The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1227.042

- +11.544+0.95%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Apple Intelligence is now open to the Global market! It supports Simplified Chinese and other languages, and Vision Pro can also use AI now.

Apple's AI features are now available to more Global users, with added support for Simplified Chinese and other languages, making it usable in almost all regions of the world. Apple also integrated Apple Intelligence into Vision Pro, equipped with a range of innovative AI tools. On Monday, Apple's stock price at one point rose over 1.5%, leading the rise among the Technology "Seven Giants".

Here's How Much $100 Invested In Apple 5 Years Ago Would Be Worth Today

U.S. stocks closed: the three major Indexes closed mixed, with tariff threats causing severe market fluctuations.

① Conservative media stocks in the USA surged over 700% on their debut; ② The Nasdaq Golden Dragon China Index fell 0.61%, with a cumulative decline of 0.08% in March; ③ News of a merger between the chip foundry giants GlobalFoundries and United Microelectronics has emerged; ④ Amazon launched the AI agent Nova Act.

Wall Street Rallied to End Higher After Earlier Losses Pushed the S&P 500 to a 6-month Low

OCC Withdraws From Climate Principles for Large Banks

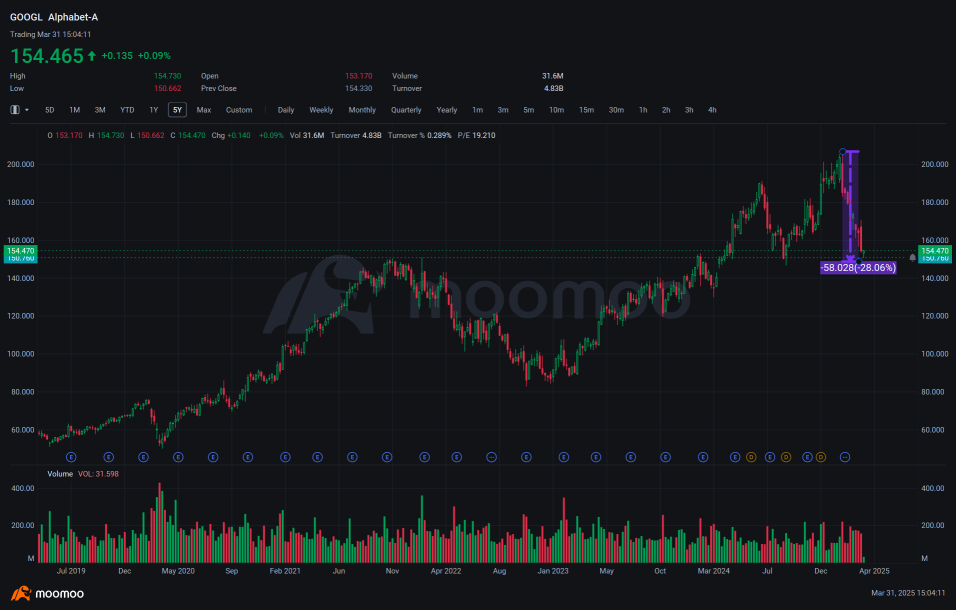

Alphabet Bulls Stay the Course, Undeterred by Analyst Downgrades: Options Chatter

Comments

The tech giant’s search business is “about to come under siege,” and that risk isn’t fully reflected in analysts’ estimates, Melius Research said Monday as it cut its price target on the stock to $173 from $218, according to a Bloomberg report.

MoffettNathanson also lowered its price target on the ...