The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1457.271

- +12.212+0.85%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Apple To Unveil iPhone 16, Watches, And AirPods At September 10 Event: Report

Here's How Much $100 Invested In Moody's 5 Years Ago Would Be Worth Today

Will the iPhone 16 be unveiled in two weeks? Apple may hold its most important new product launch event on September 10th.

According to reports, the iPhone 16 will be equipped with the A18 chip and will be enhanced by Apple Intelligence. It will introduce a new capture button similar to a shutter, and will be available for sale on September 20th. Apple will also release the Apple Watch Series 10 and update the entry-level and mid-range AirPods. Apple is currently testing four Mac models with the M4 chip.

Nvidia Is Next Week's Top Stock, Market Strategist Says: Why Best Long-Term Idea Is 'Just Buy Nvidia And Put It Away'

BILL Holdings' Growth Prospects Clouded By Investment Pressures, Legal Concerns: Goldman Sachs Downgrades Stock

Shares of Banking Companies Are Trading Higher Amid Overall Market Strength Following Fed Chair Powell's Comments About the Economy and Future Rate Cuts.

Comments

🤣

Milestones ahead - not to disagree with any ones else, Just my opinion:

1. Jackson Powell speaking today - positive.

2. August. 28th: Earnings

3. Sept Fed dropping rates

4. Apple sept new iPhone released. AI UPDATES and new iMac mini etc

5. Fed rate cuts October

6. Fed rates. Cuts December

7. Blackwell Processers etc etc etc

Q4 will be a continuing bull 🐂 But will have. Few pull backs 😇

Only my opinion.

1. Jackson Powell speaking today - positive.

2. August. 28th: Earnings

3. Sept Fed dropping rates

4. Apple sept new iPhone released. AI UPDATES and new iMac mini etc

5. Fed rate cuts October

6. Fed rates. Cuts December

7. Blackwell Processers etc etc etc

Q4 will be a continuing bull 🐂 But will have. Few pull backs 😇

Only my opinion.

Make Your Choice

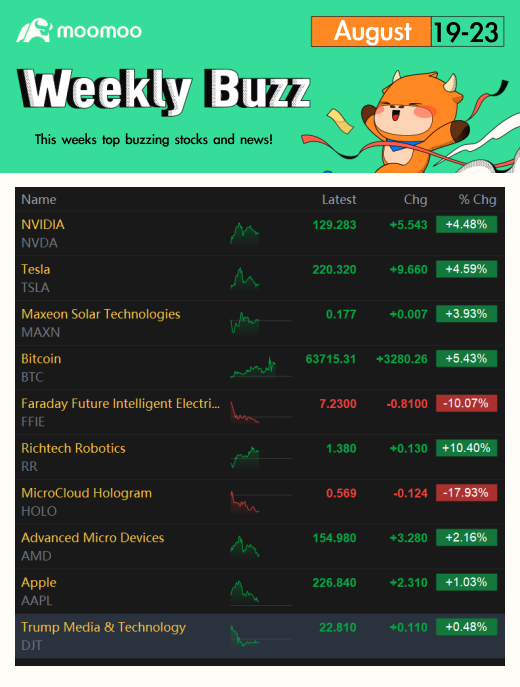

Weekly Buzz

What a Friday it is! Federal Reserve President Jerome Powell said everything short of 'we are cutting rates in September' at the Jackson Hole, WY Ec...

remember, the 1% make money on the way down and on the way up.

remember, the 1% make money on the way down and on the way up.

with you

with you  is to have as many shares of whatever YOU believe in long term, and to enjoy the ride

is to have as many shares of whatever YOU believe in long term, and to enjoy the ride RIGHT

RIGHT

DISCLAIMER:

DISCLAIMER: