The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1620.597

- -16.218-0.99%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Weekly Buzz: So far, Santa is Letting us Down

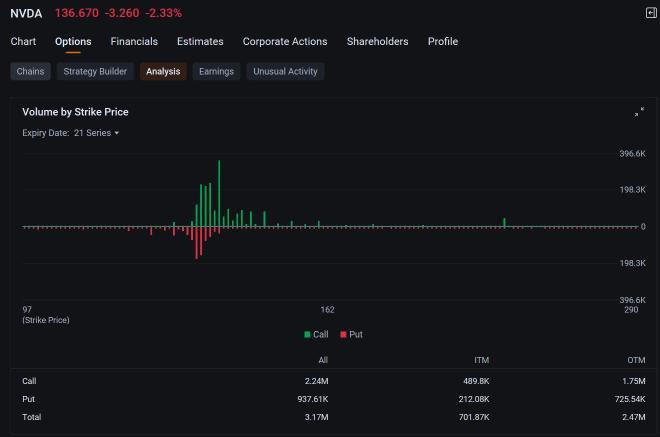

Nvidia, Tesla, Apple, Palantir, AMD Top Options Volume as Holders Exit 0DTE

10 Information Technology Stocks Whale Activity In Today's Session

Friday Market Pulls Back, Led by Mag Seven Decline | Live Stock

Check Out What Whales Are Doing With Citigroup

Assessing Apple's Performance Against Competitors In Technology Hardware, Storage & Peripherals Industry

Comments

Make Your Choice

Weekly Buzz

The week was slow in terms of news and trade volume, but that did not stop investors from pushing $Apple (AAPL.US)$ to new records, a rally that fizzled out by the end of the week. After multiple down sessions, it looks like...

After the 4 pm close, the $Dow Jones Industrial Average (.DJI.US)$ fell 0.77...

Mega cap tech fell Friday, dragging the $Nasdaq Composite Index (.IXIC.US)$ and the $S&P 500 Index (.SPX.US)$ as liquidity thins amid a holiday-shortened trading week. Nvidia's decline also weighed on...