No Data

BLK Blackrock

- 1020.450

- +2.720+0.27%

- 1020.450

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Weekly Buzz: Last Short Week of Jan Sees Records, Trump Gives Orders

Wall Street Today: Market Pulls Back After Wild Week

Fund Update: GREENLEAF TRUST Just Disclosed New Holdings

Live Stock: First Week Down, Market Pulls Back a Hair After Records

The inflow of funds is unstoppable; Vanguard's S&P 500 Index Fund is expected to become the largest global ETF.

The seemingly unstoppable influx of funds is driving Vanguard Group Inc. to soon take away a crown that has been held by State Street for decades. Data compiled by Bloomberg shows that by early 2025, nearly $18 billion had flowed into Vanguard's S&P 500 Index ETF (code: VOO), which is more than five times that of the second-ranked fund, and this ETF set a historical record last year with an annual inflow of $116 billion. The assets of this Fund have skyrocketed to $626 billion, soon to surpass the current largest Global ETF — SPDR S&P 500.

During the Trump era, Davos cannot stop worrying about the inflation ghost.

According to the last panel discussion at the 2025 Davos Forum, Global inflation has not disappeared, and developed economies cannot afford to be complacent amidst volatile Consumer behavior and tense trade situations. From IMF President Georgieva to Blackrock CEO Larry Fink, a number of attendees acknowledged that although central banks have made various efforts to rein in Consumer prices, policymakers still need to pay close attention. "Most of the spirit's body is in the bottle, a bit stuck there," said the IMF president. "But the legs are still hanging outside. We need to bring it in."

Comments

The financial sector delivered a stellar performance in the fourth quarter of 2024, with the $Financial Select Sector SPDR Fund (XLF.US)$ outperforming the broader S&P 500 Index. The XLF gained 7.21% in Q4 2024, significantly outpacing the 3.03% gain of the S&P 500. Fueled by robust earnings reports from key players like $JPMorgan (JPM.US)$ and $Goldman Sachs (GS.US)$, the sector demonstrated resilience and gro...

![[US Earning Season] Financials sector outperformance!](https://sgsnsimg.moomoo.com/sns_client_feed/103513015/20250117/5795f3c70d19a639375e78441e8274dc.png/thumb?area=101&is_public=true)

![[US Earning Season] Financials sector outperformance!](https://sgsnsimg.moomoo.com/sns_client_feed/103513015/20250117/d0473b692ea62e56b1e92d7133cc950f.png/thumb?area=101&is_public=true)

![[US Earning Season] Financials sector outperformance!](https://sgsnsimg.moomoo.com/sns_client_feed/103513015/20250117/d1ba03332162307a97ff63923e783374.png/thumb?area=101&is_public=true)

Just past 4 pm ET Wednesday, $Dow Jones Industrial Average (.DJI.US)$ climbed 1.65%, while the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ gained 1.83% and 2.45%, respectively.

MACRO

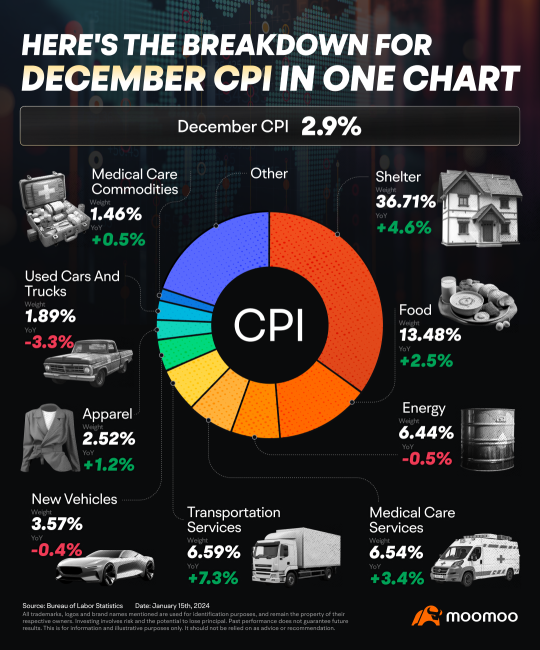

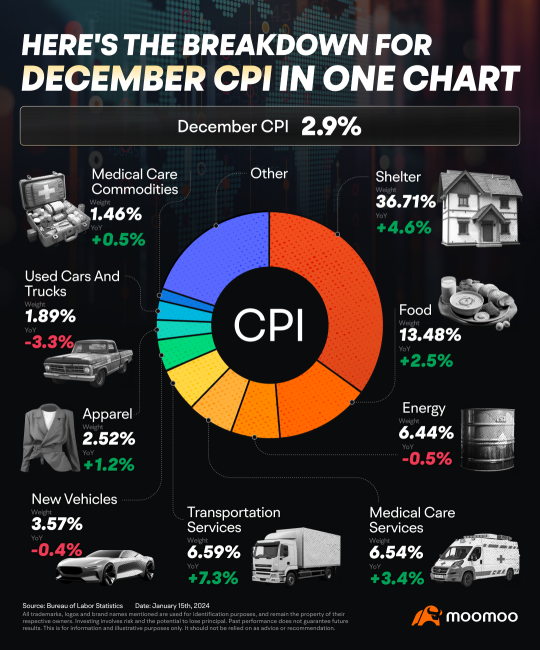

In macroeconomics, the Consumer Price index grew at just 2.9% in Decemb...

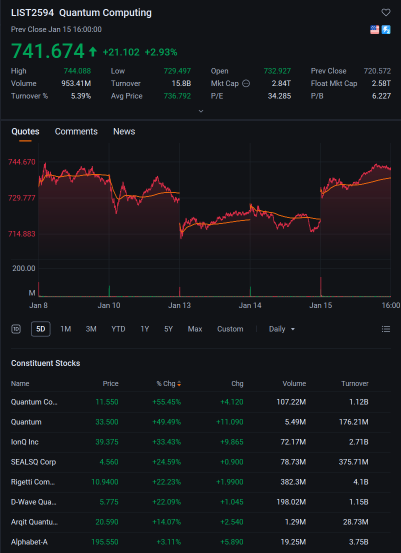

Within industry themes tracked by moomoo, bank earnings were leading the market, reflecting gains in investment banking, dealmaking, and the overall market.

$JPMorgan (JPM.US)$ was up slightly Wed, p...