The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1577.792

- -5.525-0.35%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Making Money From Crowd Stampede – Palantir Becomes Largest Defense Contractor In Blink Of An Eye

AT&T, JPMorgan Have Reportedly Pulled Out of Twitch Ads After Allegations of Antisemitism

Why You Should Be Checking Reddit Again Ahead of Trading

What's Going On With Bank Of America (BAC) Shares

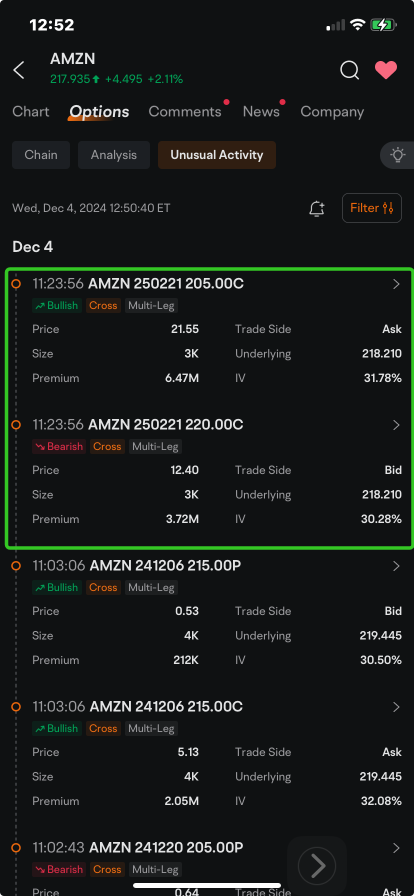

American Express Unusual Options Activity For December 04

10 Information Technology Stocks Whale Activity In Today's Session

Comments

The company's cloud services division, the Amazon Web Services began offering the chips to customers, Bloomberg reported yesterday. $Apple (AAPL.US)$ is in early stag...