The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1514.480

- -2.705-0.18%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Live Stock: Stargate Rivals the Scale of the Manhattan Project, Musk Said it's a Pipe Dream

Comparing Apple With Industry Competitors In Technology Hardware, Storage & Peripherals Industry

Apple To $183? Here Are 10 Top Analyst Forecasts For Wednesday

Visa Analyst Ratings

AI Trade Gets a Big Boost From the Stargate Project

US Morning News Call | Trump Announces $500B 'Stargate' AI Venture

Comments

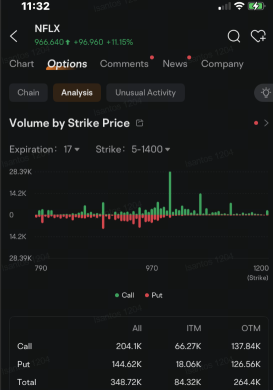

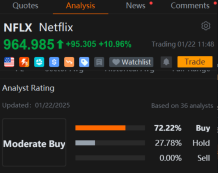

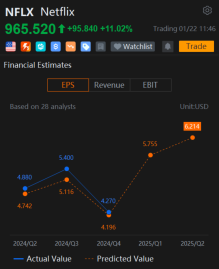

Shares of the streaming giant climbed as much as 15% to an all-time high of $999 after Netflix announced price increases. That came after net subscribers grew more than double the ...

• $S&P 500 Index (.SPX.US)$ (+0.63%): Continued to climb, reflecting positive sentiment across the broader market.

• Tech Giants Leading the Charge:

• Microsoft ( $Microsoft (MSFT.US)$ +3.11%) and NVIDIA ( $NVIDIA (NVDA.US)$ +3.59%) outperformed

• Meta Pla...

most of us and them are concerned because apple sales are declining, not growing, nothing new (innovative) they have ntg left to offer for now!!!! it is actually concerning....they have couple good things tho (cash flow, cash, addicted apple users and Apple services, maybe they're cooking something tooo with AVGO and AWS chips)

most of us and them are concerned because apple sales are declining, not growing, nothing new (innovative) they have ntg left to offer for now!!!! it is actually concerning....they have couple good things tho (cash flow, cash, addicted apple users and Apple services, maybe they're cooking something tooo with AVGO and AWS chips)