No Data

C241213C54000

- 17.75

- 0.000.00%

- 5D

- Daily

News

Express News | Citigroup : RBC Raises Target Price to $74 From $67

Citi: It is reported that HSBC Holdings plans to cut $3 billion in costs during restructuring, which has a positive impact on the stock price.

Citigroup released a research report stating that HSBC Holdings (00005) plans to cut costs by 3 billion dollars in the restructuring process, which accounts for about 10% of its cost base, involving large-scale layoffs, including about 40% of 175 senior managers. The bank believes that this news will have a positive impact on HSBC's stock price, as it helps to narrow the efficiency gap between HSBC and other domestic peers outside of Hong Kong and the United Kingdom, though there are execution risks. HSBC is one of the most Bullish stocks in the bank's assessment of Hk Based Banks in Europe and Hong Kong.

Citibank gives YUE YUEN IND a "Buy" rating with a Target Price of HKD 20.3.

Citibank released a research report stating that YUE YUEN IND (00551) has seen a 10.9% increase in Revenue for its footwear manufacturing Business (MFG) year-to-date, and the situation in the first 11 months of this year aligns with the bank's expectations. Since the end of September, due to revenue growth and gross margin expansion for the fourth quarter of 2024, the MFG Sector has performed strongly, with stock prices rising over 25%, assigning a Target Price of HKD 20.3 and a 'Buy' rating.

Citigroup Options Spot-On: On December 11th, 139.52K Contracts Were Traded, With 2.36 Million Open Interest

Wall Street commodity traders' performance this year is expected to be the worst since before the pandemic

As market volatility weakens, the commodity trading business of the world's major investment banks may experience the worst year since before the outbreak of the pandemic. According to data compiled by Coalition Greenwich, the combined net revenue of more than 250 companies, including Goldman Sachs, Citigroup, and J.P. Morgan Chase, will reach 10.6 billion US dollars this year, which is nearly one-fifth less than last year's total revenue. Angad Chhatwal, head of global macro markets at Coalition Greenwich, said, “The trading boom is fading away, and revenue will drop a further 3% in 2025.” Chinese flag, tall

US inflation is in line with expectations, consolidating market expectations that the Fed will cut interest rates next week

Consumer prices in the US rose steadily last month as expected, strengthening the market's expectations that the Federal Reserve will continue to cut interest rates next week. The so-called core consumer price index, which excludes food and energy costs, rose 0.3% for the fourth month in a row, according to data released by the Bureau of Labor Statistics on Wednesday. The indicator climbed 3.3% year over year. Economists believe that core inflation reflects the underlying inflation trend better than the overall CPI, which includes frequently fluctuating food and energy prices. The overall CPI rose 0.3% month-on-month, while the year-on-year increase was 2.7%. The S&P 500 index opened higher, and US Treasury yields were released after the CPI data was released

Comments

The market expectations is that nonfarm payroll will increase by 214,000 in November. However , a much hotter than expected number may not be welcomed.

$Crude Oil Futures(JAN5) (CLmain.US)$ $Salesforce (CRM.US)$ $Bank of America (BAC.US)$ $iShares Bitcoin Trust (IBIT.US)$ $Netflix (NFLX.US)$ $Cloudflare (NET.US)$ $MARA Holdings (MARA.US)$ $iShares Bitcoin Trust (IBIT.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$ $Taiwan Semiconductor (TSM.US)$ $Snap Inc (SNAP.US)$ $Citigroup (C.US)$ $Wells Fargo & Co (WFC.US)$ $Lemonade (LMND.US)$ $Block (SQ.US)$

1. Government Support and Vision

• Vision 2030: Abu Dhabi’s Vision 2030 focuses on transitioning to a knowledge-based economy, prioritizing sectors like technology, AI, and sustainability.

• MGX Initiative: Abu Dhabi recently launched a $100 billion MGX fund to boost global AI and techn...

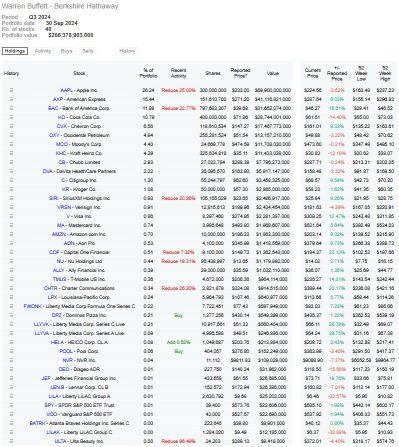

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Apple (AAPL.US)$ $American Express (AXP.US)$ $Bank of America (BAC.US)$ $Coca-Cola (KO.US)$ $Chevron (CVX.US)$ $Occidental Petroleum (OXY.US)$ $Moody's (MCO.US)$ $Citigroup (C.US)$ $Visa (V.US)$

随文附件图只是无意中在某达人moomoo分享中发现的,僅共参考,如有冒犯,请多包涵和指导,不喜勿喷,谢谢!希望大家都可以因为moomoo梦想成真,心想事成

The attached picture was just found by accident in the sharing of a certain expert moomoo. It is for reference only. Please forgive and teach me If it is of...

Diamond kuku bird ❤ :

sentosa island Diamond kuku bird ❤ : you is girls a

Diamond kuku bird ❤ sentosa island :

sentosa island : or double sex

Diamond kuku bird ❤ sentosa island :