The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1241.811

- -9.816-0.78%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Jefferies Stock Slides After Economic Uncertainty Impacts Q1 Results

Jefferies Financial Group Declares $0.40 Dividend

Jefferies Financial Group Shares Are Trading Lower Following a Q1 Revenue Miss.

Jefferies Financial Gr Q1 2025 GAAP EPS $0.57 May Not Compare To $1.04 Estimate, Total Net Revenues $1.593B Miss $1.863B Estimate

Amazon Takes Creative Control Of James Bond, Taps Top Producers to Reboot Iconic Franchise

AI Infrastructure Stocks Fall as Microsoft Scraps Some Data Center Plans

Comments

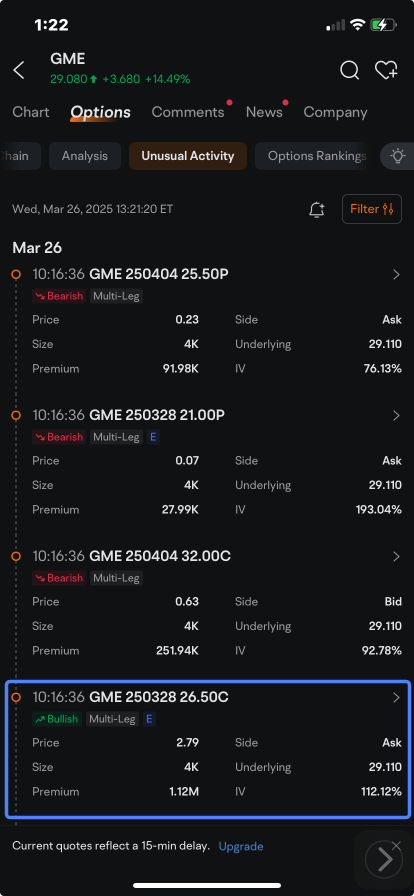

The video game retailer that reported a sixth straight quarterly revenue decline Tuesday joined other companies investing in the largest cryptocurrency, inspired by $Strategy (MSTR.US)$, whose sh...