The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1571.471

- +4.935+0.32%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

A strong response to the 'Trump tariff threat'! Canada’s Energy Minister: The USA cannot find alternatives at all.

① The Canadian Minister of Energy, Jonathan Wilkinson, stated that Trump's claim that the USA does not need anything from Canada is "completely wrong." ② Wilkinson mentioned that the USA finds it difficult to find alternatives to Canadian Crude Oil Product, Uranium, and potash, and warned that trade retaliation measures, including export taxes, may be taken.

CFPB Says Green Light for FDX to Issue Open Banking Standards

U.S. stock market close: the three major indexes varied in performance; Huang Renxun's remarks caused a collapse in the Quantum Computing Sector.

① The Nasdaq China Golden Dragon Index fell by 0.67%, with most China Concept Stocks declining; ② Wildfires ravaged California, and Electrical Utilities provider Edison International fell by 10%; ③ Jensen Huang stated that a "very useful" quantum computer may take several decades to arrive; ④ Intel: will continue to focus on the independent graphics card market.

S&P 500 Positive for 'First Five Days,' Huang Sees Decades till Quantum | Wall Street Today

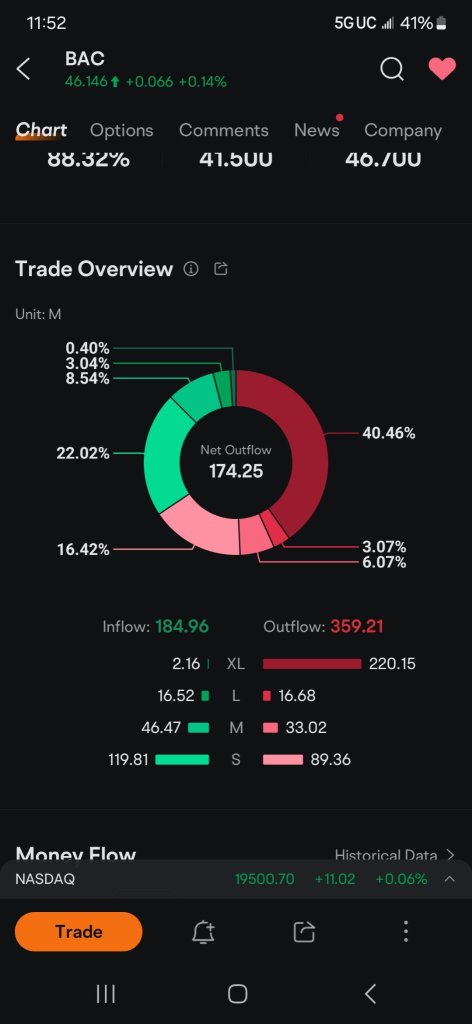

A Closer Look at Bank of America's Options Market Dynamics

Kraft Heinz Analyst Ratings

Comments

Minutes from the Federal Reserve’s December monetary policy meeting show that almost all policymakers believe the inflation outlook poses an increasing risk. Off...