The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1611.529

- +24.832+1.57%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Options Market Statistics: Tesla's Rollercoaster Week Ends with Friday Sell-Off; Options Pop

Friday Market Rebounds Some of Weeks Loss | Wall Street Today

Here's How Much $1000 Invested In Visa 15 Years Ago Would Be Worth Today

Which Magnificent 7 Stock Will Do Best In Santa Claus Rally? Tesla Edged Out As 28% Select...

Market Whales and Their Recent Bets on Visa Options

UBS Says 'Underweight the Names With High China Exposure'

Comments

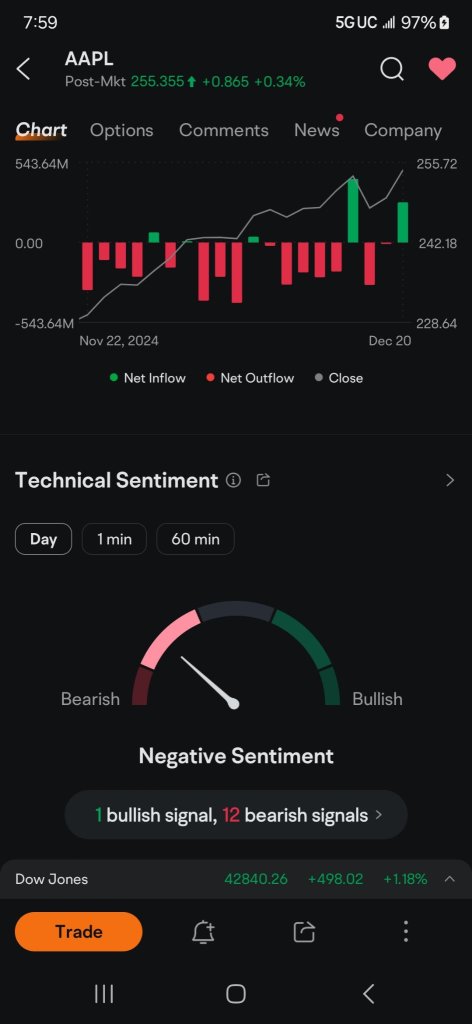

I dare somebody to find 5 weeks on this chart. For the past many years that have the most perfect candles as these in the gold box..... And they all coincide with major outflow and perfect weekly resistance..... I hate to be conspiracy theory here, but this is a bit ridiculous....