No Data

C Citigroup

- 64.170

- -0.330-0.51%

- 64.190

- +0.020+0.03%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Former US Deputy Secretary of the Treasury: The global economy is showing resilience, and future momentum comes from the AI revolution.

On October 27, 2024, Nathan Sheets, Chief Economist of Citigroup and former Deputy Secretary of the US Department of the Treasury, shared his views on the current economic situation and future trends at the annual conference of the TCFA. He pointed out that despite the resilience shown by the global economy in recent years in the face of geopolitical challenges and monetary tightening policies, the true growth drivers in the future will come from digital transformation and the AI revolution. Sheets emphasized that behind the global economic recovery is the rapidly growing digital economy and automation processes. Since 2000, the global internet penetration rate has increased from 2.

Citigroup To Go Ex-Dividend On November 4th, 2024 With 0.56 USD Dividend Per Share

Thursday, Halloween Market Falls in Scary Reaction to Earnings | Wall Street Today

Citigroup Options Spot-On: On October 31st, 115.67K Contracts Were Traded, With 2.3 Million Open Interest

Former Citi Bankers Ask Board to Pull Back Hundreds of Bonuses - Report

Citigroup & Google Cloud Collaborate to Accelerate Digital Strategy

Comments

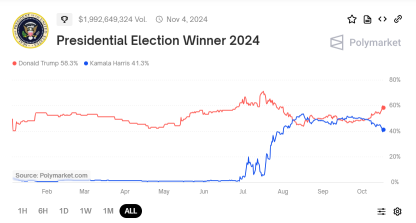

The U.S. stock market is witnessing a revival of the "Trump Trade." Shares in Trump's social media venture, $Trump Media & Technology (DJT.US)$, have soared more than 220% since Octobe...

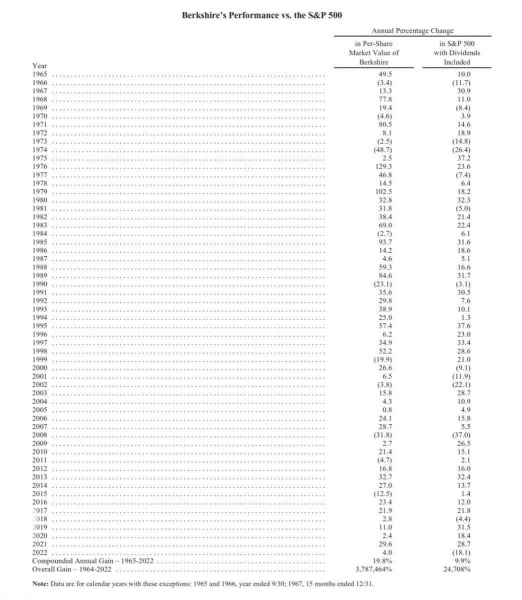

Of the companies to hit this milestone, Berkshire took the longest—approximately 44.5 years from the time it went public—according to data compiled by my friends at VisualCapitalist.

Notably, Berkshire is the first non-tech company in the U.S. to achieve this feat.

In contrast, Meta $Meta Platforms (META.US)$ reached t...

What did we learn from the nation's top lenders?

NII pressure: The slowdown in net interest income (NII) continued in Q3—but less than anticipated. JPMorgan even raised its NII projection for 2024.

Fees to the rescue: Banks were able to mitigate the NII slowdown with other revenue sources, showing their diversified revenue streams. Wells Fargo highlighted a 16% growth in fee-based revenue this year.

Investment banking activity rebou...

In fact, there was even a period (2003-2005) where Berkshire underperformed the S&P 500 for 3 years in a row!

But here’s what’s so eye opening about this:

Here’s the compounded annual gain from each of these over this time period:

S&P 500: 9.9%

Berkshire Hathaway: 19...

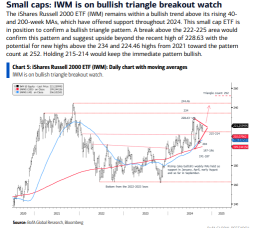

Bank Stocks Bolster Small-Cap Performance

The robust performance of small caps is largely attributed to the strong earnings reported by major U.S. banks. Financial institut...

Analysis

Price Target

No Data

No Data

US Banks Earnings

US Banks Earnings

Coach Donnie OP : We have been here before. Remember, the stock market only exists because it makes money and multiplies wealth. In order to transfer wealth to you and your family you’ll need to be patient.

Last earnings season we saw the same thing with Megacaps and the broader stock market. But it rebounded very well in Sept and Oct. I believe Nov and Dec will be higher for the stock market. Don’t allow market manipulation to cause you to panic sell. Of course, when you buy or sell is your decision.. For me, I’m staying strong and staying long. All will be well’

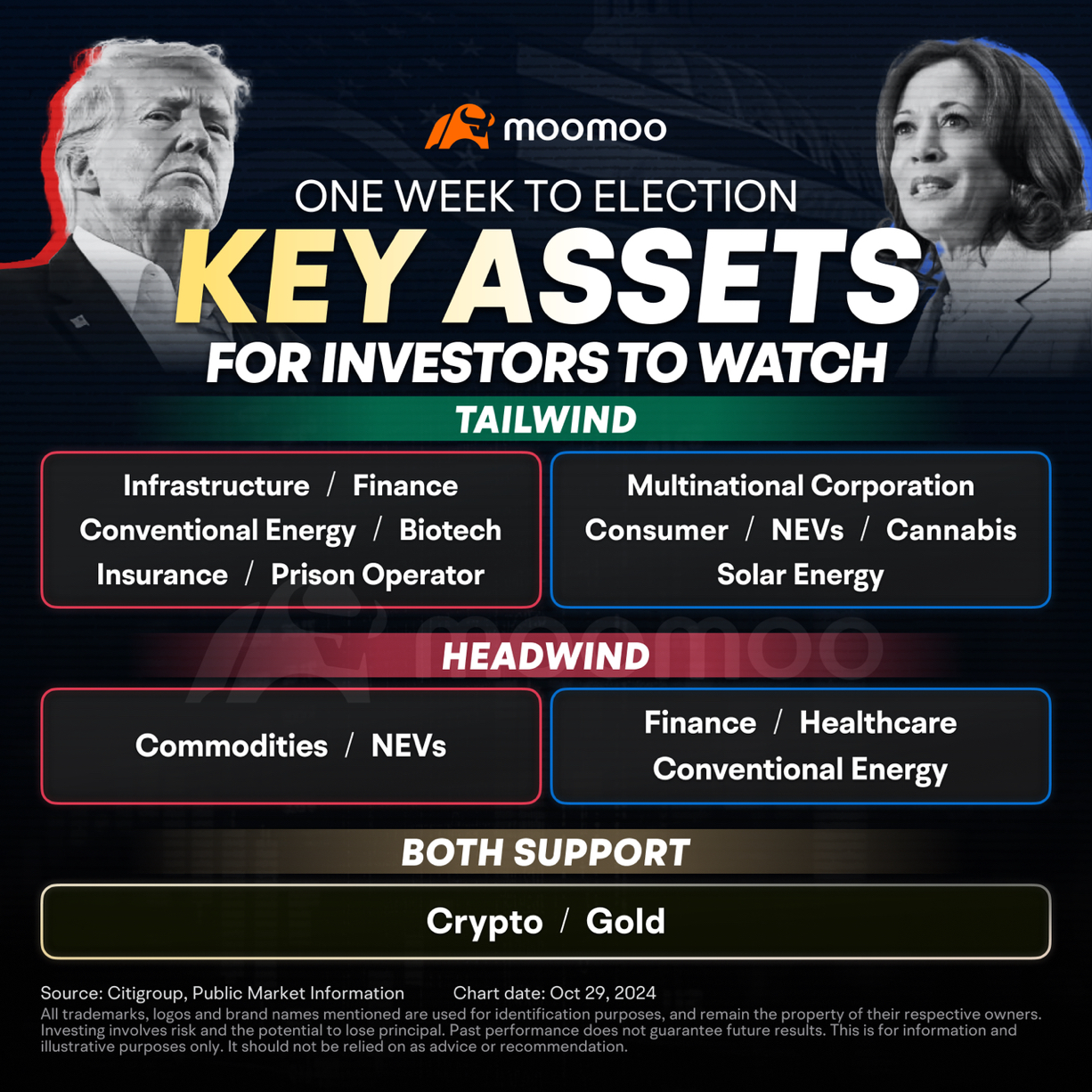

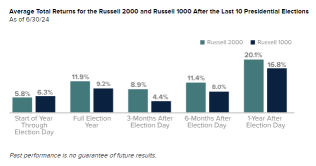

Coach Donnie OP : ELECTION COUNTDOWN: HOW THE MARKET

COUNTDOWN: HOW THE MARKET  MAY MOVE

MAY MOVE  HOW WILL YOU STRATEGIZE

HOW WILL YOU STRATEGIZE

Coach Donnie OP : I know this is taboo but I refuse not to Help when I can

with our Dollar, Our Habits, Our Beliefs, How we Treat Each Other etc WAYYYY more than at the Ballots

with our Dollar, Our Habits, Our Beliefs, How we Treat Each Other etc WAYYYY more than at the Ballots

need to Get Together and Fight

need to Get Together and Fight  for what we Believe in.

for what we Believe in.

Not a fan of politics

Definitely an advocate of Helping People and Truth

We have to Pay Attention.

Both sides have very sinister stuff going on.

We vote

We need to UNIFY or we di

It ain’t about who’s in office but we have to stay informed

Poly means Many

Ticks is Blood Suckin Leeches

Congress is the opposite of Progress

We The People

Instead of expecting some Lady or Dude we never met to improve our lives