No Data

C250103C71000

- 0.05

- 0.000.00%

- 5D

- Daily

News

Wall Street Today: AI Domestic Investment News on the Way

External headlines: The SEC of the USA established a Cryptos task force. Apple had a bleak start to the new year. OpenAI teams up with SoftBank and Oracle to invest in AI. The CEO of UBS Group hinted at continued layoffs.

The major headlines that global financial media focused on last night and this morning include: Trump will announce a massive investment in AI infrastructure in collaboration with OpenAI, SoftBank, and Oracle. US President Donald Trump is expected to announce a new AI investment plan, with SoftBank, OpenAI, and Oracle ready to announce the establishment of a joint venture. A White House official stated that Trump will announce an initial investment of 100 billion dollars on Tuesday afternoon alongside SoftBank's Masayoshi Son, OpenAI's Sam Altman, and Oracle's Larry Ellison, with the scale potentially expanding over the next four years.

Citigroup Options Spot-On: On January 21st, 152.63K Contracts Were Traded, With 2 Million Open Interest

Live Stock News: Market Climbs, Crypto Falls, Big Tech is Here and Trump Starts Signing Orders

Citi: Signs indicate that the Fed's Algo tightening may continue through 2025.

Citigroup stated that signs indicate the Federal Reserve's Algo tightening policy will continue into 2025, particularly as the use of reverse repurchase agreements (RRP) tools rises with the decrease in the Treasury's Cash / Money Market balance. Since early 2024, Citigroup strategists have expected that Algo will last at least until the first half of 2025, as they anticipate that the $3 trillion in reserves is far above the abundance level; the Federal Reserve may want the repo rate to be higher than RRP — a situation that is unlikely to occur before the debt ceiling is resolved; before repo rate changes, the federal funds rate / reserves balance (IORB) is expected to be.

IShares U.S. High Yield Bond Index ETF (CAD-Hedged) Declares CAD 0.083 Dividend

Comments

The financial sector delivered a stellar performance in the fourth quarter of 2024, with the $Financial Select Sector SPDR Fund (XLF.US)$ outperforming the broader S&P 500 Index. The XLF gained 7.21% in Q4 2024, significantly outpacing the 3.03% gain of the S&P 500. Fueled by robust earnings reports from key players like $JPMorgan (JPM.US)$ and $Goldman Sachs (GS.US)$, the sector demonstrated resilience and gro...

![[US Earning Season] Financials sector outperformance!](https://sgsnsimg.moomoo.com/sns_client_feed/103513015/20250117/5795f3c70d19a639375e78441e8274dc.png/thumb?area=101&is_public=true)

![[US Earning Season] Financials sector outperformance!](https://sgsnsimg.moomoo.com/sns_client_feed/103513015/20250117/d0473b692ea62e56b1e92d7133cc950f.png/thumb?area=101&is_public=true)

![[US Earning Season] Financials sector outperformance!](https://sgsnsimg.moomoo.com/sns_client_feed/103513015/20250117/d1ba03332162307a97ff63923e783374.png/thumb?area=101&is_public=true)

While US earnings season continues to deliver better than expected profit results from S&P500 $S&P 500 Index (.SPX.US)$ companies. As we stand right now, on Friday 17 January the Nasdaq 100 $NASDAQ 100 Index (.NDX.US)$ is 4.6% down from its record high. And the S&P500 is just 2.5% away from its record. Both app...

And US bank earnings packed a good punch, highlighting that we could expect great things from US company earnings ah...

Just past 4 pm ET Wednesday, $Dow Jones Industrial Average (.DJI.US)$ climbed 1.65%, while the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ gained 1.83% and 2.45%, respectively.

MACRO

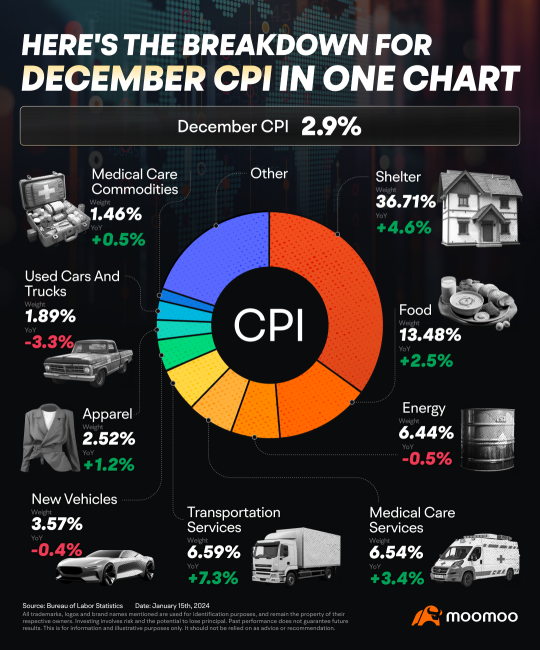

In macroeconomics, the Consumer Price index grew at just 2.9% in Decemb...