No Data

C241115C30000

- 38.70

- +5.00+14.84%

- 5D

- Daily

News

Citi: Maintains a "buy" rating on Kuaishou-W with a target price of HK$67.

Citi released a research report stating that it maintains a "buy" rating on Kuaishou-W (01024) with a target price of 67 Hong Kong dollars. The company reported strong year-on-year growth in its Singles' Day sales e-commerce GMV (gross merchandise volume), with e-commerce shelf commodity GMV increasing by 110% year-on-year, a 94% year-on-year increase on the first day of promotions, and search GMV growing by 119%. According to its performance indicators, Citi believes that Kuaishou's GMV growth during Singles' Day could exceed the bank's expected 14% year-on-year growth for Q4 2024. However, with a slowdown in growth during the off-season outside of Singles' Day, this may imply that Citi's Q4 2024 GMV forecast is expected.

Citigroup: Maintains a 'buy' rating on Vtech Holdings with a target price of 65 Hong Kong dollars.

Citi released a research report stating that it maintains a target price of HKD 65 for vtech holdings (00303) and a "buy" rating. The company's revenue for the first half of the period ending September 2025 decreased by 4.5%, and net profit fell by 6.6% to USD 87.4 million. The report states that the company's revenue was below expectations, primarily due to adjustments in the sales of the acquired company Gigaset. The bank expects the initial contribution of sales from Gigaset to account for about 4% of vtech holdings' total sales. Management indicated that Gigaset's performance in October has improved compared to before the acquisition, so Gigaset has already begun to break even.

Traders increase their bets on buying put USA government bonds, as Trump's policies are expected to reignite inflation.

Traders are increasing their bets on further declines in the USA Treasury market, expecting that the policies promised by Trump will reignite inflation and keep US interest rates high. Data released on Tuesday showed that open interest contracts for two-year note futures rose for the fourth consecutive trading day. This indicates that traders are building put positions after the election and before the release of October inflation data on Wednesday. As short positions expand, US bonds were sold off, with yields rising more than 10 basis points across the board on Tuesday. An indicator of the return rate on government bonds has narrowed the year-to-date gains by only 1.4%. Citi strategist David Bieber in the report.

Express News | Citi and Bank of Shanghai Launch First-of-Its-Kind Payments Solution for International Travelers in China

Citigroup CEO Says Its `game on' for M&A in the U.S. Post Election

Citigroup Options Spot-On: On November 12th, 201.54K Contracts Were Traded, With 2.4 Million Open Interest

Comments

随文附件图只是无意中在某达人moomoo分享中发现的,僅共参考,如有冒犯,请多包涵和指导,不喜勿喷,谢谢!希望大家都可以因为moomoo梦想成真,心想事成

The attached picture was just found by accident in the sharing of a certain expert moomoo. It is for reference only. Please forgive and teach me If it is of...

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

On the positive side, the US stock market will probably do well as Trump is pro-business and will implement tax cuts for US companies. Banks $JPMorgan (JPM.US)$ $Citigroup (C.US)$ $Bank of America (BAC.US)$ $Morgan Stanley (MS.US)$ will benefit from more lenient regulations under Trump’s administration. He is also supportive of cryptocurrency, military funding and traditional energy like oil and gas.

However, i...

Among major assets, the U.S. Dollar Index climbed as much as 1.6%, reaching its highest level in a year. U.S. Trea...

Gapping up

$Trump Media & Technology (DJT.US)$ 's shares jumped 37.3%, with the company owning the Truth Social platform and being majorly owned by Donald Trump.

Shares of $Tesla (TSLA.US)$ climbed 12.6%, as the electric vehicle leader is seen to benefit greatly from a Trump victory, especially with CEO Elon Musk's strong support.

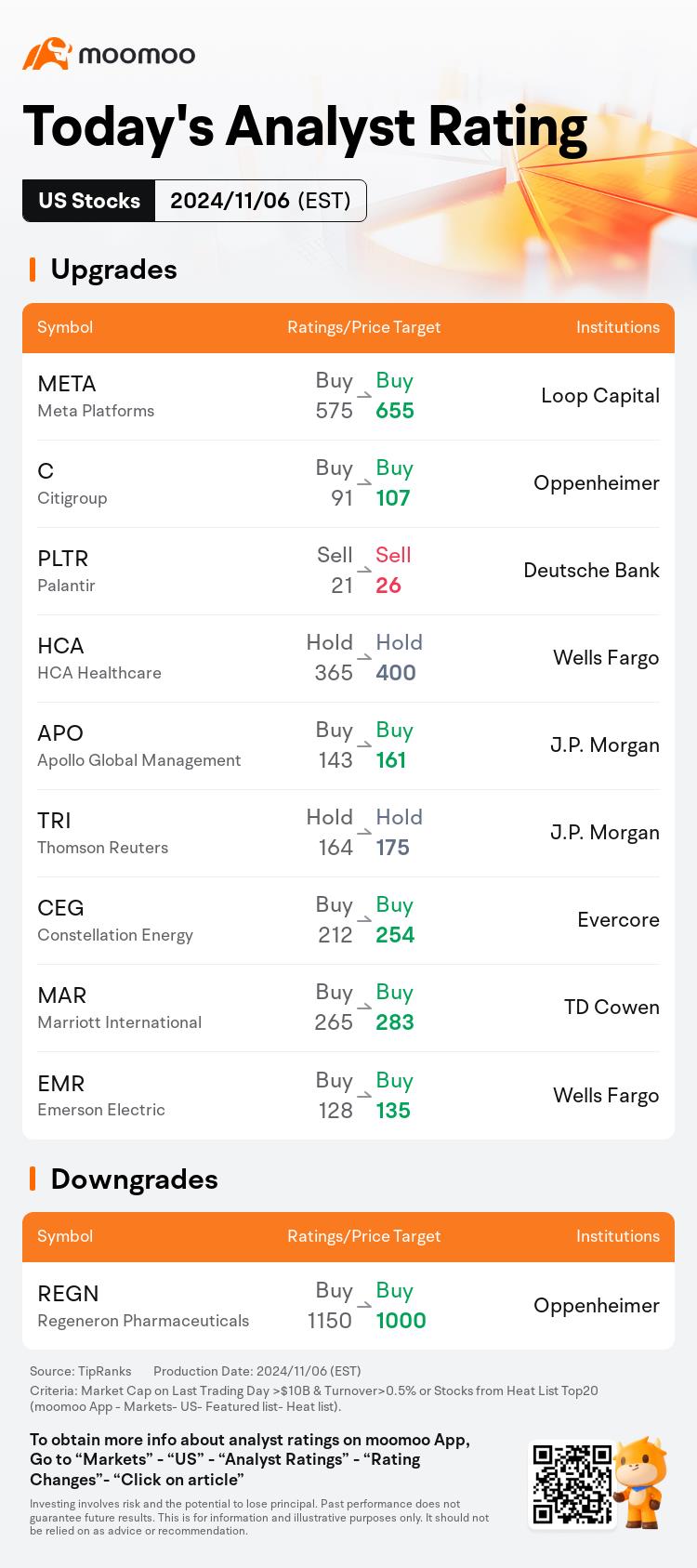

Shares of financial giants $Citigroup (C.US)$ , $Bank of America (BAC.US)$ , and $Wells Fargo & Co (WFC.US)$ each asc...

President Trump 2024-2028

President Trump 2024-2028

0FaFa0 OP : Thank you for the encouragement and support.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

溫馨提示 : Can't grasp the strength of Tsla, Nvda, and Bitcoin updates.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) Been busy and prosperous for the past 4 years.

Been busy and prosperous for the past 4 years.

EbdAidivn : If you held on to Coinbase pre 125 give yourself a pat on the back