The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1475.412

- +1.501+0.10%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Apple Analyst Signals 'Slower Start To The AI Cycle' As iPhone 16 Demand Softens

EXCLUSIVE: Top 20 Most-Searched Tickers On Benzinga Pro In September 2024 – Where Do Tesla, Nvidia, Apple, DJT Stock Rank?

OpenAI Valuation Soars To $157B In Latest Funding Round

Decoding 9 Analyst Evaluations For Citigroup

What the Options Market Tells Us About Visa

American Express's Options Frenzy: What You Need to Know

Comments

Larger Image: tradingview.com...

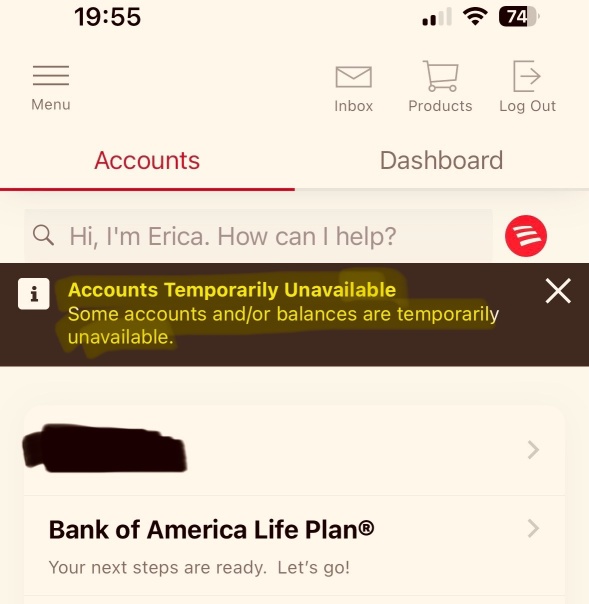

$Bank of America (BAC.US)$

Would have done better if I was covering China Market on retrospectively speaking.

Actual:

Best performing options: $Alphabet-C (GOOG.US)$ $Apple (AAPL.US)$ $Tesla (TSLA.US)$

Can be better O...