No Data

C Citigroup

- 70.390

- 0.0000.00%

- 70.180

- -0.210-0.30%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Citigroup Inc. (NYSE:C) Is Largely Controlled by Institutional Shareholders Who Own 73% of the Company

Citigroup Unusual Options Activity

Citi: Maintain Buy rating on KEYMED BIO-B with a Target Price of 60 Hong Kong dollars.

Citi released a research report stating that KEYMED BIO-B (02162) is undervalued, and its further progress in commercialization as well as the launch of new candidate drugs will prompt investors to reassess its value. Therefore, it maintains a "Buy/High Risk" rating with a Target Price of HKD 60. Recently, the weakness in KEYMED's stock price has fully reflected the 40% price cut of Dupixent in negotiations with the national medical insurance catalog, exceeding the market expectation of 30%, as well as investors' concerns about the commercialization prospects. KEYMED's management previously expressed confidence in a sales target of 0.5 billion RMB for 2025, with 60% planned.

Citibank: maintains XINYI SOLAR's "Neutral" rating, lowering the Target Price to 3.1 Hong Kong dollars.

Citi released a research report maintaining a "neutral" rating on XINYI SOLAR (00968), focusing on the losses in Photovoltaic Glass windows due to weak market demand. However, its financial status remains robust, with a forecast for lower capital expenditure budgets next year. The Target Price has been lowered by 14% to HKD 3.10 to reflect the adjusted earnings forecast. The firm indicated a downward adjustment of 11% to 18% in its Net income projections for XINYI SOLAR from this year through 2026, mainly reflecting a reduction in Photovoltaic Glass sales forecasts. The firm also assumes a year-on-year increase in glass production capacity of 14% and 4.5% over the next two years, impacted by additional capacity closures and postponed new projects. The firm's profit forecast for the company this year suggests.

Citigroup: Reiterates XIAOMI-W 'Buy' rating with a Target Price of HK$34.9.

Citi released a research report reaffirming XIAOMI-W (01810) with a "Buy" rating and a Target Price of 34.9 Hong Kong dollars. Future main catalysts include an increase in SU7 Ultra electric vehicle Orders, the launch of a new intelligent driving system, potential mobile phone subsidy policies, and the rollout of the YU7 electric vehicle. The report states that XIAOMI held a comprehensive ecosystem partner conference in Peking last Friday (27th), reaffirming that R&D expenditures for this and next year will be 24 billion and 30 billion yuan respectively, estimating that R&D expenditures from 2022 to 2026 will exceed 100 billion yuan, primarily concentrated on AI and operations.

January's Must-see Financial Events: CES 2025, Q4 Earnings Season, and Trump's Inauguration Day

Comments

Tax-Loss Harvesting: Investors often sell off underperf...

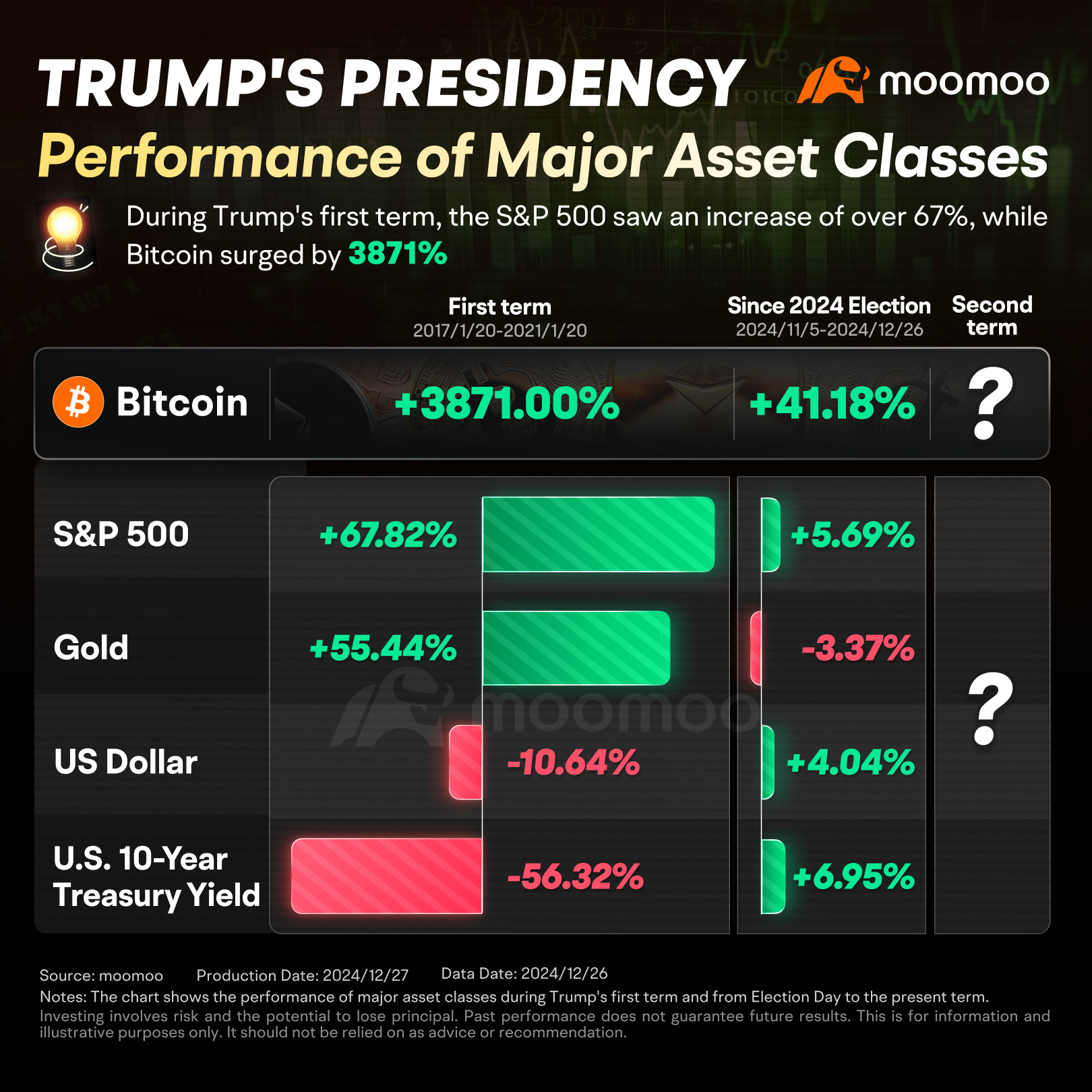

Since Election Day on November 5, 2024, up to December 26, 2024, the S&P 5...

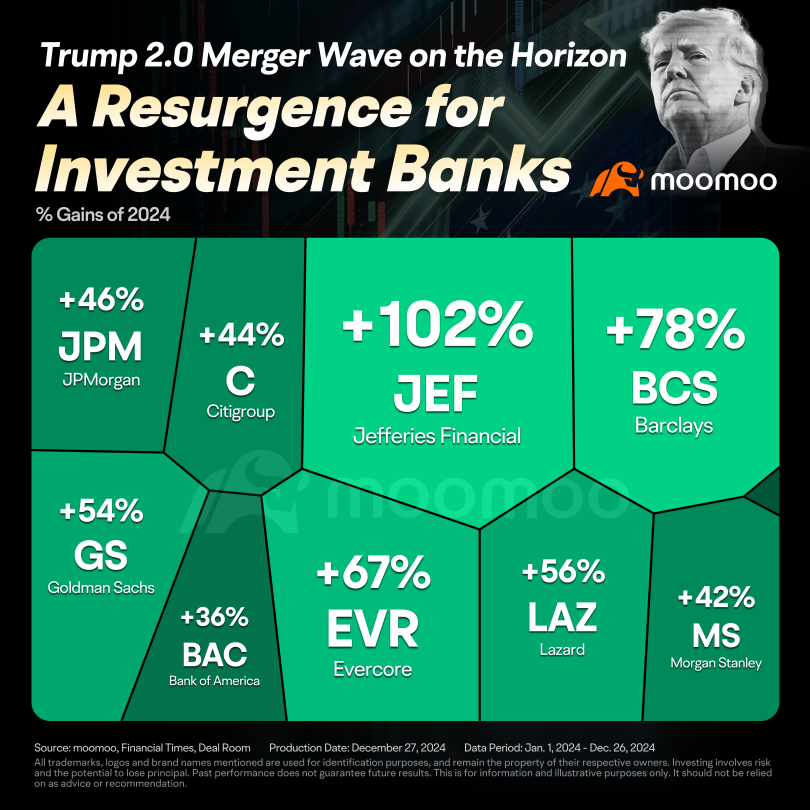

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...

No Data

Buy n Die Together❤ :

103575541 :

104088143 : What happened?