Digital Payments are transactions that take place via digital or online modes, with no physical exchange of money involved. The Digital Payments concept includes major US-listed companies that offer electronic and cashless means of payments.

- 1146.395

- +21.670+1.93%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Crazy cryptocurrency market! Analysts are betting that bitcoin will not experience a significant pullback until it reaches $150,000.

①Bitcoin's price has surged nearly 30% in the past seven days, breaking through $89,000 in the past 24 hours; ②Analysts predict that Bitcoin's price will continue to rise due to positive political momentum, social media hype, continued interest rate cuts, and the prospect of becoming a strategic reserve asset for the United States.

The US dollar, bitcoin, and Tesla are surging! Investors are all in on the 'Trump trade'.

The 'Trump trade' is causing a new wave, the dollar hitting a more than four-month high, non-US currencies under pressure; Bitcoin is unstoppable, aiming for the milestone of 0.1 million US dollars before the end of the year; Tesla, since the election day, has seen an almost absurdly large rebound of 39%.

Witness history! Bitcoin breaks through $89,000, cryptos concept stocks soar across the board.

Digital currencies started to surge fiercely over the weekend and continued to accelerate on Monday. The top digital currencies by market cap all skyrocketed. Ethereum and Solana both saw a cumulative increase of about 40% in the past 7 days, higher than Bitcoin's 31%. Dogecoin, supported by Musk, doubled in value over the week. Major Bitcoin holder MicroStrategy stated that it spent approximately $2.03 billion to buy around 0.0272 million bitcoins, marking the largest purchase since December 2020. Blackrock's Bitcoin ETF IBIT has an asset under management exceeding one of the largest gold ETFs, IAU.

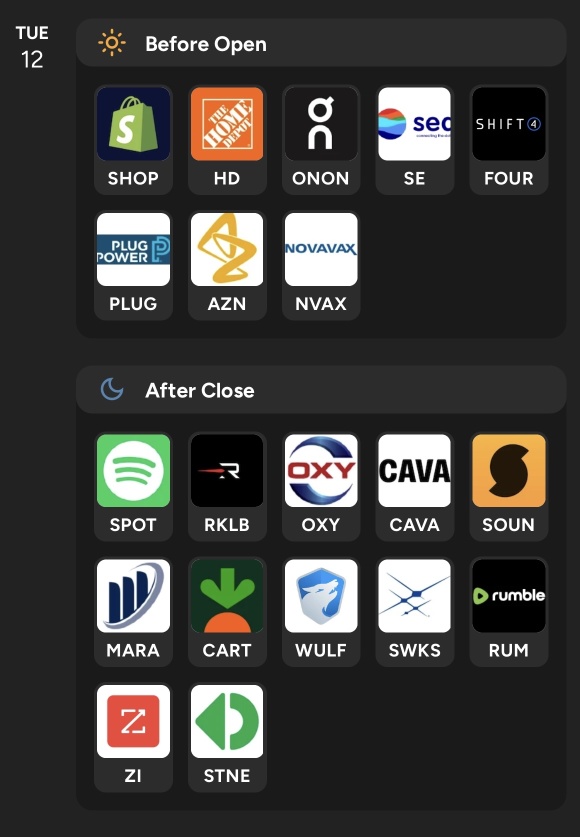

Shopify Q3 Earnings Preview: Stock Hits 52-Week Highs, Analysts Expect Second Best Revenue Quarterly Total In Company History

Bitcoin Blasts Through $88,000 As Market 'Euphoria,' Regulatory Optimism Take Hold

Spotlight on Visa: Analyzing the Surge in Options Activity

Comments

Earnings and Revenue Estimates

Revenue: Analysts forecast revenue of $2.11 billion, marking a 23% YoY increase. This would be Shopify’s second-largest quarterly revenue after Q4 2023's $2.14 billion.

Earnings per Share (EPS): Expected EPS of 27 cents, up from 24 cents YoY, with Shopify...