The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1603.533

- +8.609+0.54%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Apple's Homegrown Wireless Chip To Come To iPhone Later In 2025

10 Information Technology Stocks Whale Activity In Today's Session

Most and Least Shorted S&P 500 Financial Stocks in November

Chevron Tops Most Shorted Large-cap Stock for Second Straight Month in November, Hazeltree Says

Moodys Analyst Ratings

P&C Insurers May Foot Some of the Bill for Struggling Taxi Insurer - Report

Comments

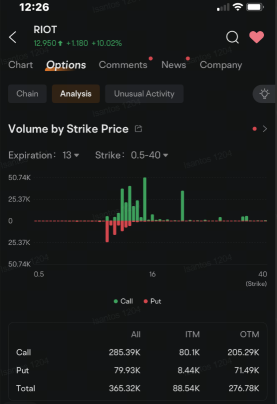

Shares jumped as much as 12.8% to $13.28 Thursday morning, likely helping fuel demand for call options. The most active of them are call options th...

https://x.com/tim_cook/status/1862229896296374762?t=JPxETCXCm1rlT0PseZE16A&s=19

Kyle Schramm : shit! When!? tell us what you see!?

101721316 : there is no support at 240 huh