The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1513.063

- +1.990+0.13%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

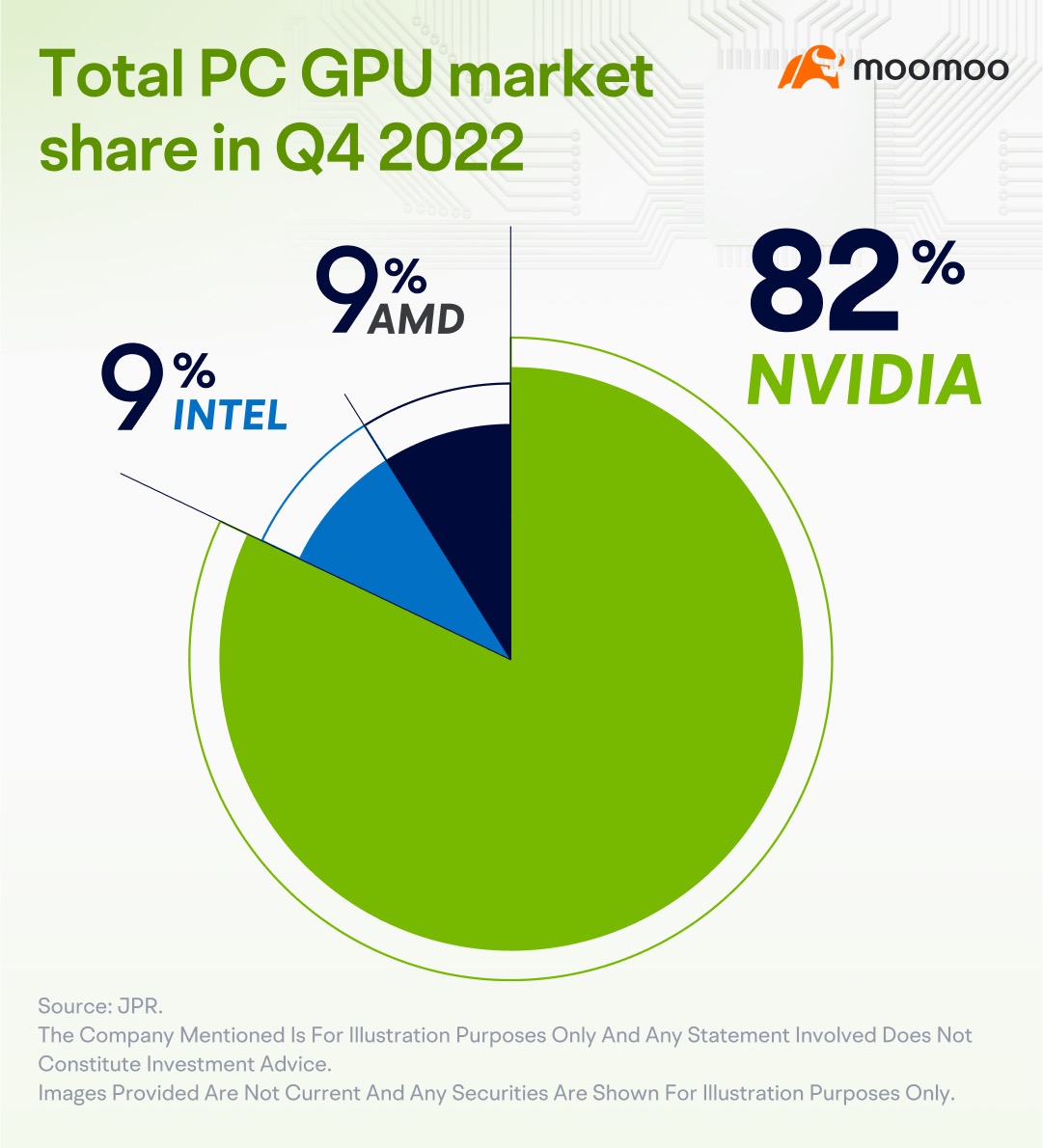

Tech giants' financial reporting season is coming again, and this time the focus is still on: nvidia and capital expenditures.

Analysts believe that considering the expensive stock price and the high base of the same period last year, nvidia's Q3 performance may "face challenges", investors closely watching its AI investment and Blackwell chip situation; On the capital expenditure side, Wall Street generally expects it to continue to surge, but still bullish on AI potential.

Is Trump stable? The gambling odds are close to the level when the Democratic Party changed leaders.

Although the current polling numbers from institutions in the USA show that the competition between the Republican presidential candidate Trump and the Democratic presidential candidate Harris is still intense; However, in the more "real" - directly affecting the gains and losses of the gamblers in the gambling market, the balance of victory is clearly tilting towards Trump's side.

Options Market Statistics: United Airlines Stock Soars After Earnings Beat; Options Pop

Apple's car-making project failed, directly benefiting BYD Company Limited? It is rumored that they have been secretly collaborating for six years, developing long-range electric vehicle batteries.

According to the media, ten years ago, BYD Company Limited engineers showed Apple executives an early version of blade batteries, planting the seeds of cooperation, and the cooperative research and development laid the foundation for BYD's current vehicle battery technology; Apple does not own any technology currently used in blade batteries; Before cooperating with BYD, Apple had invested millions of dollars in battery pack design and engineering.

U.S. stock market closing: all three major indexes rose collectively, with the Chinese concept stock index up nearly 1%.

1. China concept stocks varied, nasdaq china golden dragon index rose by 0.93%; 2. Airbus plans to cut 2,500 jobs in defense and aerospace departments; 3. General Motors invests $0.625 billion in a top lithium project in the USA; 4. E-mini russell 2000 index has reached its highest level in nearly three years.

Apple Chief People Officer to Leave Company After Two-year Stint: Report

Comments

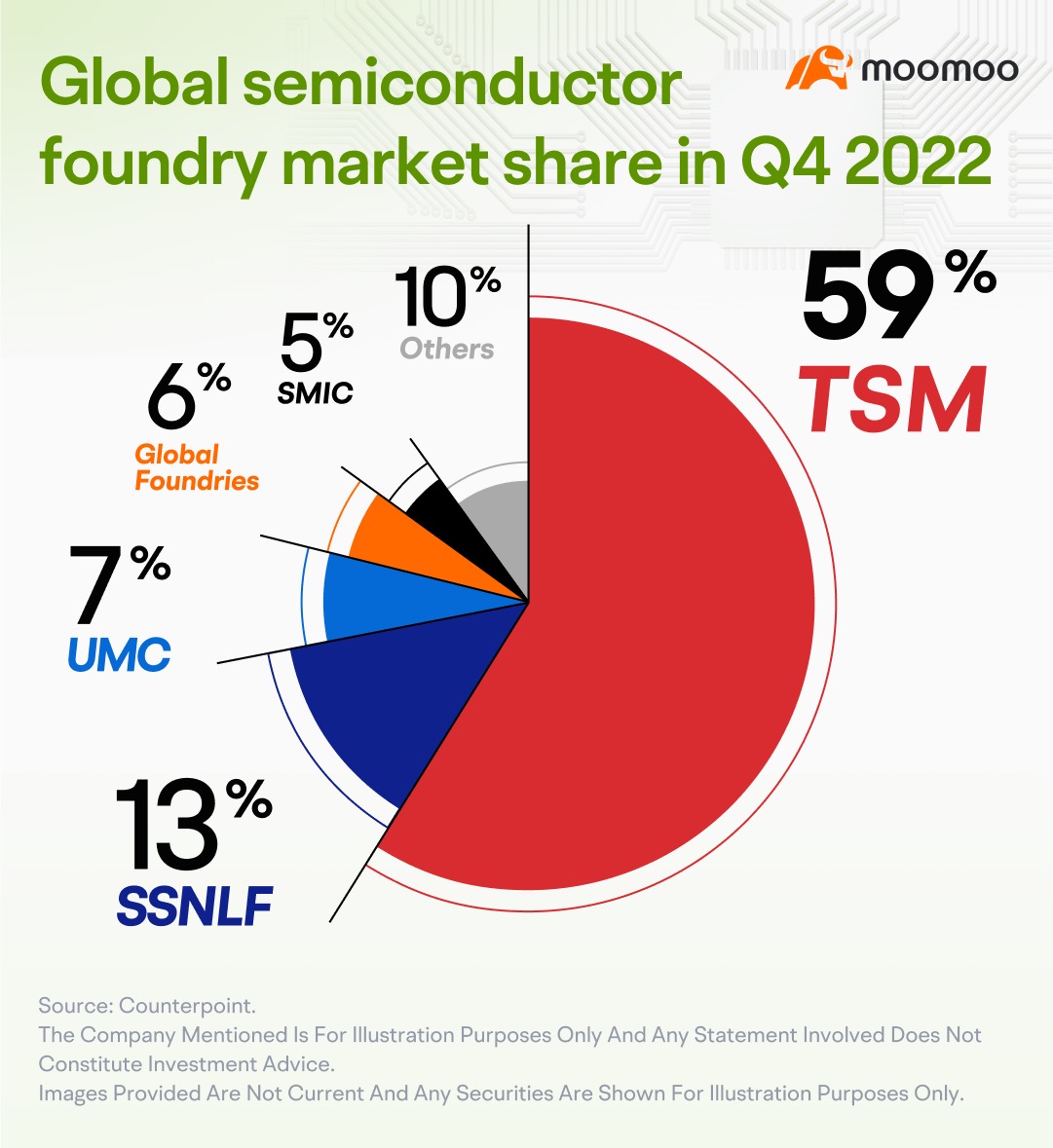

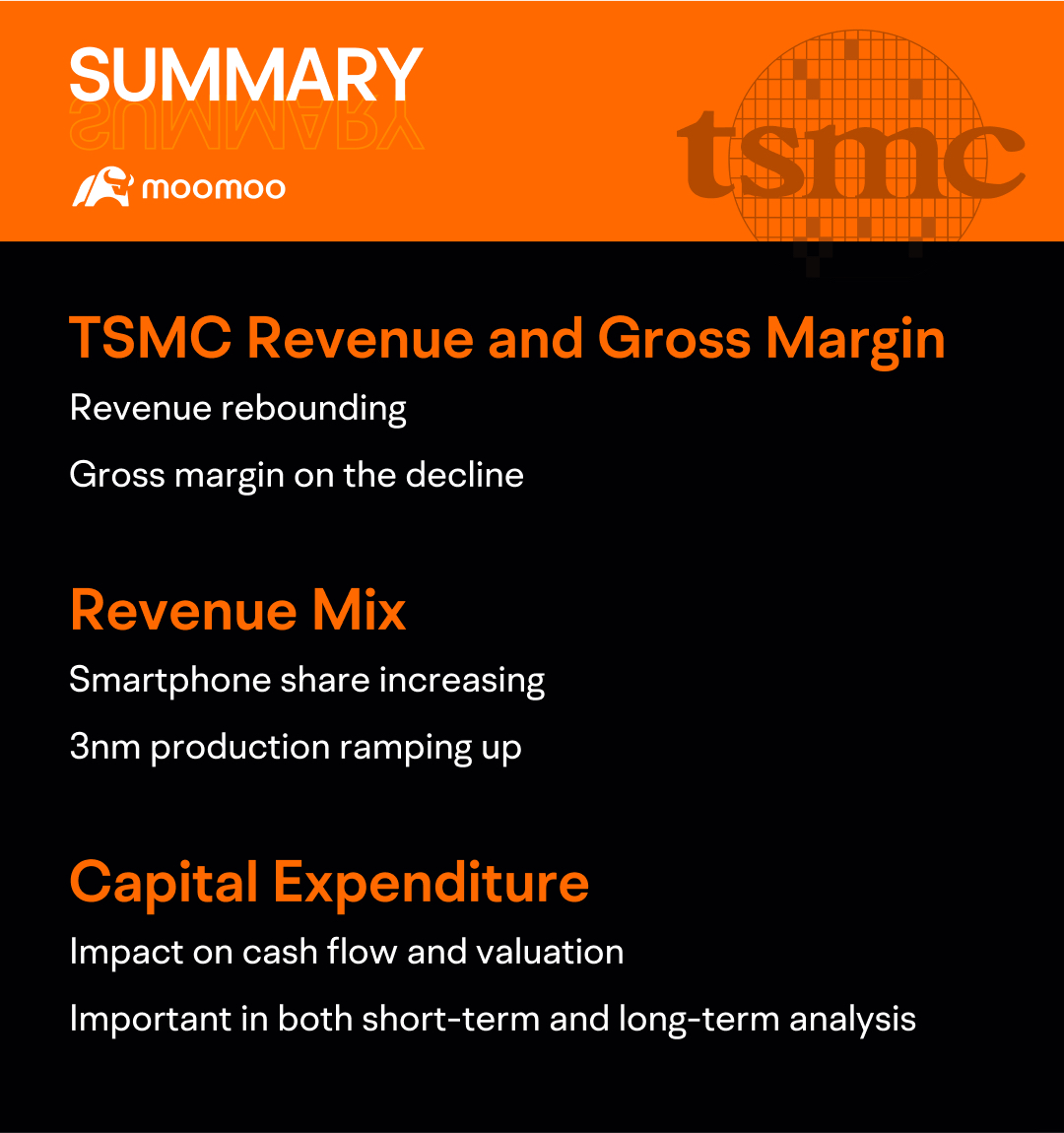

A little info on $Taiwan Semiconductor (TSM.US)$ the dominant producer of advanced chips used in artificial intelligence applications, is expected to report a 42% leap in third-quarter profit on Thursday thanks to soaring demand.

The world's largest contract chipmaker, whose customers include $Apple (AAPL.US)$ and $NVIDIA (NVDA.US)$, has ...

Meanwhile...banks are closing.. Be prepared.. it's coming..

Full article

https://www.dailymail.co.uk/yourmoney/bank-closures/article-13933689/us-bank-closures-list.html

As always, do your own due diligence before committing.