No Data

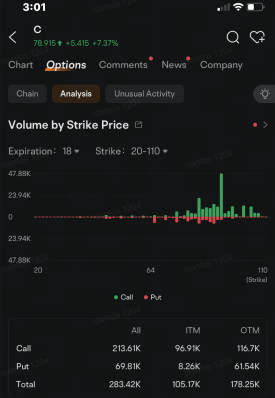

C Citigroup

- 81.210

- +1.220+1.53%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

IShares U.S. High Yield Bond Index ETF (CAD-Hedged) Declares CAD 0.083 Dividend

U.S. Equities Face Positive Takeover Momentum -- Market Talk

Express News | RPT-Buzz-US Stocks Weekly: Running the Table

Wolfe Research Adjusts Price Target on Citigroup to $87 From $83, Keeps Outperform Rating

Citigroup Posts Q4 Results: How Should You Approach the Stock Now?

Citi: Maintains HK & CHINA GAS "Neutral" rating with a Target Price of HKD 6.3.

Citi published a research report stating that based on a 12-month period, it maintains a "neutral" rating for HK & CHINA GAS (00003), with a Target Price of HKD 6.3. It is expected that last year's core net profit will remain relatively flat year-on-year (recorded 5.894 billion Hong Kong dollars the year before), and the forecasted dividend yield for this year will reach 5.9%, higher than the current yield of 4.6% for the ten-year US Treasury. The report states that HK & CHINA GAS's annual dividend payment of 6.5 billion Hong Kong dollars from 2022 to 2023 has been driven by debt. The report mentions that the company hopes to generate more Cash in the long term through emerging businesses to maintain its dividend per share, such as the production and sales of sustainable Aviation fuel and green Methanol.

Comments

The financial sector delivered a stellar performance in the fourth quarter of 2024, with the $Financial Select Sector SPDR Fund (XLF.US)$ outperforming the broader S&P 500 Index. The XLF gained 7.21% in Q4 2024, significantly outpacing the 3.03% gain of the S&P 500. Fueled by robust earnings reports from key players like $JPMorgan (JPM.US)$ and $Goldman Sachs (GS.US)$, the sector demonstrated resilience and gro...

![[US Earning Season] Financials sector outperformance!](https://sgsnsimg.moomoo.com/sns_client_feed/103513015/20250117/5795f3c70d19a639375e78441e8274dc.png/thumb?area=101&is_public=true)

![[US Earning Season] Financials sector outperformance!](https://sgsnsimg.moomoo.com/sns_client_feed/103513015/20250117/d0473b692ea62e56b1e92d7133cc950f.png/thumb?area=101&is_public=true)

![[US Earning Season] Financials sector outperformance!](https://sgsnsimg.moomoo.com/sns_client_feed/103513015/20250117/d1ba03332162307a97ff63923e783374.png/thumb?area=101&is_public=true)

While US earnings season continues to deliver better than expected profit results from S&P500 $S&P 500 Index (.SPX.US)$ companies. As we stand right now, on Friday 17 January the Nasdaq 100 $NASDAQ 100 Index (.NDX.US)$ is 4.6% down from its record high. And the S&P500 is just 2.5% away from its record. Both app...

And US bank earnings packed a good punch, highlighting that we could expect great things from US company earnings ah...

Just past 4 pm ET Wednesday, $Dow Jones Industrial Average (.DJI.US)$ climbed 1.65%, while the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ gained 1.83% and 2.45%, respectively.

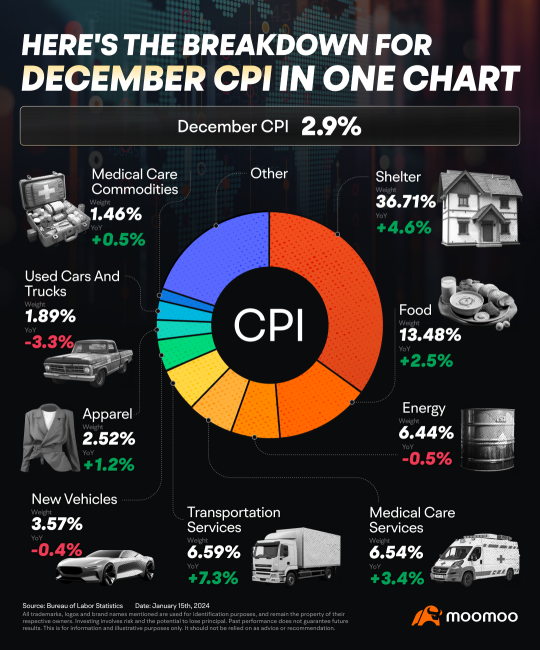

MACRO

In macroeconomics, the Consumer Price index grew at just 2.9% in Decemb...

As of 3:01 p.m. in New York Wednesday, about 283,400 options changed hands, more than triple the 20-day average volume of 92,689, according to data compiled by Bloomberg. Call options t...

Buy n Die Together❤ :

Money Thrill : good article![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)