Dividend Aristocrats includes high-dividend stocks that offer a regular stream of income to investors in the form of dividend payments. High-dividend stocks are often issued by stable, established companies with strong cash flows and earnings. They are defensive investments because they tend to be less volatile than other types of stocks. During periods of market volatility or economic uncertainty, these stocks may hold up better than growth stocks, which can help protect investors during market downturns. Refer to the S&P 500 Dividend Aristocrats Index for more details.

- 1369.640

- -21.785-1.57%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Dover Q2 2024 Earnings Preview

Peter Thiel, Founders Fund Lead $11M Investment In Pudgy Penguins Parent Company: 'Excited to Drive the Consumer Crypto Revolution Forward'

Notable Earnings Before Thursday's Open

Albemarle Is Out of Wells Fargo's Signature Picks

Oppenheimer Maintains Outperform on Pentair, Raises Price Target to $98

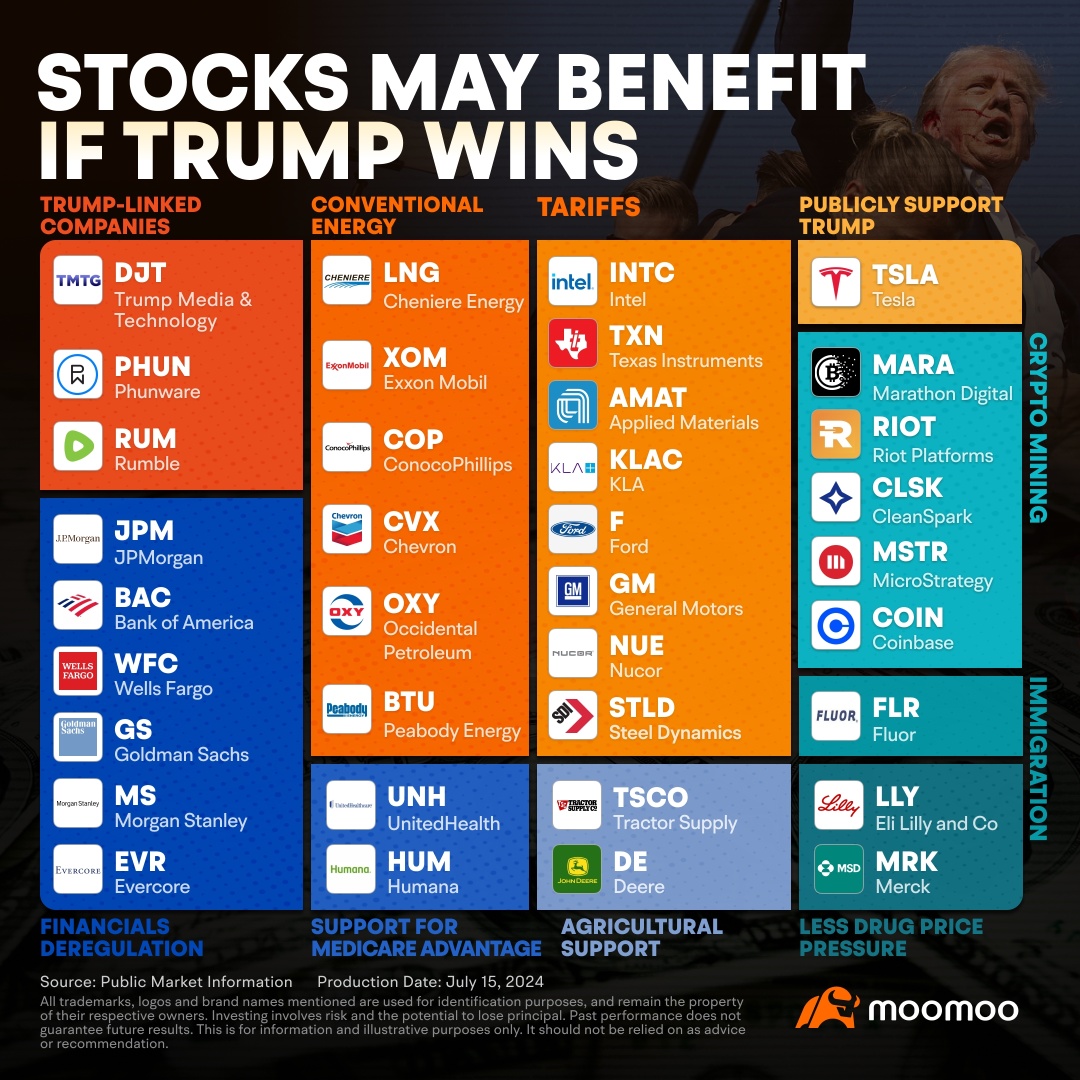

Election Watch: Will Conservatives and Liberals Move the Meter With Their Stock Picks?

Comments

For the first time, the yield on 30-year Treasury bonds has exceeded that on 2-year bonds, the futures of the three major U.S. stock indices have collectively risen, and the pric...

Paul Anthony : best person