Robotics includes companies involved in the design, creation, and manufacture of robots. These machines can perform tasks autonomously or semi-autonomously, often with the aim of improving efficiency, productivity, and safety across various industries. Robotics companies are rapidly innovating new technology with applications across many industries. They offer opportunities for growth and efficiency, align with long-term automation trends, and have the potential for disruption in emerging markets, making them appealing to investors.

- 3401.244

- -55.546-1.61%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Fed Meeting Causes Market Plunge: Hawkish Tone Surprises Expectations

Jeff Bezos-Backed Perplexity Raises $500 Million, Tripling Its Valuation To $9 Billion As Competition With Google And OpenAI Heats Up

"The next NVIDIA" is emerging, A-shares tapping into ASIC must be booming, is there a new narrative for AI Chip?

① Broadcom's performance has surged, and Morgan Stanley estimates that the AI ASIC market size will increase from 12 billion dollars in 2024 to 30 billion dollars by 2027; ② Compared to general GPUs, ASICs have advantages in terms of energy consumption and cost; ③ Most AI ASIC-related stocks in the A-share market have different business directions from Broadcom, and the segments driven by AI ASIC, such as optical modules and Switches, are receiving considerable attention.

Trump's tariff plan is unpopular! More than half of the USA population opposes imposing taxes on commodities from Mexico.

①The plan of the USA's incoming president Trump to impose tariffs does not seem to be popular among the public. According to a poll, 51% of USA voters oppose imposing tariffs on commodities from Mexico, Canada, and China; ②Standard & Poor's states that USA tariffs will increase inflation rates and reduce economic output, while some citizens and businesses are stockpiling goods due to tariff concerns, leading to a significant increase in throughput at the ports of Los Angeles and Long Beach in November.

The Volume has soared, let's get to know the latest rising "four monster stocks" in the US market.

Yesterday, the total trading volume of Quantum Computing, Rigetti Computing, financial technology and defense company Nukkleus Inc., and voice recognition and AI company SoundHound AI was close to 10 billion USD, surpassing 476 constituent stocks in the S&P 500 Index.

Nvidia Partner TuSimple Rebrands As CreateAI Shifts Focus From Autonomous Driving To AI-Powered Gaming And Content

Comments

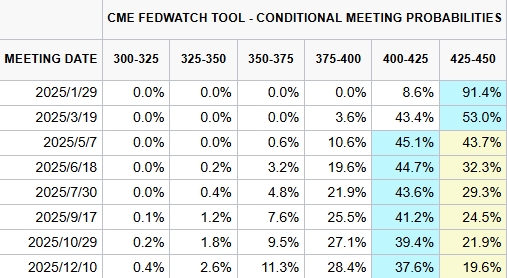

Source: CME FEDWATCH TOOL

However, investors s...

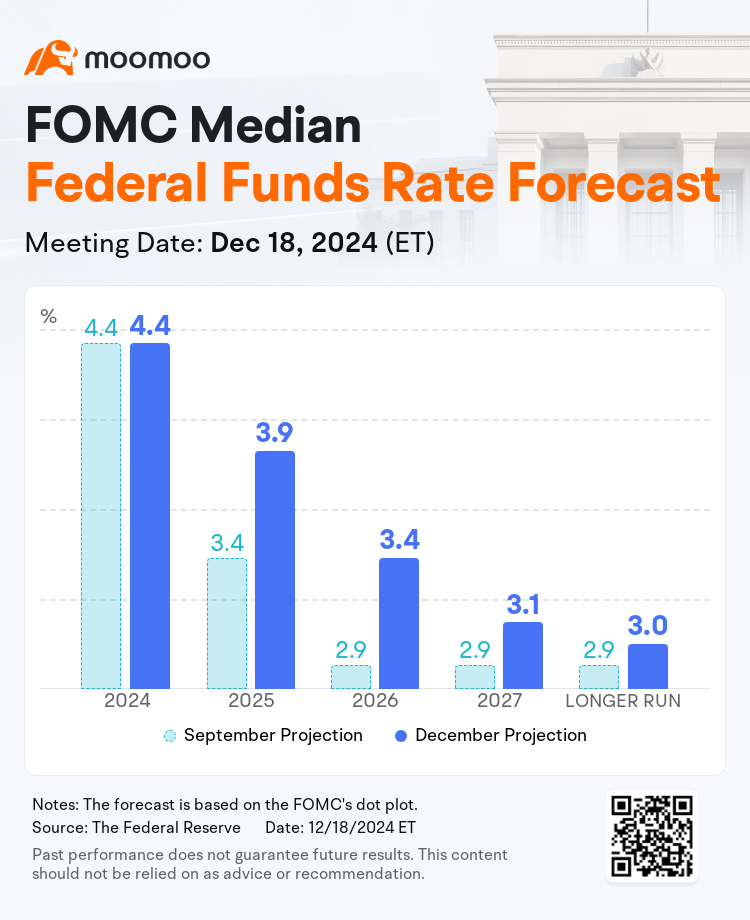

Although the market had anticipated this meeting, the hawkish tone exceeded expectations, underscored by four key points:

1、Significant Reduction in Rate Cut Projections

2、Notable Increase in 2024 PCE Inflation Forecasts

3、Clear Indication of Upside Risks to Inflation

4、Opposition from Several Committee Member...

Trading NVDA recently (this week) feels like riding a roller coaster due to unpredictable events:

1. Impact of Competitors:

- AVGO's announcement of increased revenue over the next 3 years slightly affected NVDA’s sentiment, alongside China's investigation into NVDA. These events created short-term negative pressure on NVDA’s chart.

2. Positive Catalyst:

- On 17/12, NVDA’s CEO announced their new product, Jetson Supercom...

1、Significant Reduction in Rate Cut Projections

2、Notable Increase in 2024 PCE Inflation Forecasts

3、Clear Indication of Upside Risks to In...