The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1471.953

- +25.177+1.74%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Apple Sees Bullish Views at Wedbush on Product and AI Driven Services Growth Ahead

Insider Trades: American Express, Costco Among Notable Names This Week

Apple's iPhone 16e Outsells iPhone SE By 60%, But Analysts Say It Won't Stop China Sales From Sliding In 2025

Apple Reportedly Fights UK Government's 'Unacceptable' Encryption Order Behind Closed Doors — No Press Or Public Allowed

If You Invested $1000 In This Stock 10 Years Ago, You Would Have This Much Today

Shale Executives Worry About Likely Peak Oil in Coming Years Despite 'Drill Baby Drill' Mantra

Comments

the Mag7 $Roundhill Magnificent Seven ETF (MAGS.US)$ VS Drag $Roundhill China Dragons ETF (DRAG.US)$ has been a narrative that's attracted eyeballs, debate, and imagination.

But one thing is for sure, the capital flight from Mag7, AI related, arguably over-priced, ATH stocks, switch to China tech that has been struggling, so called under-valued (value of China stocks can never be accurately determined due to creative accounting and interference/control of CCP), low PE ratio stocks, i...

That’s the magic of compounding—where your money

📈 The Millionaire Formula: Start with $60,000

Say you start with $60,000 and invest it wisely with an average 20% annual return. 📊 That’s achievable with a mix of growth stocks, ETFs, a...

A bullish harami appears beside a red candle. A bottom reversal is going to happen and stock is moving up. Next Monday, should see continuing up trend. Waiting to see 216 level again.

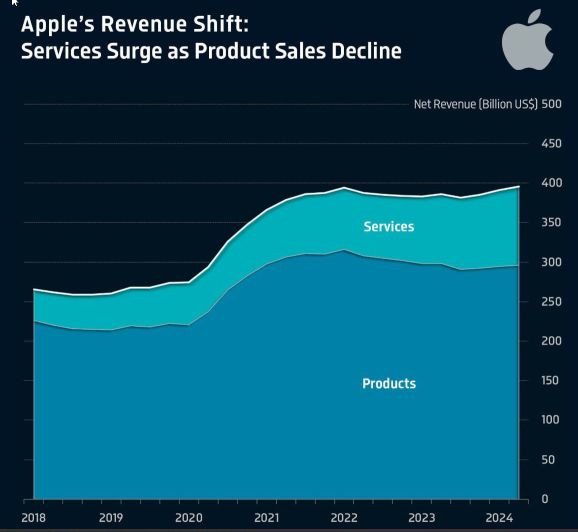

– Product revenue: Declined 3.2% ($306B → $296B)

– Services revenue: Increased 37.7% ($72B → $99B)

– Services now represent 25% of total revenue (up from 19% in 2021)

This transformation reflects Apple's deliberate strategic realignment rather than a reactive response to market conditions. ...

sooogod : How is the hype behind this organized? Sors has also been shorting Tesla for a long time; are these actions legal?