No Data

C241206C56000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Express News | Citigroup : BofA Global Research Raises Price Objective to $90 From $78

Citigroup Inc. (NYSE:C) Is a Favorite Amongst Institutional Investors Who Own 76%

Citigroup: Maintains "buy" rating for Meituan-W with a target price raised to HKD 203.

Citi released a research report stating that it maintains a "buy" rating for Meituan-W (03690), with the target price raised from 192 HKD to 203 HKD. The report mentioned that Meituan's performance in the third quarter of the fiscal year 2024 is robust, with total revenue rising 22% year-on-year, which is 1.7% higher than market expectations; adjusted net income increased by 124% year-on-year, which is 9.8% higher than market expectations. This performance was mainly supported by the better-than-expected growth in core local business operating profit and other factors. Looking ahead to the fourth quarter, the latest stimulus measures from the central government may support consumer demand. The bank also believes that Meituan's strong execution of product and operational strategies and ongoing innovation will contribute positively.

As "transition finance" becomes a trend on Wall Street, jpmorgan remains reluctant to embrace it.

JPMorgan still has doubts about a trend embraced by many Wall Street peers. "Transition finance" exists in a regulatory gray area, describing the allocation of capital to activities that ultimately help reduce carbon emissions in the broader economy. Financing for decarbonizing businesses is also seen as a massive business area, with Apollo Global Management Inc. recently mentioning that energy transition could bring about $50 trillion in investment opportunities over the next few decades. Against this backdrop, some large banks on Wall Street are

Citigroup Options Spot-On: On November 29th, 82,441 Contracts Were Traded, With 2.38 Million Open Interest

10 Financials Stocks Whale Activity In Today's Session

Comments

1. Government Support and Vision

• Vision 2030: Abu Dhabi’s Vision 2030 focuses on transitioning to a knowledge-based economy, prioritizing sectors like technology, AI, and sustainability.

• MGX Initiative: Abu Dhabi recently launched a $100 billion MGX fund to boost global AI and techn...

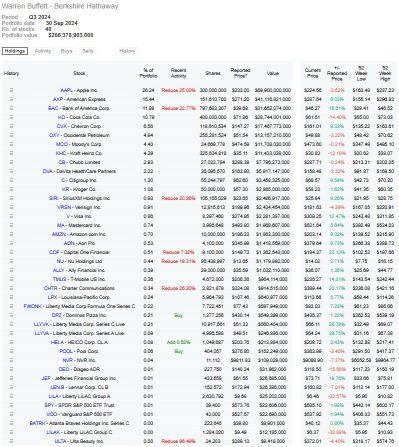

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Apple (AAPL.US)$ $American Express (AXP.US)$ $Bank of America (BAC.US)$ $Coca-Cola (KO.US)$ $Chevron (CVX.US)$ $Occidental Petroleum (OXY.US)$ $Moody's (MCO.US)$ $Citigroup (C.US)$ $Visa (V.US)$

随文附件图只是无意中在某达人moomoo分享中发现的,僅共参考,如有冒犯,请多包涵和指导,不喜勿喷,谢谢!希望大家都可以因为moomoo梦想成真,心想事成

The attached picture was just found by accident in the sharing of a certain expert moomoo. It is for reference only. Please forgive and teach me If it is of...

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

On the positive side, the US stock market will probably do well as Trump is pro-business and will implement tax cuts for US companies. Banks $JPMorgan (JPM.US)$ $Citigroup (C.US)$ $Bank of America (BAC.US)$ $Morgan Stanley (MS.US)$ will benefit from more lenient regulations under Trump’s administration. He is also supportive of cryptocurrency, military funding and traditional energy like oil and gas.

However, i...