The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1526.395

- +0.079+0.01%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

What the Options Market Tells Us About Chevron

Apple Options Market Signals Investors Divided Over iPhone 16's Sales Outlook

Monday Market Pulls Back From Highs, With Earnings To Come | Moovin Stonks

Understanding Mastercard's Position In Financial Services Industry Compared To Competitors

US Banks Plan Sharp Cuts In Corporate Deposit Returns As Fed Lowers Interest Rates: Could Financial Stocks Take A Hit?

Mastercard Analyst Ratings

Comments

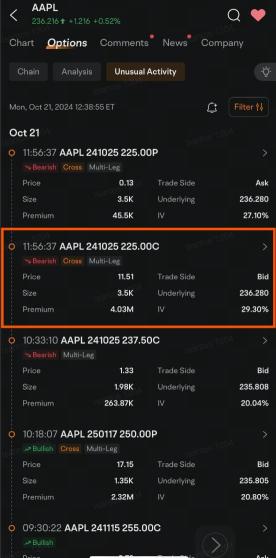

Unusual activities in the Apple stock options market showed three bearish positions and two bullish ones just before noon in New York Monday. The bearish trades were posted even as the stock headed for a closing record high.

The bigge...

My name is Kevin Travers; here are the news stories and animal spirits hitting Wall Street Today.

$Spirit Airlines (SAVE.US)$ jumped more th...

Credible Commerce : We about to explode up