Dividend Aristocrats includes high-dividend stocks that offer a regular stream of income to investors in the form of dividend payments. High-dividend stocks are often issued by stable, established companies with strong cash flows and earnings. They are defensive investments because they tend to be less volatile than other types of stocks. During periods of market volatility or economic uncertainty, these stocks may hold up better than growth stocks, which can help protect investors during market downturns. Refer to the S&P 500 Dividend Aristocrats Index for more details.

- 1404.011

- -17.570-1.24%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

CNBC Halftime Report Final Trades: Caterpillar, The Carlyle Group, IShares U.S. Real Estate ETF

CNBC Halftime Report Final Trades: Caterpillar, The Carlyle Group, IShares U.S. Real Estate

Least Shorted S&P 500 Stocks in June

Berkshire Hathaway Hits Record High; Will US Stocks Shift From Tech-Driven to Value-Driven?

The

The next trend for generative AI could be the TTT model.

The 'brain' of the Transformers architecture that supports models such as Sora is a lookup table and so-called hidden states. Unlike Transformers, TTT does not continuously grow as it processes more data. It replaces hidden states with machine learning models, like nested dolls of AI, which is within a model.

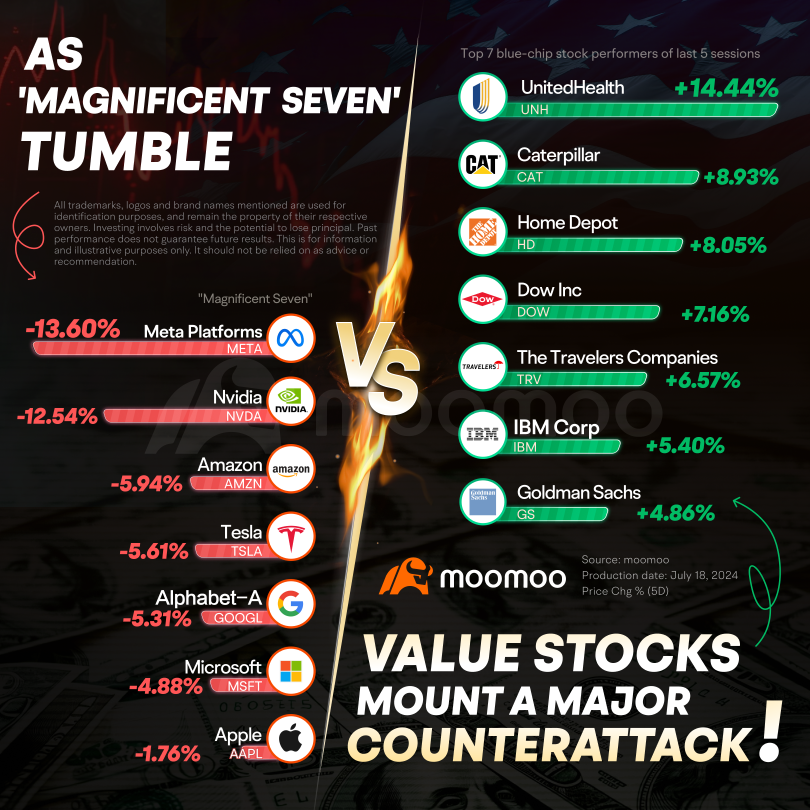

Dow Jones Extends All-Time Highs: Blue Chips Post Strongest 6-Day Gain Versus Tech Stocks In 22 Years

The Dow Jones Industrial Average Index reached a new record high of 41,198 points Wednesday, closing 0.6% higher and extending its winning streak to six consecutive sessions in the green.Blue-chip

10 Consumer Discretionary Stocks With Whale Alerts In Today's Session

This whale alert can help traders discover the next big trading opportunities.Whales are entities with large sums of money and we track their transactions here at Benzinga on our options activity

Comments

Over the last six sessions, the Dow Jones has risen by 5%, while the tech-heavy Nasdaq 100 fell by 3.3% as rate cut rally extends. Meanwhile, $Berkshire Hathaway-A(BRK.A.US$, a representative of value stocks, has ri...

Chasing_FreedomOP : pet it begin

Chasing_FreedomOP : make America great again