swift Q4 Profit Tops Street View, Sets Upbeat Guidance

Wall Street Today: Does Anyone Have the Cash for Stargates

Caterpillar Snaps Six Straight Sessions of Gains

Comments

$Walmart (WMT.US)$

If you’re hungry for more updates, join our community of over 700 members! Everyone’s welcome—check it out here: Join the server Trader’s Tavern with us

Alright, let’s get into it! Here are a few small-cap stocks I’ve got my eye on for the next few months.

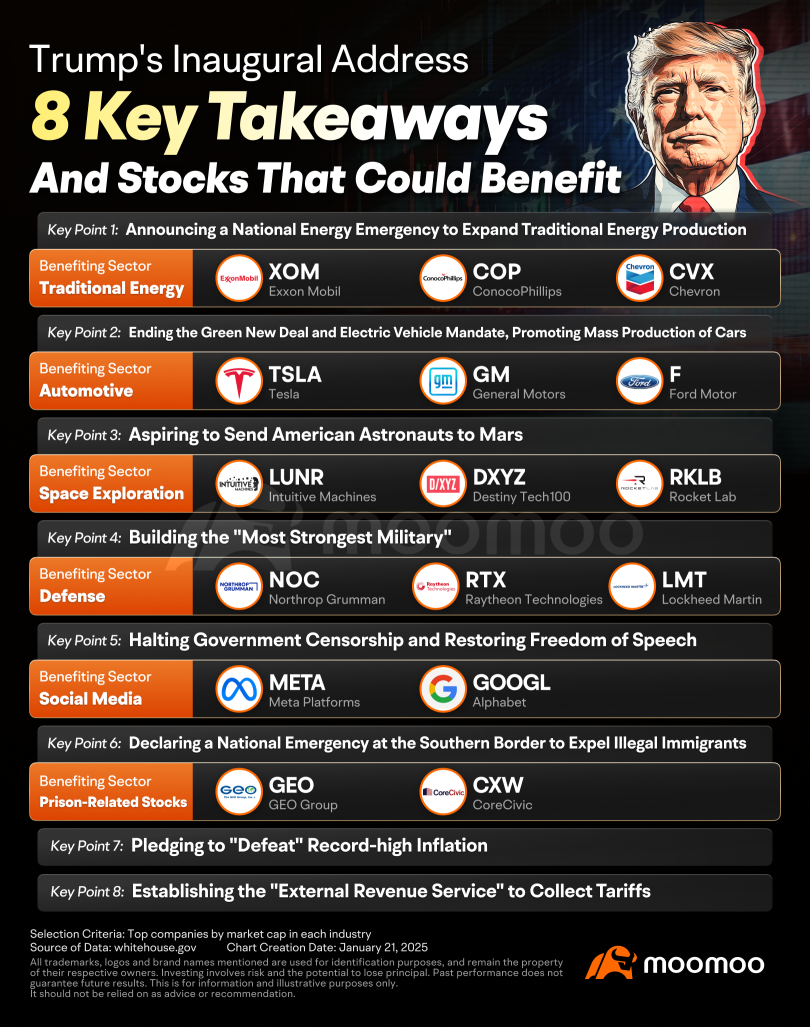

$The GEO Group Inc (GEO.US)$ - A real estate investment trust specializing in the design and managem...

151364853 : all up except smr