The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1611.353

- -25.462-1.56%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Friday Market Pulls Back, Led by Mag Seven Decline | Live Stock

Check Out What Whales Are Doing With Citigroup

Assessing Apple's Performance Against Competitors In Technology Hardware, Storage & Peripherals Industry

4 Stocks to Watch on Friday: NFLX, AAPL on $4T Watch and More

Trump Could Make M&A Great Again, Key Stocks for Gains

US Morning News Call | Apple Hits Record High with 5-Day Rally, Market Cap Nears $4 Trillion

Comments

Break a Leg 🍀

Just a few more days before we see the first surge of 2025.

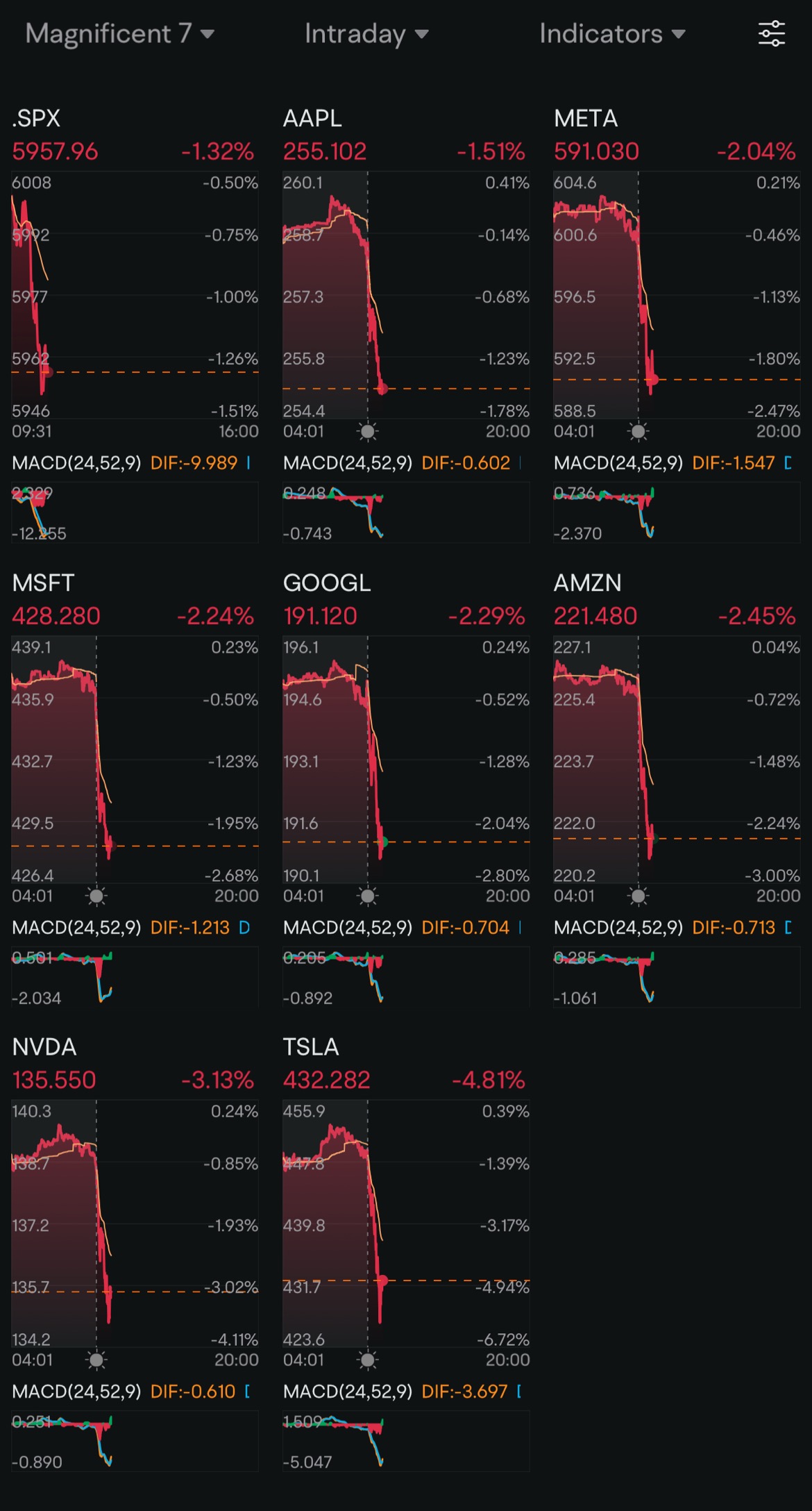

$Apple (AAPL.US)$ $Meta Platforms (META.US)$ $Alphabet-C (GOOG.US)$ $Tesla (TSLA.US)$ $Microsoft (MSFT.US)$ $Amazon (AMZN.US)$ $NVIDIA (NVDA.US)$

The market turned around, and mag seven stocks were leading the Dow lower Friday. Ten out of 11 S&P 500 sectors were lower.

Within industry themes tracked by moomoo, Lidar Technology was leading the market lower, followed by "Top Gainers Yester...

Key Decliners

• Tesla ( $Tesla (TSLA.US)$): The biggest loser today, dropping a hefty -4.81%, possibly driven by profit-taking or concerns over valuation.

• Nv...