No Data

BRK.A Berkshire Hathaway-A

- 687441.800

- +5442.800+0.80%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Warren Buffett Heads Into 2025 With $325 Billion Cash Pile, His Largest in Over Three Decades: Expert Says It 'Will Provide An Opportunity For The Successors To Make Their Own Mark'

Berkshire Hathaway Inc. (BRK.B) Is Attracting Investor Attention: Here Is What You Should Know

Warren Buffett Spent Only $100 Starting His First Investment Company – Its Christmas Closure Led To $981 Billion Berkshire Hathaway

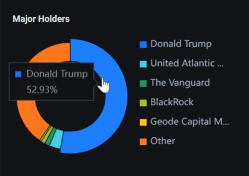

With 55% Ownership of the Shares, Berkshire Hathaway Inc. (NYSE:BRK.A) Is Heavily Dominated by Institutional Owners

Why is Buffett stockpiling a huge amount of Cash / Money Market to head for 2025?

Buffett observers believe that he is still patiently waiting for the right moment to make a "big elephant Trade" and that building a large Cash reserve is also beneficial for his successor.

Insider Trades: Berkshire Adds OXY, Nvidia & Salesforce Among Notable Names This Week

Comments

I’ve mostly held straight shares, but now I’m curious about dabbling in options. Would options give me a way to manage risk while testing potential upside? Or am I better off adding more shares and staying the course? The number...

Cautious investor wants good returns but less risk

Bonds less risk, less return. Stocks more risk, more return. Mix them together; moderate risk, moderate return.

Bonds can’t beat inflation by enough, stocks have the potential to beat inflation by a lot.

(2024) Bond yield average 3%, (2024) stock yield average 13%.

Your portfolio plan must be around 10-20 years, needs commitment and monthly affordable top ups to dedicated to your bo...

Us Equities Recouped the Losses on Inflation Relief

Buffett Boosts Stake in Occidental Petroleum for Three Straight Days

DJT Shares Drops After Trump Transfers Stake to Revocable Trust

Top Glove Swings to Profit with Quarterly Revenue of RM885.59 Million

Stocks to Watch: TOPGLOV, KENERGY, AIRPORT, etc

- Moomoo News MY

Wall Street...

leaveraged berkshire.

$Direxion Daily BRKB Bull 2X Shares (BRKU.US)$

At the closing bell 4 pm ET, the S&P 500 climbed 1.28%, the Dow Jones Industrial Average climbed 1.52%, and the Nasdaq Composite Index climbed 1.21%.

MACRO

In macro, Personal Consumption Expenditure numbers came in lower than expected, 2.4% vs 2.5%, but trending higher...

No Data

Kuries : The covered call strategy can give you extra income, but I’d be cautious about going too aggressive on calls if the market starts to slow. I’m personally sticking to shares but keeping a close eye on options when the right opportunity arises.

Ahh_gee_Joey : I'm cautious about the volatility. I feel like adding more shares would give me more stability, especially with the macroeconomic uncertainty ahead. What’s your plan if the market turns sour, though?

areecep OP Kuries : I hear you—options can open up great opportunities, but like you said, the risk is real. I’ll probably start small and monitor the market closely. Thanks for the insight!

areecep OP Ahh_gee_Joey : Appreciate the input!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) I’m leaning toward a mix of both, but like you said, macro uncertainty is a concern. If things take a downturn, I’ll probably stick to more shares for stability. Let’s see how it plays out.

I’m leaning toward a mix of both, but like you said, macro uncertainty is a concern. If things take a downturn, I’ll probably stick to more shares for stability. Let’s see how it plays out.