The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1572.705

- +1.314+0.08%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Sales have plummeted by 47% year-on-year! Foreign phones have faced a "Waterloo" in China, is Apple no longer appealing?

According to media calculations, in November 2024, the shipment of foreign smartphone brands in the Chinese market will be only 3.04 million units, a significant year-on-year decline of 47.4%, with a quarter-on-quarter drop as high as 51%. Among them, Apple phones occupy the vast majority of the market share, while other international brands like Samsung occupy only a small portion.

17 Analysts Have This To Say About American Express

Santa Clause Came and Went Without Bringing Gifts | Weekly Buzz

Friday? More Like Grinch Day | Wall Street Today

Evercore ISI Predicts Tech Will Lead the S&P 500 to Another 20% Upside Year in 2025

PLTR, NVDA, Among Top Technology Gainers in 2024; INTC and ENPH Among Losers

Comments

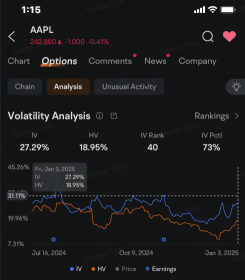

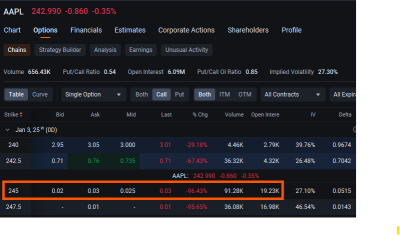

The implied volatility rose to 27.3% Friday, the highest since early November, as Apple shares headed for their fifth straight loss. A decline today would mark the longest losing streak for the stock since April.

Shares slipped after news reports that shipments of foreig...