No Data

C241122P68000

- 0.01

- -0.07-87.50%

- 5D

- Daily

News

Citigroup: Man Wah Hldgs rated as "buy", target price lowered to 8 Hong Kong dollars.

Citigroup released a research report stating that Man Wah Hldgs (01999) had a 7.4% year-on-year decline in revenue in the first half of the fiscal year, with a 0.3% increase in net profit, and the mid-term performance met expectations. However, the bank lowered the group's earnings forecast per share for the fiscal years 2025 to 2027 by 11% to 19%, and reduced its target price from HK$9 to HK$8 to reflect weaker-than-expected market prospects in China, yet maintained a 'buy' rating. Citigroup expects Man Wah's revenue in the second half of the fiscal year to decline by approximately 4%, and anticipates a slight decrease in China market revenue in the following months, projecting an 11% decline in the second half of the year, an improvement from the 17% decrease in the first half of the year. The bank believes that due to

Citigroup Options Spot-On: On November 22nd, 228.29K Contracts Were Traded, With 2.27 Million Open Interest

Weekly Buzz: Nvidia Falls on Near Perfect Report, but Only For a Day

Sector Update: Financial Stocks Rise Late Afternoon

Bank of America Private Bank Lures $7 Billion Advisor Duo From Citi -- Barrons.com

Express News | CNBC Halftime Report Final Trades: Deckers Outdoor, Electronic Arts, Citigroup, IShares MSCI India ETF

Comments

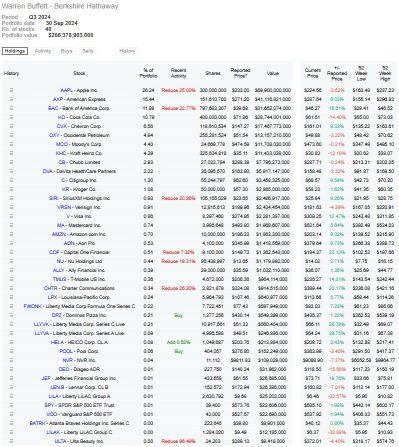

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Apple (AAPL.US)$ $American Express (AXP.US)$ $Bank of America (BAC.US)$ $Coca-Cola (KO.US)$ $Chevron (CVX.US)$ $Occidental Petroleum (OXY.US)$ $Moody's (MCO.US)$ $Citigroup (C.US)$ $Visa (V.US)$

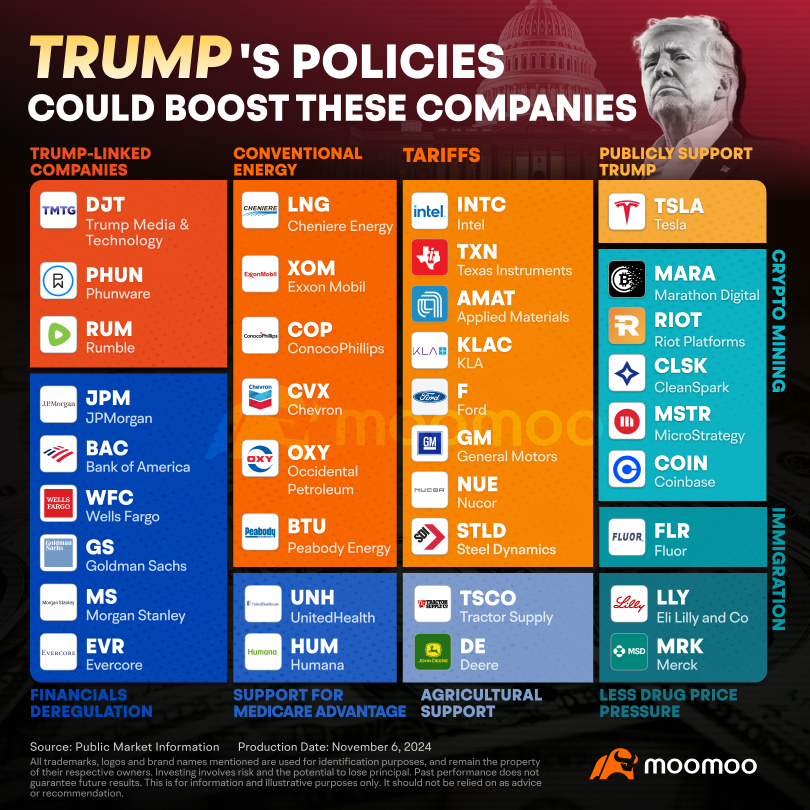

随文附件图只是无意中在某达人moomoo分享中发现的,僅共参考,如有冒犯,请多包涵和指导,不喜勿喷,谢谢!希望大家都可以因为moomoo梦想成真,心想事成

The attached picture was just found by accident in the sharing of a certain expert moomoo. It is for reference only. Please forgive and teach me If it is of...

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

On the positive side, the US stock market will probably do well as Trump is pro-business and will implement tax cuts for US companies. Banks $JPMorgan (JPM.US)$ $Citigroup (C.US)$ $Bank of America (BAC.US)$ $Morgan Stanley (MS.US)$ will benefit from more lenient regulations under Trump’s administration. He is also supportive of cryptocurrency, military funding and traditional energy like oil and gas.

However, i...

Among major assets, the U.S. Dollar Index climbed as much as 1.6%, reaching its highest level in a year. U.S. Trea...

President Trump 2024-2028

President Trump 2024-2028

Lnova : where is $Super Micro Computer (SMCI.US)$

MARKET-TEST-DUMMY Lnova : Good question

小熊维尼睡大觉 : This is September, but I have already seen October online.

Mrstocksplitsundae : he's old . and out of touch with the new market....his Era is over..